CNBC’s Jim Cramer on Wednesday said investors should consider buying some stocks while investor sentiment is extremely negative, leaning on charts analysis from technician Ralph Vince.

“The charts, as interpreted by Ralph Vince, suggest that investor sentiment has reached extremely negative levels, to the point where you’ve got to hold your nose and buy something,” he said.

related investing news

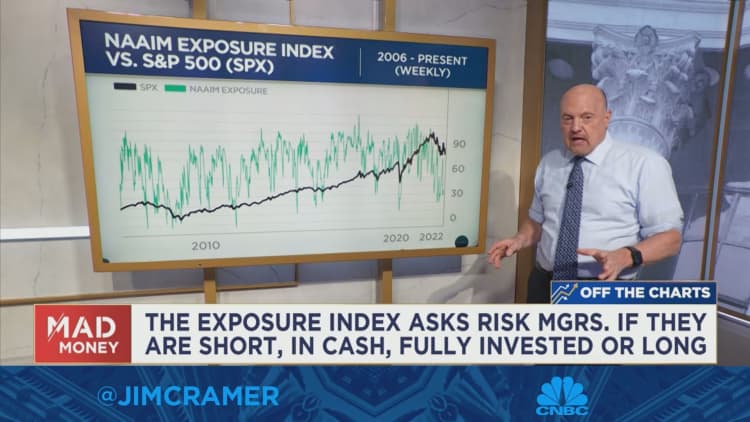

To explain the technician’s analysis, Cramer first examined the chart of the S&P 500 going back to 1980, with data from the American Association of Individual Investors in blue.

The data shows the percentage of bullish investors in the association’s weekly sentiment survey. Last week, it was at 17.7%, which is one of the lowest readings in history, according to Cramer. He added that Vince believes that whenever the bulls make up less than 20% of the overall pie, investors should do some buying.

Cramer then examined the chart of bearish investors in red.

That number hit 60.9% last week, and according to Vince, the last time the reading was as negative as that was before a great bottom in March 2009. In other words, the chart suggests that now is a terrific buying opportunity, Cramer said.

“You’ve got to hold your nose and buy something, even if it makes you want to puke. History says it’s the right call,” he said.

For more analysis, watch Cramer’s full explanation below.