Binance’s Co-founder & CEO Changpeng Zhao has specified a number of interviews discussing the outlook for cryptocurrency following a turbulent pair of months in the market place.

NurPhoto / Contributor / Getty Images

Over a thirty day period after the collapse of FTX, trader concern about crypto exchange Binance isn’t fading.

Binance’s native token, BNB, has fallen 15% in the earlier week, like a fall of over 6% in the earlier 24 hrs. BNB, very first minted in 2017, is the world’s fifth most precious cryptocurrency, with a industry cap of about $39 billion, in accordance to CoinMarketCap. It is guiding only bitcoin, ethereum, tether and USD Coin.

The most up-to-date issue looming about Binance is FTX’s bankruptcy proceedings. Binance was the initial outside the house trader in FTX. In exiting its fairness posture in the firm previous yr, Binance acquired payment equivalent to about $2.1 billion.

In an interview with CNBC’s “Squawk Box” on Thursday, Binance CEO Changpeng Zhao dismissed concerns that his business could have that dollars clawed back again as FTX winds its way through individual bankruptcy court docket and trustees search to retrieve any fraudulent conveyances made by FTX to outdoors corporations or traders.

“We are financially Alright,” Zhao reported, following he was questioned by CNBC’s Becky Rapid if the organization could cope with a $2.1 billion demand from customers.

Crypto buyers have develop into skeptical of reviews from leading executives about the financial health of their organizations. FTX founder and ex-CEO Sam Bankman-Fried mentioned on Twitter that his firm’s property had been fantastic, even as executives realized it was in the midst of a liquidity crunch that at some point compelled the trade into personal bankruptcy. Bankman-Fried was arrested this 7 days in the Bahamas and charged by U.S. prosecutors with fraud and funds laundering.

Withdrawal calls for are an additional region of problem. Zhao stated that around $1.14 billion of internet withdrawals took place on Tuesday, but tweeted that this was “not the highest withdrawals we processed, not even prime [five].” On Wednesday, he said the predicament had “stabilized.” Blockchain analytics organization Nansen claimed the withdrawal range on Tuesday attained as higher as $3 billion.

A Binance spokesperson instructed CNBC in a assertion that, “we handed this intense pressure exam since we operate a pretty very simple business enterprise design – keep belongings in custody and make income from transaction expenses.” The spokesperson did not present an fast reaction to a query about the drop in BNB.

Binance and FTX had been intimately linked. Zhao declared publicly previous month that his business was liquidating its placement in FTT, FTX’s native coin, amid issues encompassing the solvency of both equally FTX and its sister buying and selling company, Alameda Study.

FTX then faced an instant surge in withdrawal requires, and Binance stepped in with a non-binding agreement to get the business as element of a rescue plan. A working day later on, Binance backed out of the offer, stating that FTX’s “issues are outside of our command or capability to support.”

Like all of the key crypto projects and firms, Binance created its have currency. On its web site, the organization says people today can “use BNB to shell out for products and solutions, settle transaction expenses on Binance Clever Chain, participate in exceptional token gross sales and extra.” Spots exactly where BNB can be utilized, the site states, contain payment, travel and leisure.

You can find a circulating provide of about 160 million BNB out of a full greatest offer of 200 million, in accordance to CoinMarketCap. Bloomberg documented in June that the SEC was investigating no matter whether the 2017 token sale amounted to a safety provided that really should have been registered with regulators.

— CNBC’s MacKenzie Sigalos contributed to this report.

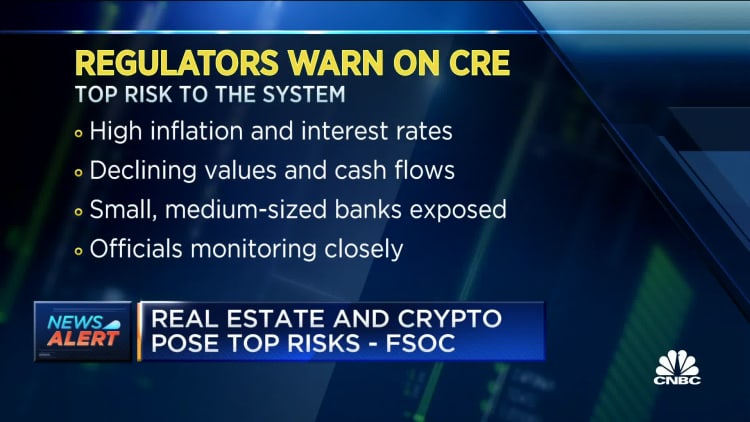

Watch: Regulators spotlight best risks: commercial authentic estate, credit rating losses, crypto