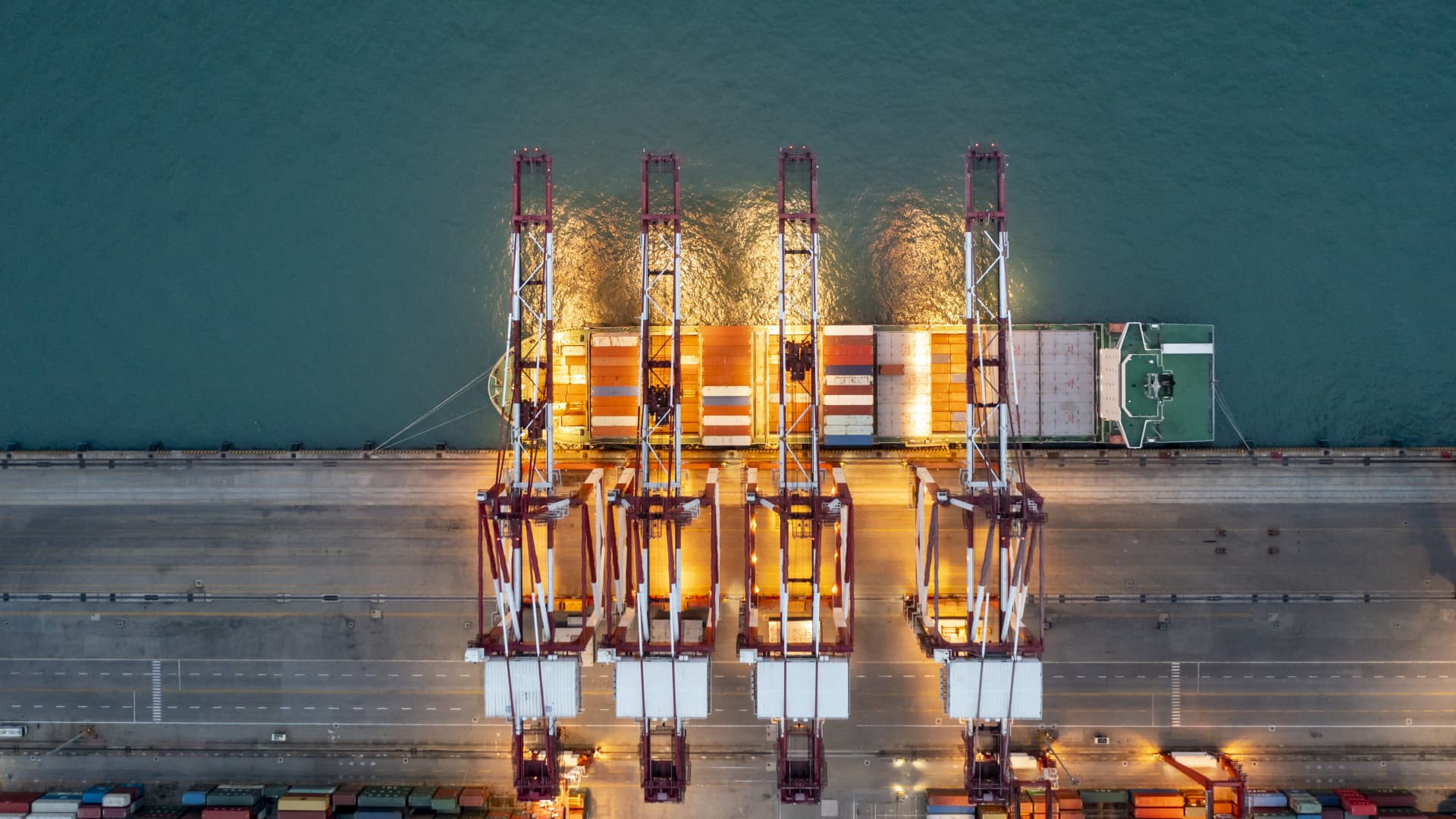

QINGDAO, CHINA – May perhaps 06: Aerial perspective of illuminated Qingdao Qianwan Container Terminal at dusk on May well 6, 2023 in Qingdao, Shandong Province of China.

Vcg | Visual China Team | Getty Visuals

China’s exports grew 8.5% in April in U.S. greenback terms, marking a next-straight thirty day period of advancement, though imports fell 7.9% in comparison with a 12 months ago.

Economists polled by Reuters believed exports would increase 8% in April, although imports ended up forecast to keep on being unchanged. In March, imports declined 1.4% yr-on-year while exports saw a surprise soar of 14.8%, government data showed.

relevant investing information

China’s trade surplus grew to $90.21 billion in April, up from the surplus of $88.2 billion in March.

Softer trade info in April is probably to reflect “residual seasonality” following this year’s Lunar New 12 months, economists at Goldman Sachs said in a Monday notice.

Goldman Sachs economists predicted to see “the dissipation of this seasonal bias to sluggish export growth in April,” they wrote in a take note before this month previewing China’s trade info.

New economic info introduced from the world’s next-biggest economic climate confirmed that China’s service sector remained a vivid place despite disappointing manufacturing unit knowledge.

The Nationwide Bureau of Statistics’ production acquiring manager’s index reading skipped expectations and fell into contraction territory with a reading of 49.2 in April from March’s reading of 51.9.

“China is past the speediest stage of its reopening,” Goldman Sachs economists wrote in a independent Friday observe. It reiterated its forecast for China’s economy to see whole-12 months expansion of 6% in 2023.

“Current conferences with customers in the mainland recommend slowly fading pessimism on in close proximity to-term development, but some worry all around deflationary pressures, nevertheless in our watch this is not a key danger for 2023-24,” they wrote.

Inflation ahead

China’s inflation info is slated for release Thursday. Economists be expecting inflation slowed to a .3% 12 months-on-calendar year rise, according to a Reuters poll.

Thirty day period-on-thirty day period, selling prices are predicted to remain flat, in accordance to the survey.

The economy’s producer price index is forecast to mark its seventh-straight thirty day period of declines right after the index fell 2.5% in March. Economists polled by Reuters count on to see a fall of 3.2%.

“Central bankers in China seemed to have tiny problems about deflation, judged by the PBoC quarterly monetary plan stories and meeting minutes,” BofA Global Study economists which include Helen Qiao wrote in a note, including that officials look self-assured in a rebound for inflation forward.

BofA economists stated they “count on inflationary tension to rise as the output hole narrows in 2H23, especially on the back again of a new credit rating cycle kicking off.”