Yuga Labs, the creator of the viral Bored Ape Yacht Club non-fungible tokens, introduced a new round of layoffs on Friday as the NFT frenzy appears to interesting.

Greg Solano, YugaLab’s CEO, introduced that the startup would lay off an unspecified amount of staff as it undergoes “restructuring.”

“To put it merely: Yuga dropped its way,” he wrote in a assertion posted on X. “Obtaining ourselves centered and on the right path means staying a more compact extra agile and cryptonative team.”

Bored Ape Yacht Club ground value declines

The information comes as the floor rate for the common NFT collection once touted by stars like Justin Bieber and Paris Hilton sinks to lows not observed given that it was unveiled in 2021.

The ground price tag is the lowest selling price an NFT in a provided selection will market for. As of Could 1, Bored Ape Yacht Club’s flooring value hovered all-around 13.395 ETH, according to OpenSea, which would be really worth approximately $40,000 at the time of publication. That’s down from a peak floor cost of 128 ETH on May 1, 2022, in accordance to NFTPriceFloor, which would have been value close to $354,000 at that time.

That is a considerably cry from the best charges Bored Apes at the time bought for. In September 2021, a Bored Ape was auctioned by Sotheby’s for a very little around $24 million.

But irrespective of Bored Ape Yacht Club’s considerably decrease flooring price tag, the NFT market place is nonetheless displaying some symptoms of life. On April 25, an anonymous collector shelled out close to $12 million well worth of ETH for a CryptoPunk NFT, in accordance to OpenSea.

How YugaLabs bought began

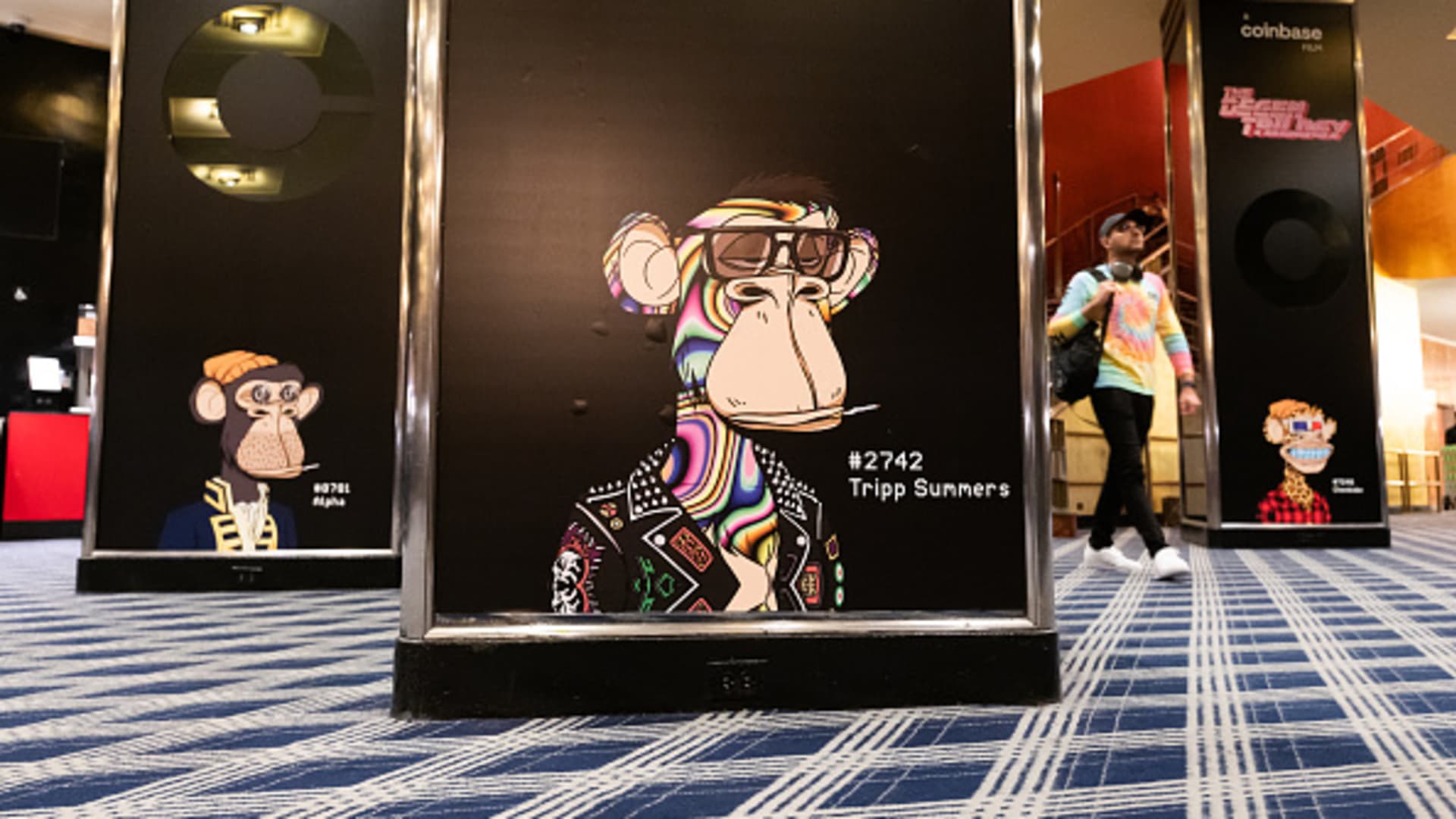

YugaLabs’ Bored Ape Yacht Club collection released in April 2021 with 10,000 NFTs depicting the cartoon apes with several hues, outfits and facial expressions.

The startup went on to launch various other NFT collections, such as Mutant Ape Yacht Club and CryptoPunks. In 2022, YugaLabs raised $450 million in seed funding and was valued around $4 billion, according to its site.

Having said that, the startup has faced its share of controversy above the previous 3 yrs. In December 2022, YugaLabs was sued by buyers who allege they had been tricked into buying Bored Apes by superstars who have been marketing the NFTs with out disclosing they had been compensated to do so.

Collectors and buyers really should do their exploration

When it comes to electronic assets these types of as NFTs, traders must do their research.

Similar to collectibles like investing playing cards or Beanie Infants, NFTs can keep sentimental benefit. Nevertheless, their financial price only goes as significant as another person else is prepared to spend for it.

There is no ensure that you will generate a earnings from selling an NFT, which is why money authorities suggest towards investing extra dollars on them than you are inclined to possibly get rid of.

Want to make further revenue outside of your working day career? Sign up for CNBC’s new online course How to Make Passive Revenue On-line to discover about common passive profits streams, ideas to get begun and genuine-lifestyle achievements tales.

As well as, sign up for CNBC Make It is e-newsletter to get strategies and tricks for accomplishment at work, with money and in existence.