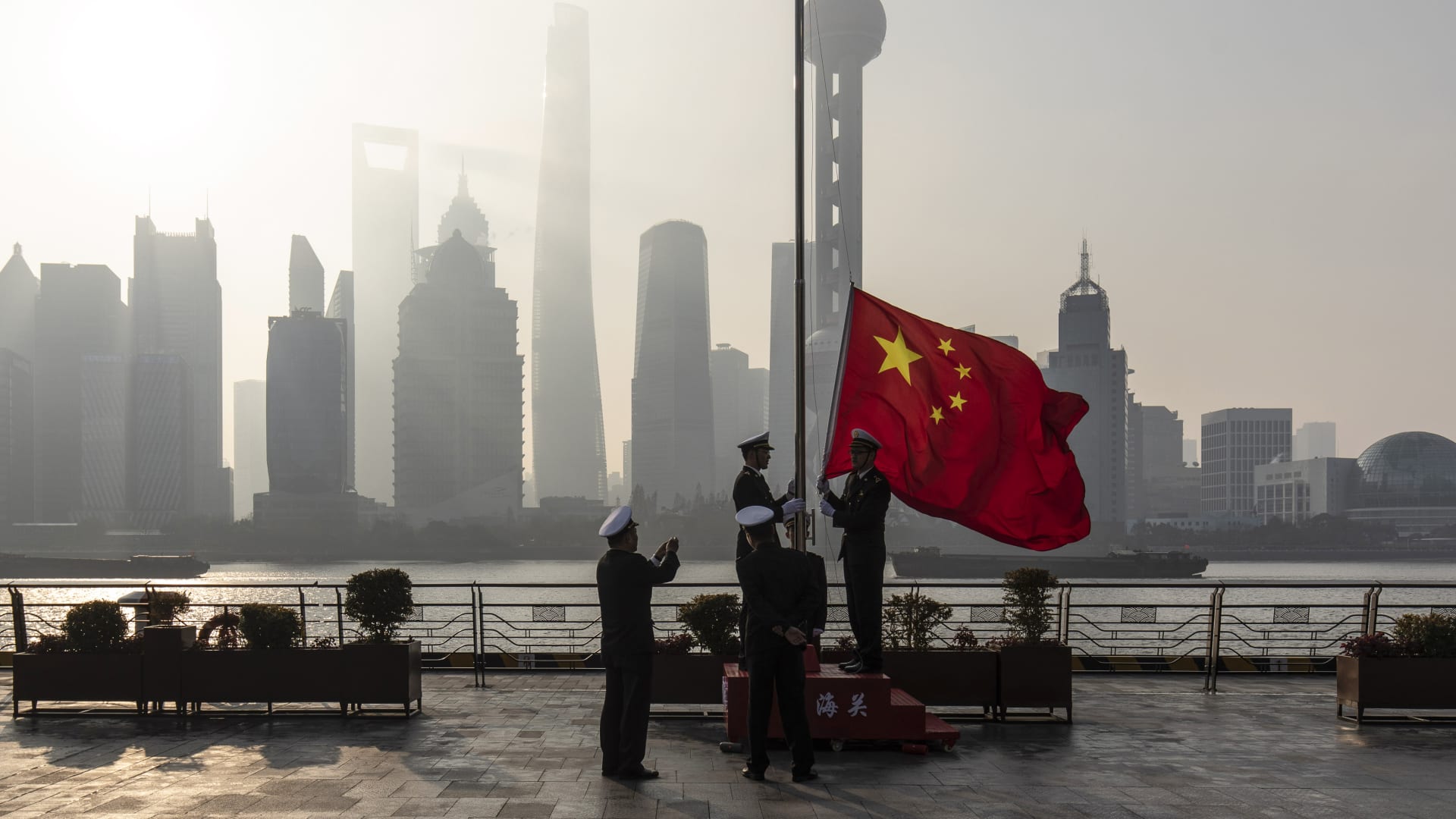

China retains critical lending premiums unchanged

The People’s Financial institution of China held its a single-year and 5-yr bank loan primary costs unchanged in December, according to an announcement.

The central financial institution managed its a single-year financial loan primary price at 3.65% and its five-calendar year financial loan prime charge at 4.30%, in line with anticipations in a Reuters poll.

The offshore and onshore Chinese yuan had been somewhat flat at 6.9808 and 6.9783 against the U.S. greenback, respectively.

– Jihye Lee

CNBC Pro: Is China set for a rebound in 2023? Wall Road pros weigh in — and reveal how to trade it

What is actually up coming for China just after it rolled back a slew of Covid-19 actions?

Market pros weigh in on the prospect of a rebound in the world’s next-major economic climate and reveal prospects for investors.

CNBC Professional subscribers can read through extra in this article.

— Zavier Ong

Lender of Japan anticipated to maintain fees steady

The Bank of Japan is predicted to preserve its desire charges continuous at -.10%, according to study of economists by Reuters.

The amount conclusion is predicted immediately after the central bank’s two-working day financial policy concludes Tuesday.

Separately, Japan’s federal government and the BOJ are reportedly aiming revise a statement committing to a 2% inflation focus on at the earliest attainable day, in accordance to Kyodo Information, citing federal government sources.

— Jihye Lee

The Fed is overdoing amount hikes, Evercore ISI claims

The Federal Reserve is most likely overdoing it’s charge hikes to tame inflation and could close up tipping the U.S. overall economy into a economic downturn, Ed Hyman of Evercore ISI wrote in a Sunday take note.

The Federal Cash amount is now 6.5% compared to a main PCE of 4.7% on the yr and bond yields at 3.5%, Hyman wrote.

“And it’s not just the Fed tightening: ECB, BoE, Mexico, Switzerland, and Norway also tightened past week,” he claimed. “Most likely extra profoundly, the cash source is contracting.”

In addition, Evercore’s economic diffusion index is approaching recession territory together with other indicators this kind of as enterprise surveys, inflation details and layoff bulletins. And, wage gains have started out to slow and large rents are demonstrating early symptoms of easing, signaling that inflation has possible operate its system.

“In any function, 87 percent of American voters are worried about a recession,” reported Hyman.

—Carmen Reinicke

S&P 500 headed for worst December in 4 years

The S&P 500 has dropped more than 6% this thirty day period, as Wall Avenue struggles heading into year-close. That places in on observe for its worst monthly functionality given that September. It would also be its major December drop since 2018, when it slid 9.18%.

Stocks near reduced for fourth working day in a row

Recession fears and dashed hopes of a year-conclude rally weighed on shares Monday, sending them to the fourth consecutive negative shut.

The Dow Jones Industrial Typical drop 163.85 details, or .50%, to close at 32,756.61. The S&P 500 fell .91% to 3,817.47, and the Nasdaq Composite shed 1.49%to 10,546.03 weighed down by shares of Amazon, which slipped 3%.

—Carmen Reinicke