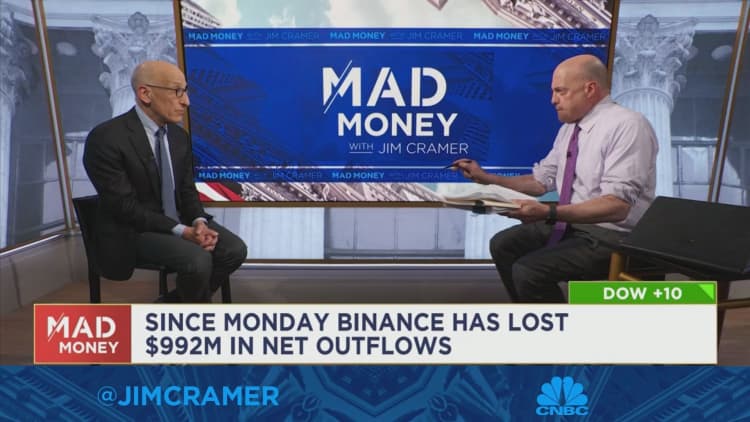

Binance’s Co-founder & CEO Changpeng Zhao has offered a number of interviews discussing the outlook for cryptocurrency next a turbulent few of weeks in the marketplace.

NurPhoto / Contributor / Getty Photos

The $2.2 billion of U.S. customer assets held by Binance is at “considerable possibility” of remaining stolen by founder Changpeng Zhao except if a freezing buy is in set spot, federal regulators said in a submitting Tuesday evening, after the crypto regulator was billed by the Securities and Trade Commission.

Lawyers from the SEC submitted an crisis movement earlier, citing a chance of cash flight and inquiring a choose to repatriate and freeze U.S. client belongings to protect against illicit transfers by Zhao or Binance entities. The SEC sued Binance and Zhao on Monday, alleging they engaged in the unregistered present and sale of securities and commingled trader funds with their own.

linked investing news

The most recent submitting explained Zhao as a “foreign national who has produced overt his sights that he is not subject matter to the jurisdiction of this Court docket.” SEC lawyers alleged that two Binance U.S. subsidiaries — BAM Investing and BAM Administration — were controlled by Zhao and experienced currently garnered “illicit gains” of at minimum $420.4 million in earnings and enterprise fundraising.

Several years of communications involving the SEC and Binance, which claims no official headquarters, advise that Binance.US couldn’t evidently reveal who controlled consumer property, according to the submitting.

“Zhao and Binance have had absolutely free reign,” the SEC alleged, in excess of “buyer property worthy of billions of dollars.”

Zhao’s attorneys say the billionaire is not topic to U.S. regulation, inspite of his manage above or useful possession of U.S. providers and bank accounts that despatched billions of pounds to Swiss and British Virgin Islands-dependent holding businesses, the SEC said.

The SEC says federal law and precedent set up the court’s jurisdiction about Zhao and Binance.

“There is no doubt that the Court docket has private jurisdiction more than all Defendants,” the SEC said.

Whilst Binance’s U.S. arm has said it maintains management more than substantially of its technological innovation and fiscal infrastructure, the SEC says Zhao’s final manage puts investor belongings at chance except motion is taken promptly.

“Offered the historical past of Zhao’s and Binance’s open drive to stay away from U.S. regulation and oversight, and their surreptitious handle more than BAM Investing and commingling of and movements of BAM Investing property by means of a website of Zhao-controlled entities outdoors of the United States, there can be no assurance that BAM Trading workers are not affected by Zhao or Binance right now,” the submitting stated.

Federal regulators are also requesting the court docket let them to serve Zhao by emailing his attorneys, stating his “pattern of geographical elusiveness” makes it tough to determine his exact residence or whereabouts. Zhao is reportedly a resident of the UAE.

Binance did not right away responded to a ask for for comment.

Watch: Timothy Massad: crypto risk ‘isn’t just about the token’