A screen displays the Nikkei 225 Inventory Ordinary figure at the Tokyo Inventory Exchange (TSE), operated by Japan Trade Team Inc. (JPX), in Tokyo, Japan, on Monday, Oct. 30, 2023. The growth of Israel’s floor operations in Gaza added extra force to global marketplaces as traders prepare for a occupied week packed with major central lender conclusions and a significant-stakes announcement of US bond revenue. Photographer: Akio Kon/Bloomberg by means of Getty Images

Bloomberg | Bloomberg | Getty Pictures

Asia marketplaces observed a unstable 12 months in 2023, with inflation, soaring desire rates and China’s sputtering recovery dragging down expansion previous calendar year.

Japan’s Nikkei 225 led the location in terms of current market functionality in 2023, and obtained about 28% very last year, according to details from Refinitiv. Japanese shares have been supported by increasing corporate final results, as effectively as growing optimism that the Lender of Japan may perhaps ultimately conclude its ultra simple financial plan just after decades of close to-zero interest premiums.

On the other hand, Hong Kong’s Cling Seng Index was the worst big performer in the area, acquiring experienced four straight decades of declines following dropping practically 14% in 2023.

Highlighting China’s underwhelming restoration is also the functionality of the CSI 300, which steps the greatest firms mentioned in Shanghai and Shenzhen, was the third worst performing inventory current market in Asia, dropping 11.38% last year.

China’s publish-reopening was “dismal” because of to a residence downturn and regional governing administration personal debt difficulties, which hurt expending and dampened need and expense in the producing sector, PhilipCapital’s research supervisor Peggy Mak advised CNBC.

Even with this, the outlook for Asia is nevertheless brilliant, in accordance to analysts from Pinebridge Investments.

They see continued solid progress momentum from Asia, as properly as a “fairly promising outlook,” which they say need to present appealing possible for selective equity investors in 2024.

“Asia’s two largest economies can not be overlooked. Although China needs a affected person, corporation-precise investment decision target as the financial system progressively stabilizes, India is surging ahead across several sectors – assuming traders retain an eye on heady valuations.”

Their look at is supported by the Global Monetary Fund, which expects a advancement price of of 4.6% in 2023 and 4.2% in 2024 for Asia, as opposed to a international progress forecast of 3% in 2023 and 2.9% in 2024. This is in accordance to Krishna Srinivasan, the IMF’s director for the Asia and Pacific area.

“Surprises abounded in 2023, from China’s underwhelming write-up-Covid restoration to the power of the U.S. economic system, the assure of artificial intelligence, and a no show worldwide economic downturn,” claimed Michael Strobaek, chief investment decision officer at Lombard Odier, in his 2024 market outlook.

Over and above 2023, here’s what buyers are wanting for in 2024.

Reduce prices

Price cuts will be entrance and middle on investors’ minds.

The U.S. Federal Reserve has laid out a roadmap for chopping costs, with the so-named “dot plot” implying costs will be cut by 75 basis points in 2024, and 100 foundation points in 2025.

Central banking institutions in Asia and all around the environment are likely to follow the Fed’s direct.

Fee hikes in significant Asia economies have mostly stopped, while banking institutions like the Reserve Lender of Australia still warn they are well prepared to get further more motion to convey inflation to heel.

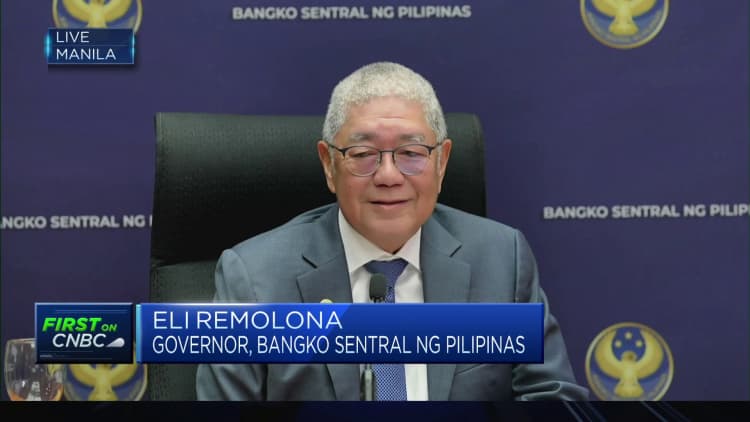

Southeast Asia’s central banking companies have mostly held costs steady and are no more time elevating interest prices aggressively, even even though banking institutions like the Philippines’ central lender are nonetheless hawkish.

The only exception is the Lender of Japan, in which traders will be watching to see if the central bank will exit its adverse desire level coverage.

Headline inflation in Japan is earlier mentioned the BOJ’s 2% target for about 19 months and will see a 5% rise in spring wage negotiations guided by the Japan Trade Union Confederation. These disorders are supportive for a policy normalization, stated Homin Lee, senior macro strategist at Lombard Odier.

Lee expects the BOJ to hike fees to % in 2024 (from the latest damaging .1%) as very well as a “gradual stop” to the bank’s 1% cap on 10-yr Japanese govt bonds, “specially now that the each day pledge to defend the cap with unrestricted purchases have been taken out.”

Pockets of development

As inflation eases and interest costs appear down, in which will the development sectors be?

Hebe Chen, sector analyst at IG Global, mentioned 2024 is probable to see normalizing inflation rates and moderating financial development, which will gain the infrastructure and real estate sectors. By extension, she explained, this will reward the power sector and commodities, as effectively as industries that electricity the AI revolution.

Additional particularly, she is is bullish on serious estate expenditure trusts and tech in Asia.

As fascination rates fall, REITs will supply more funding alternatives and allow asset acquisitions or asset recycling — in which REITs divest a property and use the funds to reinvest. That will ultimately thrust authentic returns better for REIT traders.

Independently, Chen mentioned a likely upswing in the world wide tech cycle is taking shape, and Taiwan, Vietnam, and Singapore could outperform thanks to their higher concentration of production and R&D facilities.

Which is due to the fact Vietnam, Singapore, and Malaysia — manufacturing hubs generally tapped to lower dependency on China — are now producing for markets outside China. As these kinds of, they might no for a longer period be as vulnerable to a Chinese downturn.

The heightened uncertainty and panic, unavoidably fueled by the swiftly evolving global landscape and the vital level in the China-US relations, will not make it effortless for global investors to find their solace.

Hebe Chen

Market Analyst, IG Intercontinental

Chen expects a “probable modify” for Chinese shares in 2024, even however they underperformed in 2023.

The world’s second biggest economic system will very likely see a modest recovery, supported by measures from the central authorities and an strengthening exports outlook, she reported, incorporating a worldwide tech restoration would possible add to an enhancement in Chinese exports.

Geopolitics and elections

Geopolitical developments will also be intently viewed.

Elections in Taiwan, India, and the U.S. are poised to deliver about “spectacular variations in the economic and diplomatic proportions of the Asia-Pacific (APAC) area,” Chen reported.

“The heightened uncertainty and stress and anxiety, unavoidably fueled by the quickly evolving international landscape and the essential point in the China-US relations, will not make it simple for global traders to find their solace,” she stated.

Mak from PhilipCapital said the elections in Taiwan will be the geopolitical celebration to enjoy, indicating that “how China reacts to the election success, in particular if the pro-independence [Democratic Progressive] social gathering retains regulate, could affect the new warming of ties with Europe, its key trading husband or wife.”

The U.S. elections upcoming year will also be in concentrate.

If previous president Donald Trump returns to the White Residence, she claimed. Trader confidence could potentially be eroded and fairness markets influenced, thanks to uncertainties in excess of U.S. trade procedures and fiscal paying out, she discussed.