CNBC’s Jim Cramer on Monday said that the spiking U.S. dollar could peak soon.

“The strong dollar has become an albatross around the neck of an already beaten-down market, but now the charts, at last, as interpreted by Carley Garner, suggest the dollar could be peaking,” he said.

The value of the U.S. dollar has surged in recent months, driven by the Federal Reserve’s aggressive interest rate raises and the hot U.S. economy. That’s been a headwind to companies that conduct business largely overseas and are therefore subject to an unfavorable exchange rate.

“Everything else — stocks, commodities, bonds — have all swung back this year. As Garner sees it, the greenback is the last holdout, and she doesn’t think it will last,” he said.

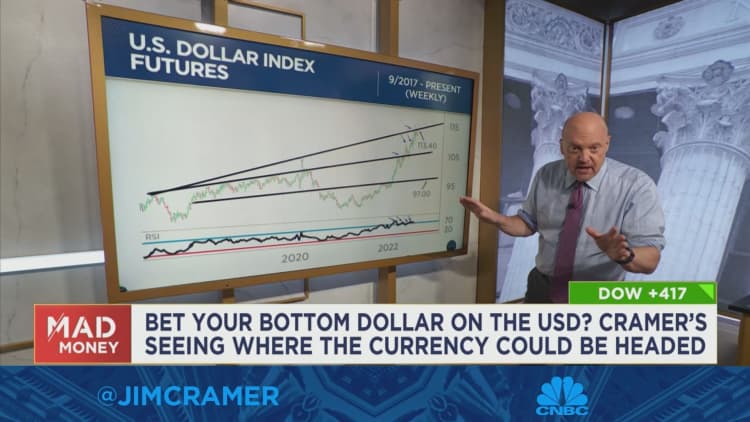

To explain Garner’s analysis, Cramer examined the weekly chart of the dollar index going back to 2017.

The dollar’s been known to make “dramatic tops,” according to Garner, and the last three peaks follow a trend line that dates back to 2016, Cramer said. The dollar’s just under that trend line, which is a ceiling of resistance and a potential point of reversal, he said.

Garner expects that the dollar will fall if it can’t break through that ceiling.

“Currently, the dollar index is at 112, and she wouldn’t be surprised if it hits 105 on the downside,” he said, adding that Garner believes the dollar index could tumble all the way to 97, where it was trading before Russia invaded Ukraine earlier this year.

For more analysis, watch Cramer’s full explanation below.