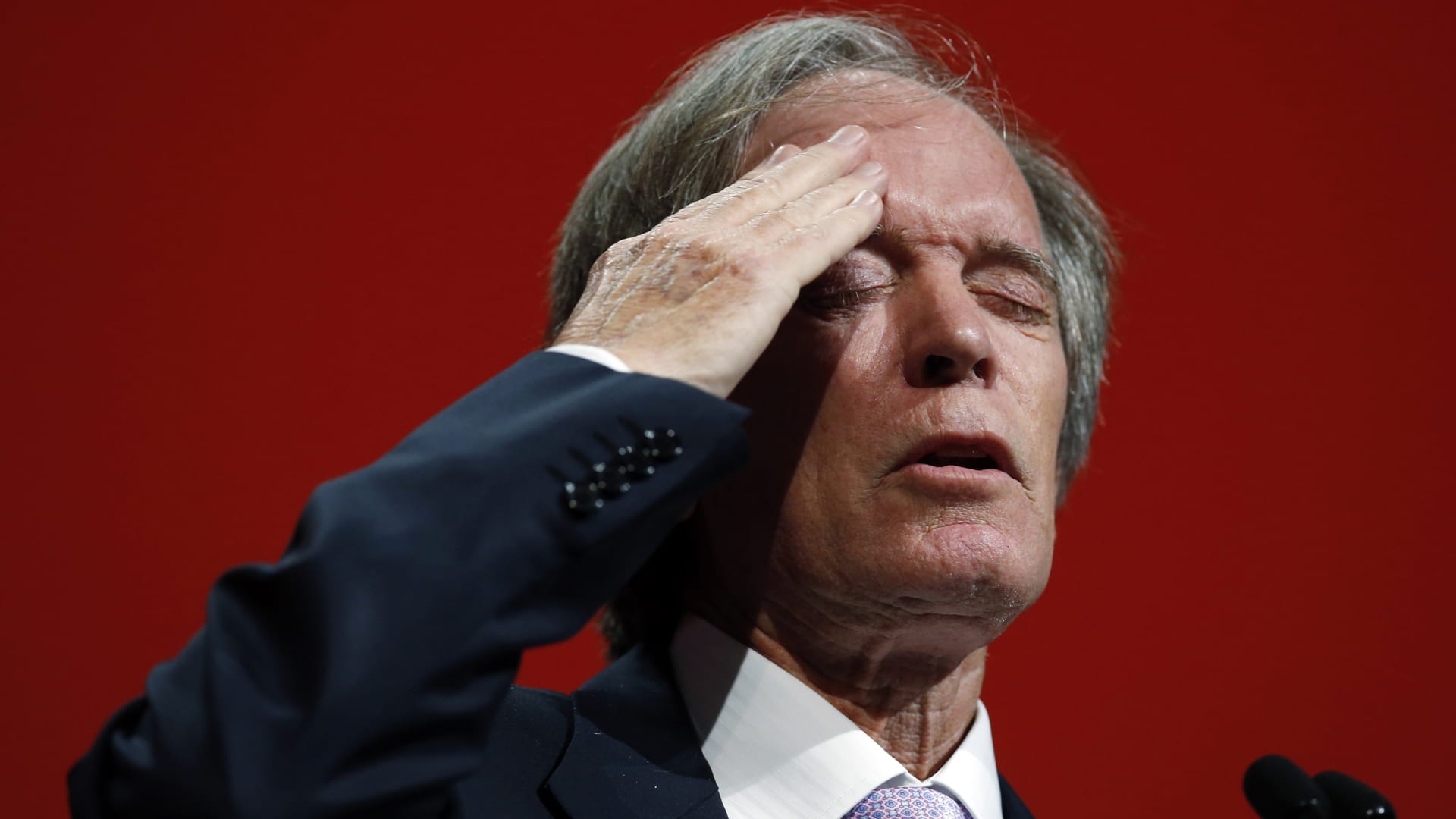

Famed investor Monthly bill Gross explained he expects massive trouble in advance must the Federal Reserve keep mountaineering interest costs.

“The overall economy has been bolstered by great amounts of trillions of dollars in fiscal expending, but in the long run when that is utilized up, I assume we have bought a delicate recession, and if curiosity prices preserve heading up, we’ve obtained more than that,” Gross stated Tuesday on CNBC’s “Halftime Report.”

similar investing news

“We have received prospective chaos in fiscal marketplaces,” he explained.

A tightening of financial plan would even more roil the capital markets, in accordance to Gross. The so-referred to as bond king and co-founder of Pimco pointed to Tuesday’s go in worldwide bond yields subsequent the Financial institution of Japan’s final decision to widen the produce on its 10-12 months Japanese govt bond.

In the meantime, a increase in fascination fees spells difficulty forward for business serious estate, which could encounter “potential defaults” ahead, Gross mentioned. Nonetheless, he expects that household actual estate will fare relatively greater, and will not be strike to the degree that it was throughout the Great Recession.

“I do think, going forward, if the Fed carries on to raise prices, that the capacity to equitize some of your housing, which is transferring down in price, is likely to be severely confined, and so that’ll provide as a caution for the housing marketplace,” Gross mentioned. “But in conditions of a debacle, as in ’07, ’08, I do not assume we’re headed there.”

Whilst at Pimco, Gross aided operate the world’s premier mutual fund. He then ran a fund at Janus Henderson right until he retired in March 2019.