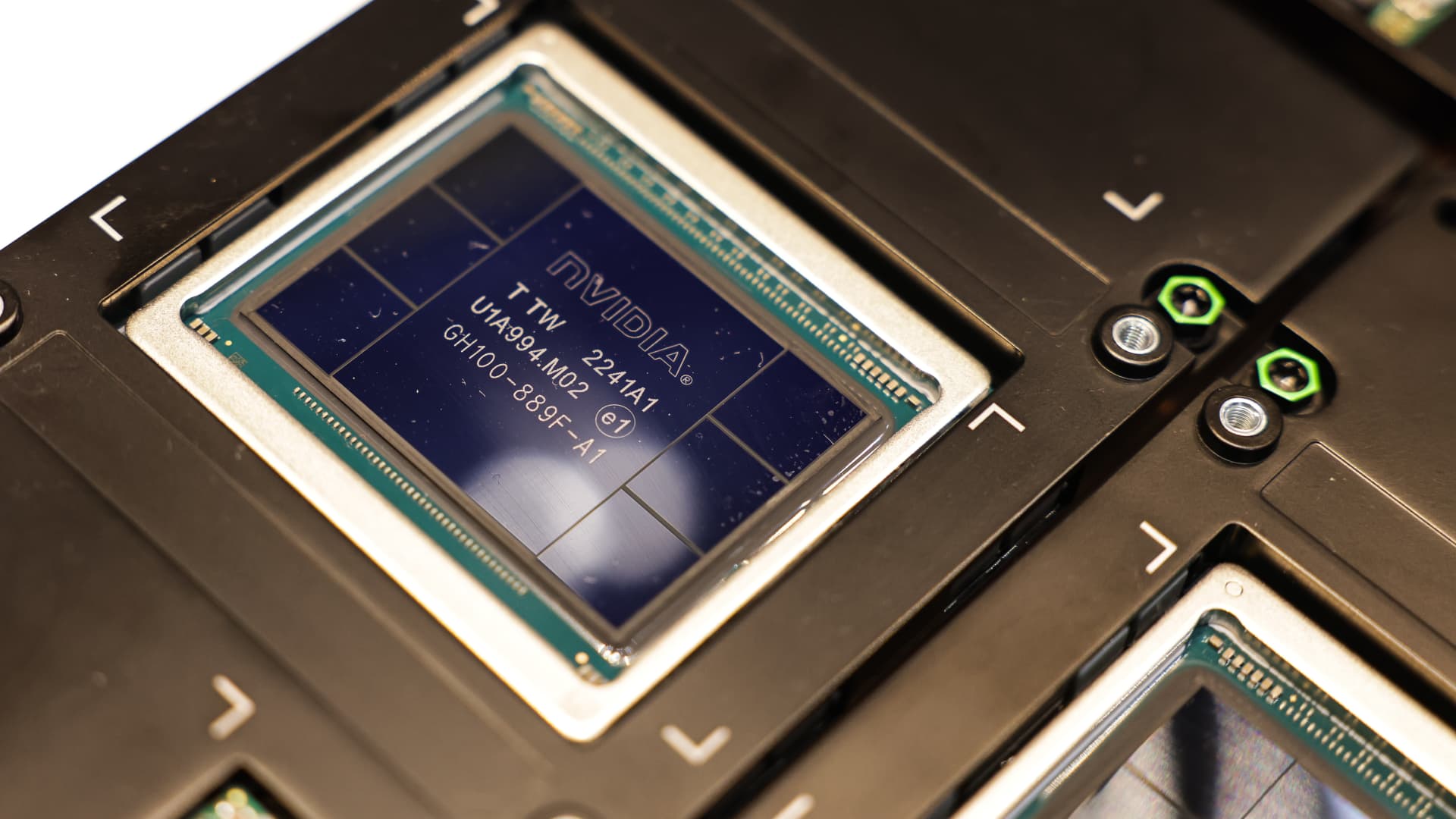

A Nvidia Corp. HGX H100 synthetic intelligence supercomputing graphics processing device (GPU) at the showroom of the company’s workplaces in Taipei, Taiwan, on Friday, June 2, 2023.

I-Hwa Cheng | Bloomberg | Getty Photos

China’s synthetic intelligence stocks fell Wednesday right after the Wall Street Journal claimed that the U.S. is setting up to impose new curbs on shipments of AI chips to China.

In accordance to the Journal, U.S. chip makers this kind of as Nvidia will be impacted by the move which could take place as early as July.

Nvidia provides graphics chips accountable for driving the technological innovation driving OpenAI’s ChatGPT and Alphabet’s Bard chatbots.

China’s CSI artificial intelligence index fell 3% on that news on Wednesday in Asia. The Shenzhen-traded shares of Inspur Digital Data Business slumped 10% and Chengdu Details Technological know-how of Chinese Academy of Sciences dropped almost 8%. These companies mostly develop computers and software program.

Other Chinese AI performs also fell. Hong Kong-outlined shares of Alibaba — which launched its very own variation of the viral chatbot ChatGPT — dropped about 1.6%, and Tencent, which is making its own AI design, declined 1.58%.

Citing resources common with the make any difference, the WSJ explained the U.S. has increasing considerations about China’s capacity to make technological developments with AI.

In accordance to the report, the U.S. Commerce Section could “end the shipments of chips manufactured by Nvidia and other chip makers to shoppers in China and other countries of worry without initial getting a license.”

The Commerce Department did not promptly reply to CNBC’s request for responses outside regular business hours.

This kind of a go will extend Washington’s attempts to block China from advanced chip technological innovation.

The U.S. carried out procedures to reduce China off from highly developed chip gear in October.

In Might, Beijing banned Chinese operators of important info infrastructure from buying solutions from Micron Technologies, stating the U.S. memory chipmaker poses a “major protection hazard.”

Washington also reportedly urged South Korea not to permit its domestic chip makers fill Micron’s void in China.