CNBC’s Jim Cramer on Friday warned investors that the stock market is unlikely to recover anytime soon.

“The charts, as interpreted by Mark Sebastian … suggest that this market’s got more downside, and it’s way too early to go really bullish,” he said.

related investing news

“Unlike him, I also believe we could get a sharp spike up, but, for our Charitable Trust, if that happens we’re going to have to do some selling,” he added.

The S&P 500 closed out its worst month since March 2020 on Friday. The Dow Jones Industrial Average tumbled 8.8% for the month, while the Nasdaq Composite dropped 10.5%.

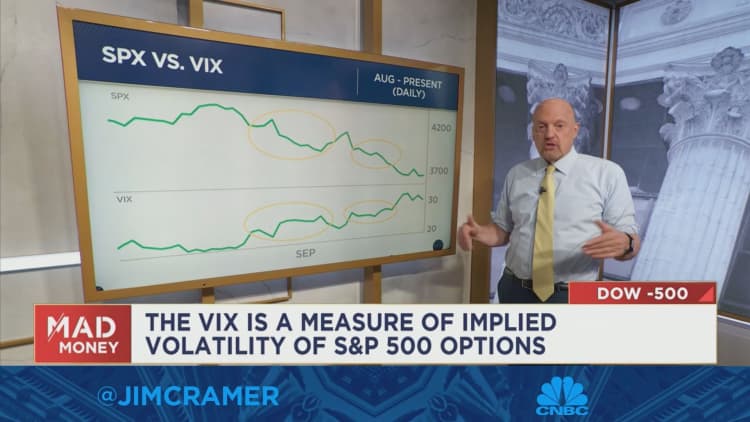

Before getting into Sebastian’s analysis, Cramer first explained that when the S&P 500 goes lower, the CBOE Volatility Index, also known as the VIX or fear gauge, typically moves higher. And when the S&P moves higher, the VIX typically goes lower.

He then examined a pair of charts showing the daily action in the S&P and the VIX:

While the S&P and VIX moved at the same pace in June, things took a turn in August. Sebastian notes that when the S&P started falling in late August, the VIX had a “slow-rolling rally” instead of roaring like it typically would, according to Cramer.

This mismatch in movement between the S&P and VIX’s movements continued through early September but only really exploded this week, Cramer said, adding that the market still is a long way from recovering.

“Sebastian’s waiting for the S&P to go down while the VIX also goes down — that’s a classic tell that a sell-off’s coming to an end,” he said. “That is not happening right now.”

For more analysis, watch Cramer’s full explanation below.