World

European Central Lender posts initial once-a-year reduction in two decades

Rain falls over the finance district and the European Central Bank (ECB) in Frankfurt, Germany. Thomas Lohnes | Getty Illustrations or photos Information | Getty Photos The European Central Financial institution on Thursday reported its very first annual reduction due to the fact 2004, adhering to hefty payouts owing to increased interest fees. It described […]

Read More

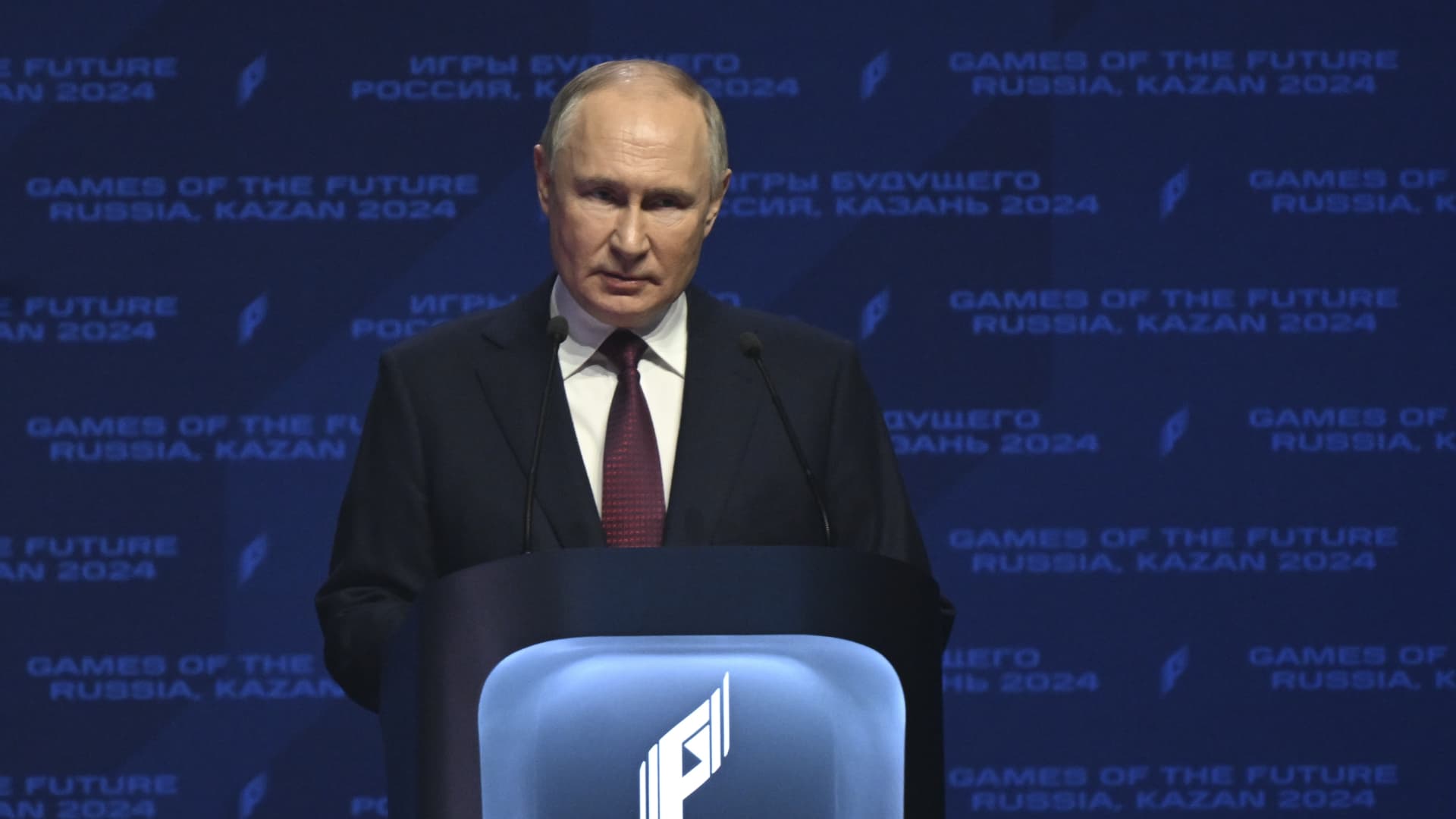

Ukraine war live updates: Russia’s Putin flies on a nuclear-capable strategic bomber; Ukraine welcomes extra military support

Russia’s Putin flies on a nuclear-capable strategic bomber Russian President Vladimir Putin attends the opening ceremony of the Phygital Centre as the international Games of the Future competition Kazan 2024 international competition kicks off in Kazan, Republic of Tatarstan, Russia on February 21, 2024. Anadolu | Anadolu | Getty Images Russian President Vladimir Putin on […]

Read More

Mercedes shares climb 5% on share buyback, despite ɾxtraordinary' uncertainty ahead

Mercedes-AMG GT 43 4MATIC+ on display screen at Brussels Expo on January 9, 2020 in Brussels, Belgium. Sjoerd Van Der Wal | Getty Pictures News | Getty Photos Mercedes-Benz shares attained about 5% on Thursday early morning right after the German carmaker conquer fourth-quarter earnings expectations and declared a new share buyback method, despite warning […]

Read More

Rolls-Royce shares bounce 10% just after 2023 income more than double

An Airbus A340-313, operated by Universal Sky Provider is landing at evening in Barcelona, Spain. Nurphoto | Nurphoto | Getty Images LONDON — Rolls-Royce shares jumped much more than 10% on Thursday after the British aerospace group much more than doubled its annual earnings in 2023 and forecast even more momentum this 12 months. Rolls-Royce, […]

Read More

Turkey retains curiosity level at 45% for first time after 8 months of hikes

Turkish flag around a DenizBank building. Turkey is envisioned to head to the polls on Sunday. Ismail Ferdous | Bloomberg | Getty Photos Turkey’s central bank held its key curiosity fee on Thursday, retaining it at 45% in spite of soaring inflation immediately after 8 consecutive months of hikes. The move was widely envisioned as […]

Read More

Most British isles firms stick with a 4-working day functioning 7 days just after taking component in entire world's major demo

Travellers on a system at Frankfurt Central Station in Frankfurt, Germany, on Friday, Jan. 19, 2024. Germany’s wrestle to revive its sluggish overall economy is about to just take an experimental change as a host of corporations consider aspect in a pilot to operate a 4-day week, with labor unions declaring that it could not […]

Read More

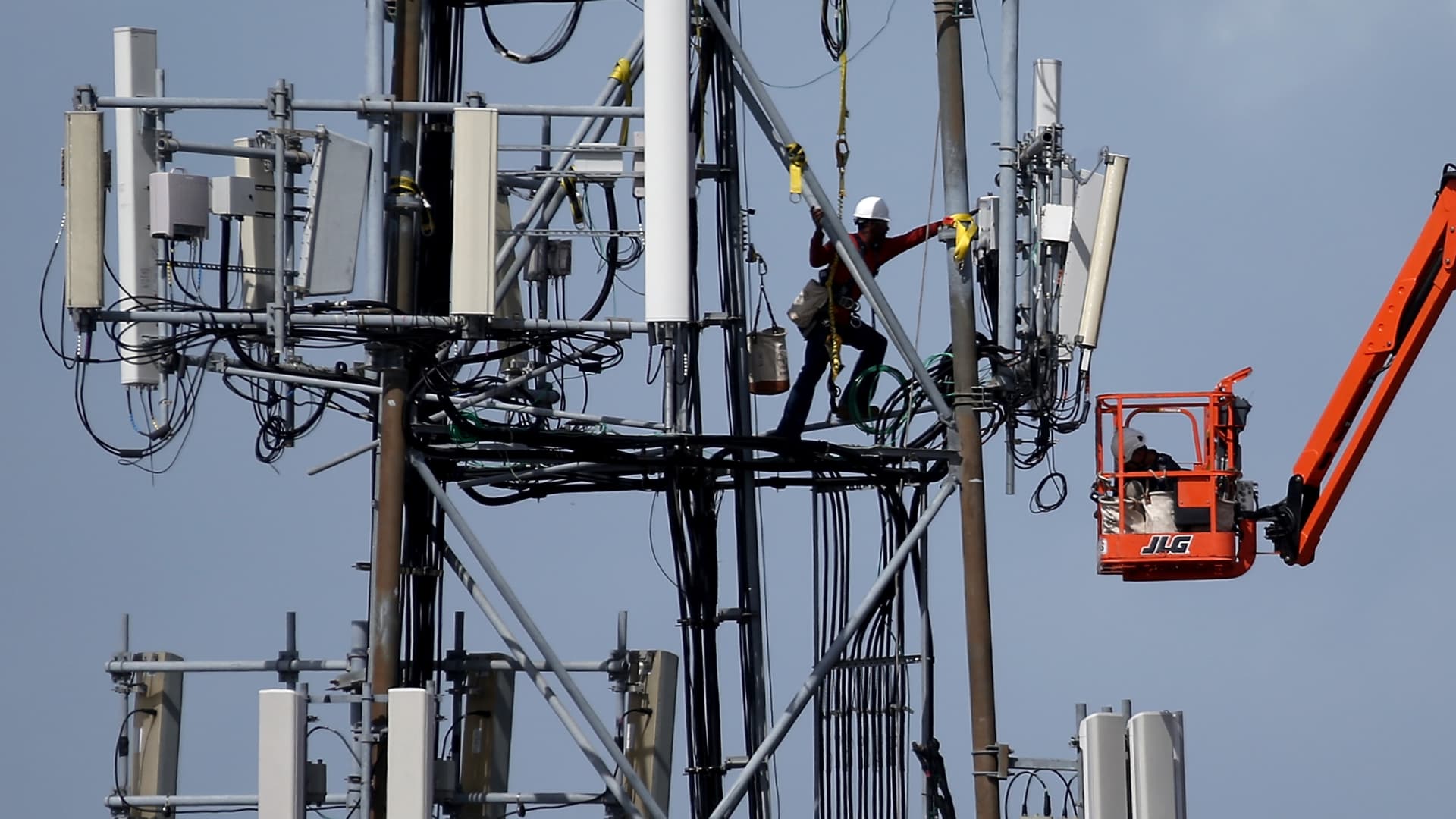

Mobile outage in U.S. hits AT&T, T-Cell and Verizon customers, Downdetector reveals

A worker climbs on a cellular interaction tower in Oakland, California. Justin Sullivan | Getty Pictures A cellular outage in the United States was documented by AT&T, T-Mobile, Verizon and other community people on Thursday, according to outage monitoring website Downdetector.com. The number of experiences of AT&T outages peaked at 31,931 at all-around 4:30 a.m. […]

Read More

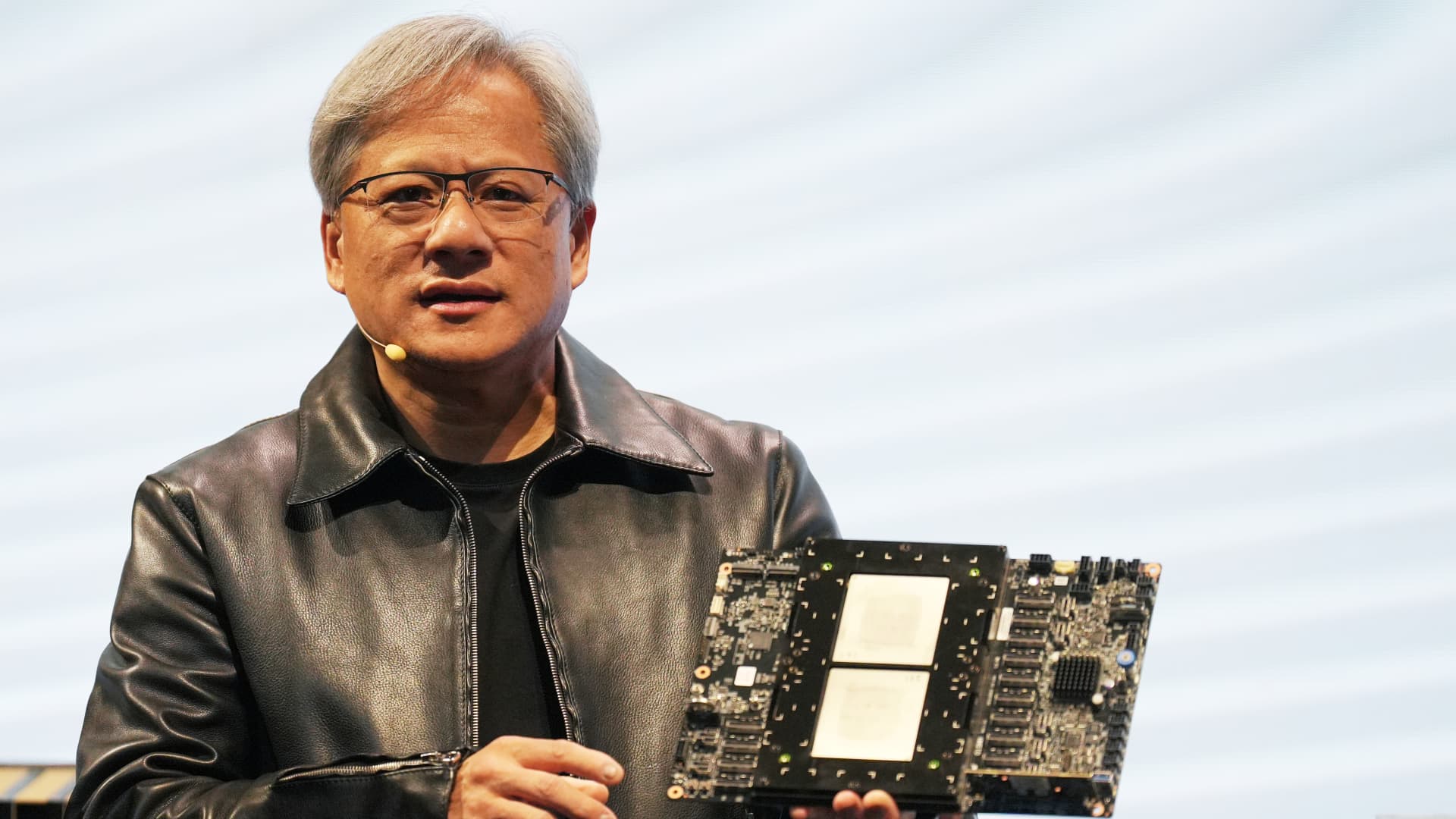

Jefferies says invest in this below-the-radar software program inventory with ties to Nvidia and approximately 20% upside

Investors on the lookout for ways to perform the synthetic intelligence frenzy may possibly want to just take a seem at this tiny-recognized communications application inventory undertaking company with Nvidia . Jefferies analyst George Notter reiterated his invest in ranking on Amdocs , citing the company’s important pros in the synthetic intelligence place. “You can […]

Read More

Right after latest gains, Russia indicators it could try out to seize Kyiv yet again — expressing the 'regime should fall'

Russian President Vladimir Putin and then-Key Minister Dmitry Medvedev in Moscow, Russia, February 23, 2018. Mikhail Svetlov | Getty Images Information | Getty Photographs A senior Russian official has signaled that Russian forces could make a further endeavor to seize Kyiv, after a failed endeavor to seize the Ukrainian money early in the war. Deputy […]

Read More