CNBC’s Jim Cramer on Tuesday said that the S&P 500 is at a critical moment that could send it higher or cut its upward trajectory short.

“The charts, as interpreted by Carolyn Boroden, suggest that the S&P 500 could be due for some near-term turbulence if it can’t break out above last week’s highs,” he said.

related investing news

The S&P 500 and Nasdaq Composite closed down on Tuesday while the Dow Jones Industrial Average inched up slightly, with stocks struggling to rebound from the previous day’s losses driven by protests against Covid restrictions in China.

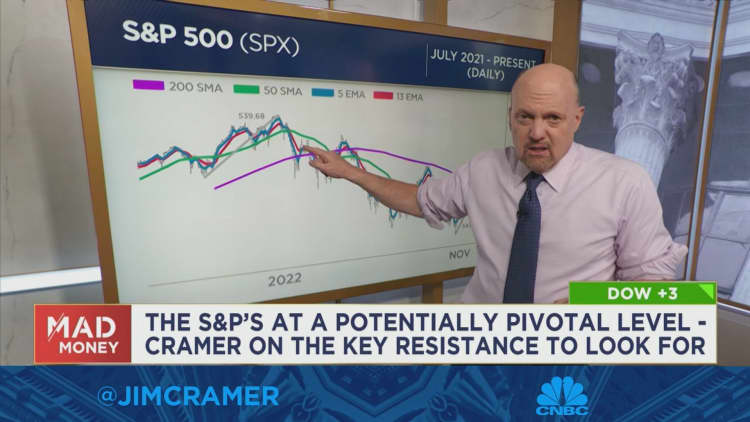

To explain Boroden’s analysis, Cramer examined the daily chart of the S&P 500.

The technical analyst sees the index approaching an important hurdle that could pose a real problem for its ability to continue gaining, according to Cramer.

More specifically, the S&P 500’s recent run from the mid-October lows is similar in scale to its rally from late 2021 through early January 2022, he explained. When the rally that started late last year peaked on Jan. 4, the index saw a “nightmare” 1327-point decline into last month’s lows.

“She’s not saying that the rally’s toast. But Boroden says the S&P needs to clear this hurdle — it needs to break out above last week’s high,” he said, adding, “In short, she sees this as a make-or-break moment for the S&P 500, at least in the near-term.”

For more analysis, watch Cramer’s full explanation below.