OMAHA, Neb. — Warren Buffett uncovered that he dumped Berkshire Hathaway’s overall Paramount stake at a reduction.

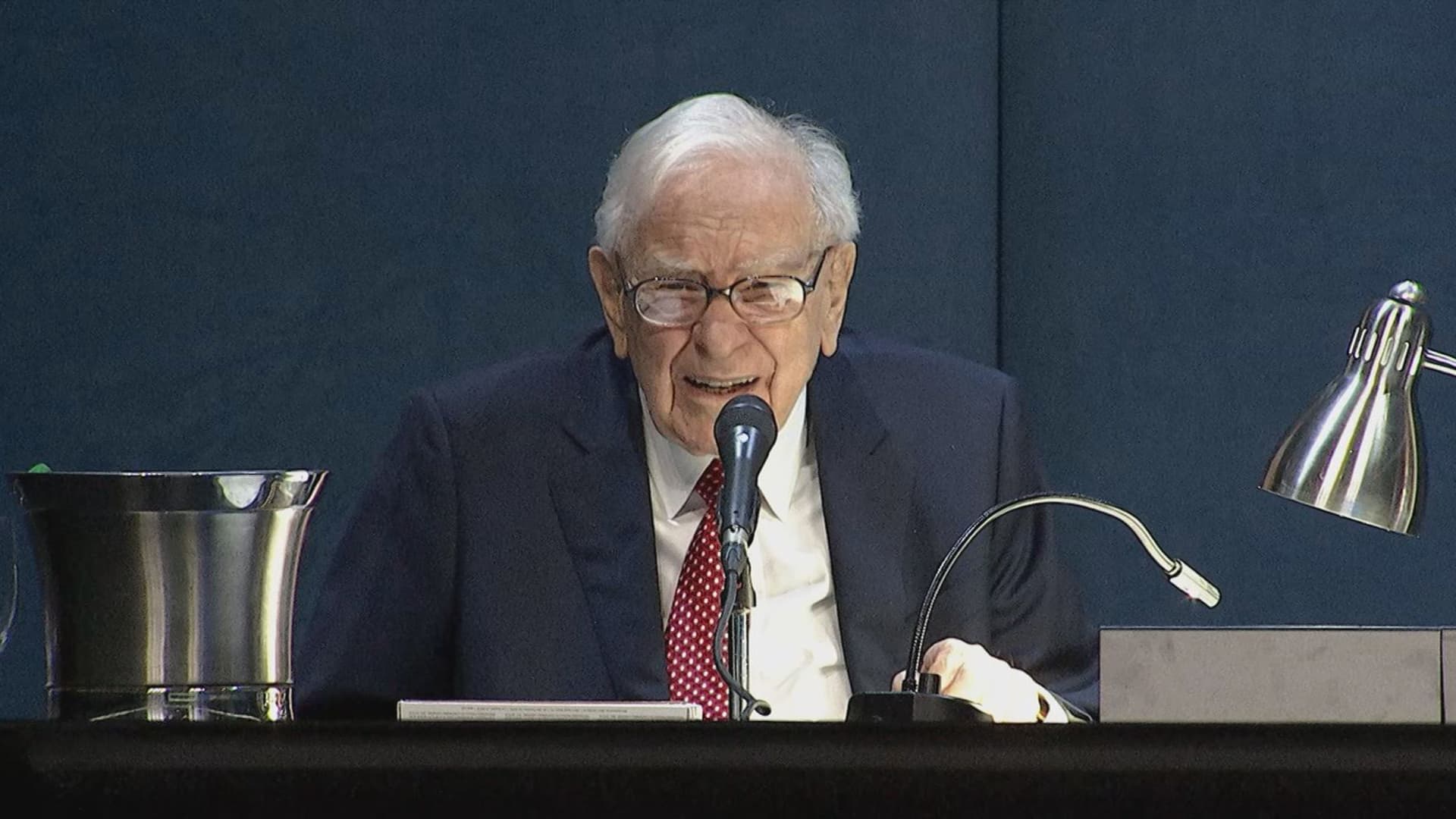

“I was 100% responsible for the Paramount final decision,” Buffett said at Berkshire’s once-a-year shareholder conference. “It was 100% my selection, and we have sold it all and we shed rather a bit of dollars.”

Berkshire owned 63.3 million shares of Paramount as of the stop of 2023, soon after reducing the placement by about a third in the fourth quarter of last calendar year, according to most recent filings.

The Omaha-dependent conglomerate 1st bought a nonvoting stake in Paramount’s course B shares in the initial quarter of 2022. Given that then the media business has had a difficult experience, encountering a dividend slice, earnings miss and a CEO exit. The stock declined 44% in 2022 and another 12% in 2023.

Just this week, Sony Shots and private equity business Apollo World Administration sent a letter to the Paramount board expressing fascination in acquiring the business for about $26 billion. The business has also been having takeover talks with David Ellison’s Skydance Media.

Paramount has struggled in the latest several years, struggling from declining earnings as extra people abandon traditional shell out-Television, and as its streaming products and services go on to get rid of money. The stock is in the purple once again this year, down virtually 13%.

Buffett reported the unfruitful Paramount guess designed him feel far more deeply about what people prioritize in their leisure time. He formerly stated the streaming industry has as well many players searching for viewer bucks, resulting in a rigid price war.