CATL is the world’s largest electric auto battery maker and provider to the likes of Tesla and Ford.

Pavlo Gonchar | Sopa Photographs | Lightrocket | Getty Photos

The world’s most significant electric car battery maker CATL is evaluating whether or not to expand its battery swapping business to worldwide marketplaces, a senior executive explained to CNBC.

CATL, or Modern Amperex Technologies Co. Limited, is a provider to companies such as Tesla and Ford.

similar investing news

In January, the Chinese battery maker released its battery swapping small business referred to as EVOGO in China throughout 10 cities. The purpose is to remove the need for electrical automobiles to cease at recharging stations. As a substitute, drivers can rent battery packs from CATL and set them into the car or truck when their other battery operates out. This usually takes a matter of minutes.

Nio, an electrical motor vehicle get started-up in China, also has a rival battery swapping method. The firm programs to increase that to making 1,000 battery swapping stations exterior China by 2025, with the majority in Europe, Nio co-founder Qin Lihong, informed Reuters this week.

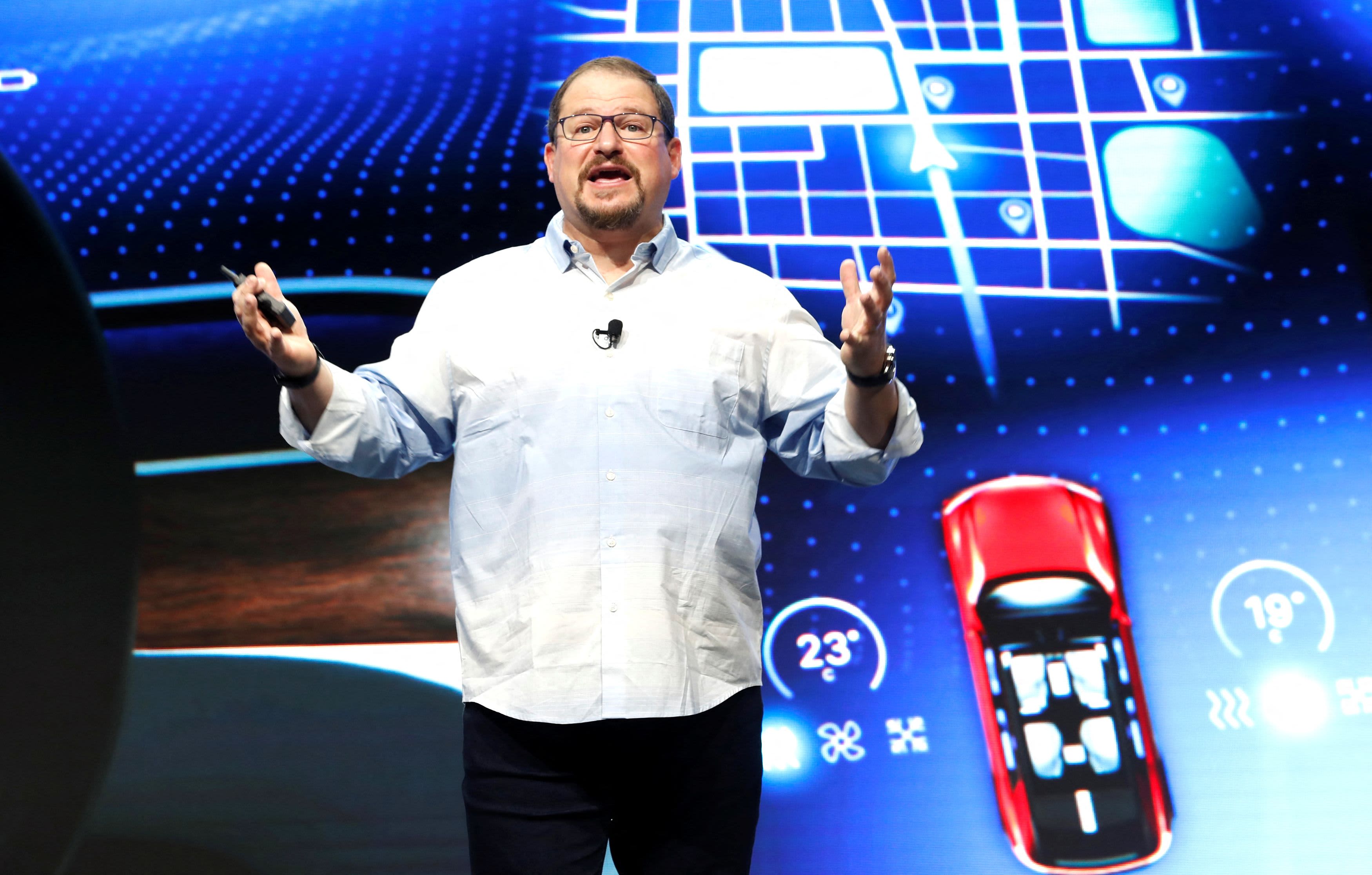

Li Xiaoning, executive president of overseas industrial software at CATL, told CNBC in an job interview on Thursday, that the enterprise is also evaluating growth of its battery swapping item into Europe.

“I would say this will get started in China this 12 months. We will phase by move examine the abroad footprint of EVOGO,” Li claimed.

“We are setting up to evaluate the likely cooperation with a lot of partners. We want to recognize the depth in practice,” he added. “There are a lot of factors we contemplate. Product technologies is one thing, a further is the enterprise scenario, the regulation, the neighborhood procedures, and also other aspects we require to think of as properly.”

If CATL expands the enterprise abroad, it could support foreign carmakers offer the battery swapping solutions to shoppers without the need of obtaining to build the expensive infrastructure on their own.

CATL is dealing with challenges together with the mounting cost of uncooked elements like lithium, which goes into its batteries.

But the company even now managed to much more than double financial gain in the second quarter as demand from customers for electric powered vehicles proceeds to continue to be strong.