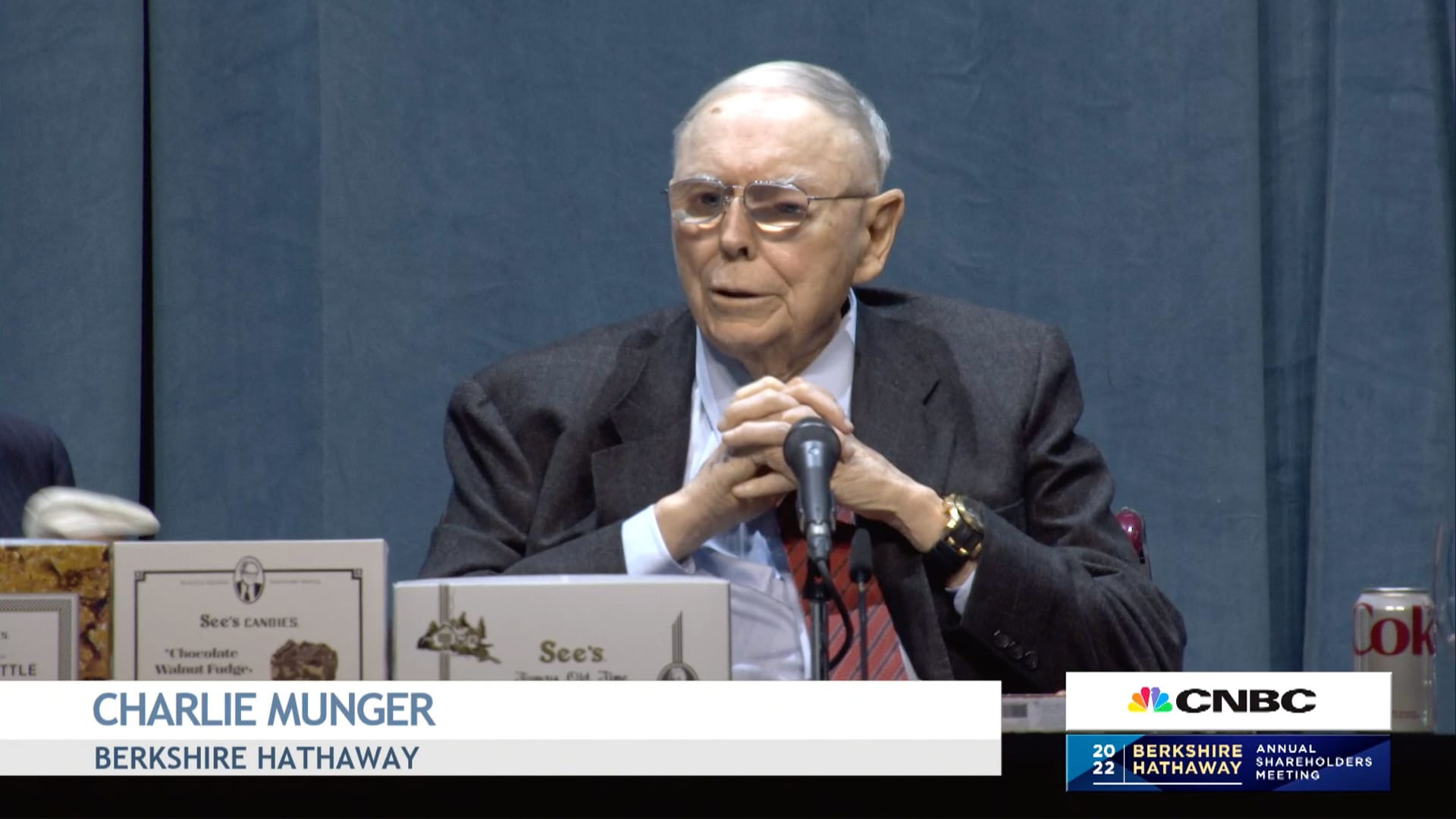

Berkshire Hathaway Vice Chairman Charlie Munger urged the U.S. govt to ban cryptocurrencies like China, saying a deficiency of regulation enabled wretched excess and a gambling mentality.

“A cryptocurrency is not a currency, not a commodity, and not a safety,” the 99-12 months-aged Munger stated in an op-ed posted in The Wall Avenue Journal on Wednesday evening.

“As an alternative, it is really a gambling agreement with a nearly 100% edge for the residence, entered into in a country wherever gambling contracts are customarily controlled only by states that compete in laxity,” Munger claimed. “Definitely the U.S. should now enact a new federal legislation that helps prevent this from occurring.”

Munger, alongside with his company associate, Warren Buffett, have been longtime cryptocurrency skeptics, contending they are not tangible or productive property. Munger’s most up-to-date opinions came as the crypto marketplace was plagued with difficulties from failed tasks to a liquidity crunch, exacerbated by the fall of FTX, once just one of the world’s greatest exchanges.

The cryptocurrency market shed additional than $2 trillion in worth previous calendar year. The cost of bitcoin, the world’s biggest cryptocurrency, plunged 65% in 2022 and it has rebounded about 40% to trade all-around $23,824, in accordance to Coin Metrics.

The renowned investor said in the latest several years privately owned corporations have issued hundreds of new cryptocurrencies, and they have come to be publicly traded without the need of any governmental preapproval of disclosures. Some have been bought to a promoter for just about absolutely nothing, soon after which the community purchases in at a lot increased costs without having fully knowledge the “pre-dilution in favor of the promoter,” Munger claimed.

He listed two “attention-grabbing precedents” that may possibly guideline the U.S. into audio motion. 1st, China has strictly prohibited companies presenting investing, order matching, token issuance and derivatives for virtual currencies. Next, from the early 1700s, the English Parliament banned all public investing in new popular stocks and saved this ban in spot for about 100 several years, Munger stated.

“What should the U.S. do right after a ban of cryptocurrencies is in area? Perfectly, one more motion may make sense: Thank the Chinese communist leader for his splendid illustration of unheard of sense,” Munger explained.

(Study the whole piece in the Journal in this article.)