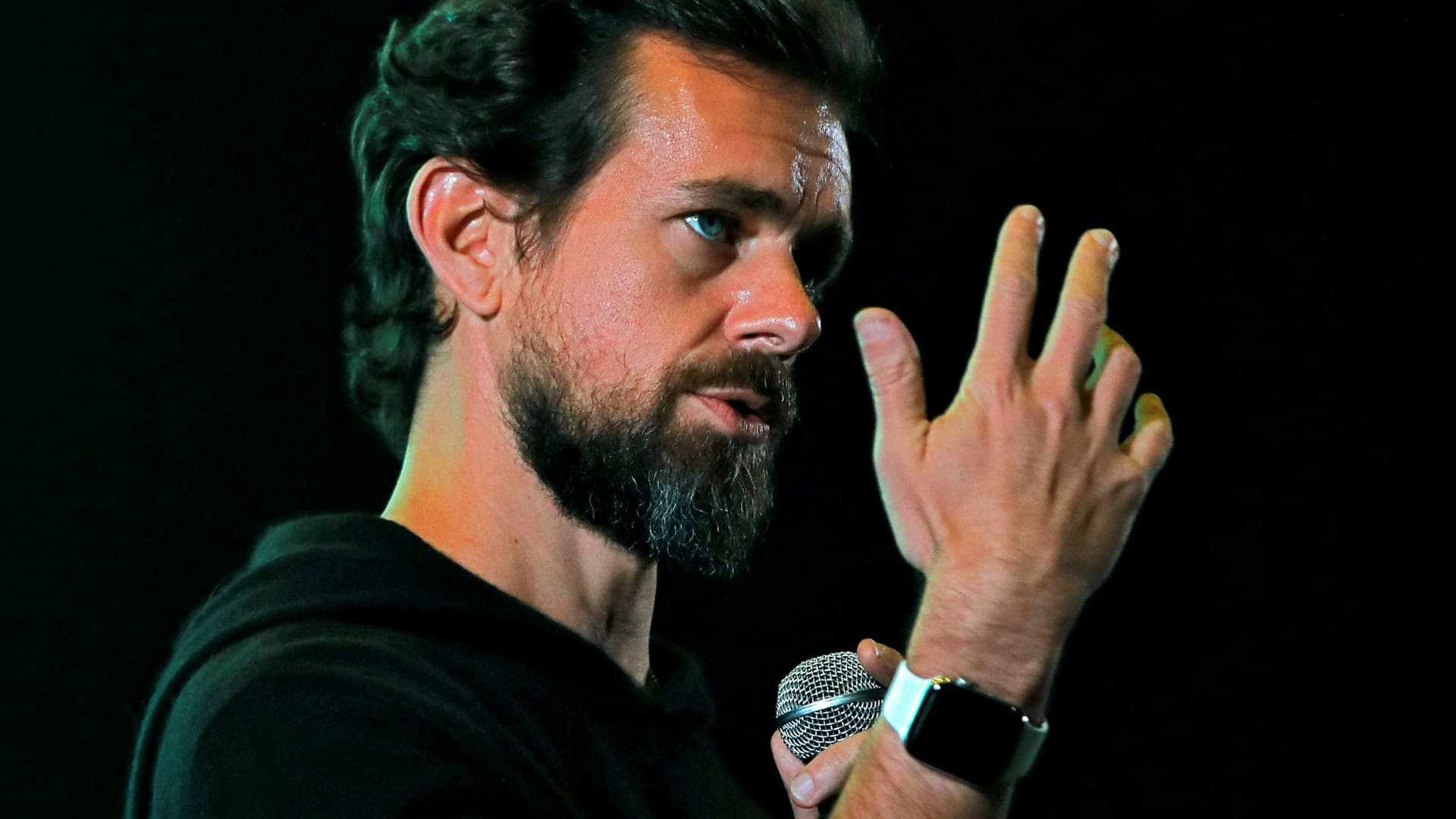

Twitter CEO Jack Dorsey addresses learners through a city hall at the Indian Institute of Technological innovation (IIT) in New Delhi, India, November 12, 2018.

Anushree Fadnavis | Reuters

Block stock rose about 3% in extended buying and selling immediately after the payments company described fourth-quarter earnings that skipped Wall Street anticipations, but posted powerful progress in gross earnings.

Here is how Block did versus Refinitiv consensus expectations:

- EPS: $.22, altered, vs . anticipations of $.30

- Revenue: $4.65 billion vs . anticipations of $4.61 billion

Block posted $1.66 billion in gross profit, up 40% from a year ago. That beat Wall Street expectations of $1.53 billion.

Analysts are likely to concentration on gross income as a additional correct measurement of the company’s core transactional firms.

The company posted a (non modified) internet decline of $114 million, or 19 cents for every share, for the quarter

Block, previously regarded as Square, advised CNBC in a connect with that the corporation ended the 12 months with 51 million month to month transacting actives for Income Application in December, with two out of a few transacting every single week on common.

Its Funds Application organization described $848 million in gross income, a 64% year-over-yr rise, in accordance to Block. Through December 2022, Funds Application experienced 51 million monthly transacting actives, an increase of 16% yr over 12 months.

The business claimed that its Cash App Card produced much more than $750 million in gross earnings in 2022, up 56% from a year earlier.

Its place-of-sale business enterprise, Sq., noticed gross financial gain grow 22% on an yearly basis to $801 million.

Prior to Thursday’s immediately after-hrs moves, the inventory was up far more than 15% in 2023.

Executives will explore the benefits on a convention call starting at 5:00 p.m. ET.