CNBC’s Jim Cramer on Tuesday said that there are three stocks that could be set to rally.

“The charts, as interpreted by Carolyn Boroden, suggest that Twitter, Valero and Occidental [Petroleum] could have some upside here. I’m more cautious on Twitter because it’s an arbitrage play, but the other two have my attention,” he said.

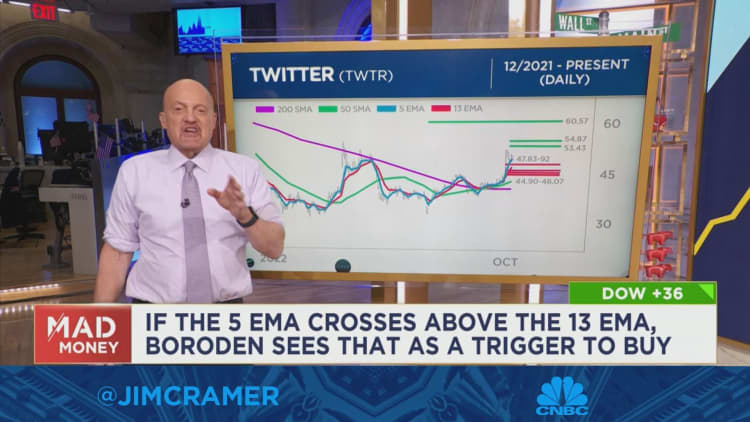

To explain Boroden’s analysis, Cramer first examined the daily chart of Twitter:

The stock has made a pattern of reaching higher highs and higher lows, which is a “textbook sign of strength,” he said.

At the same time, the key moving averages that Boroden watches look bullish. The stock is trading above both the 200-day and 50-day simple moving averages. In addition, the 5-day exponential moving average is crossing over the 13-day, according to Cramer.

“That’s her favorite buy signal,” he said.

Cramer added that Boroden sees Twitter stock easily running to $53.43 or even $54.87. He acknowledged that Elon Musk’s back-and-forth with Twitter on their deal for him to purchase the company at $54.20 a share could hurt the stock.

“I think our upside is capped at that level and if something goes wrong, wow, the stock will plummet through Boroden’s support levels in the mid-to-high $40s, at which point she says you need to go bearish because the bull thesis is toast,” he said.

For more analysis, watch Cramer’s full explanation below.