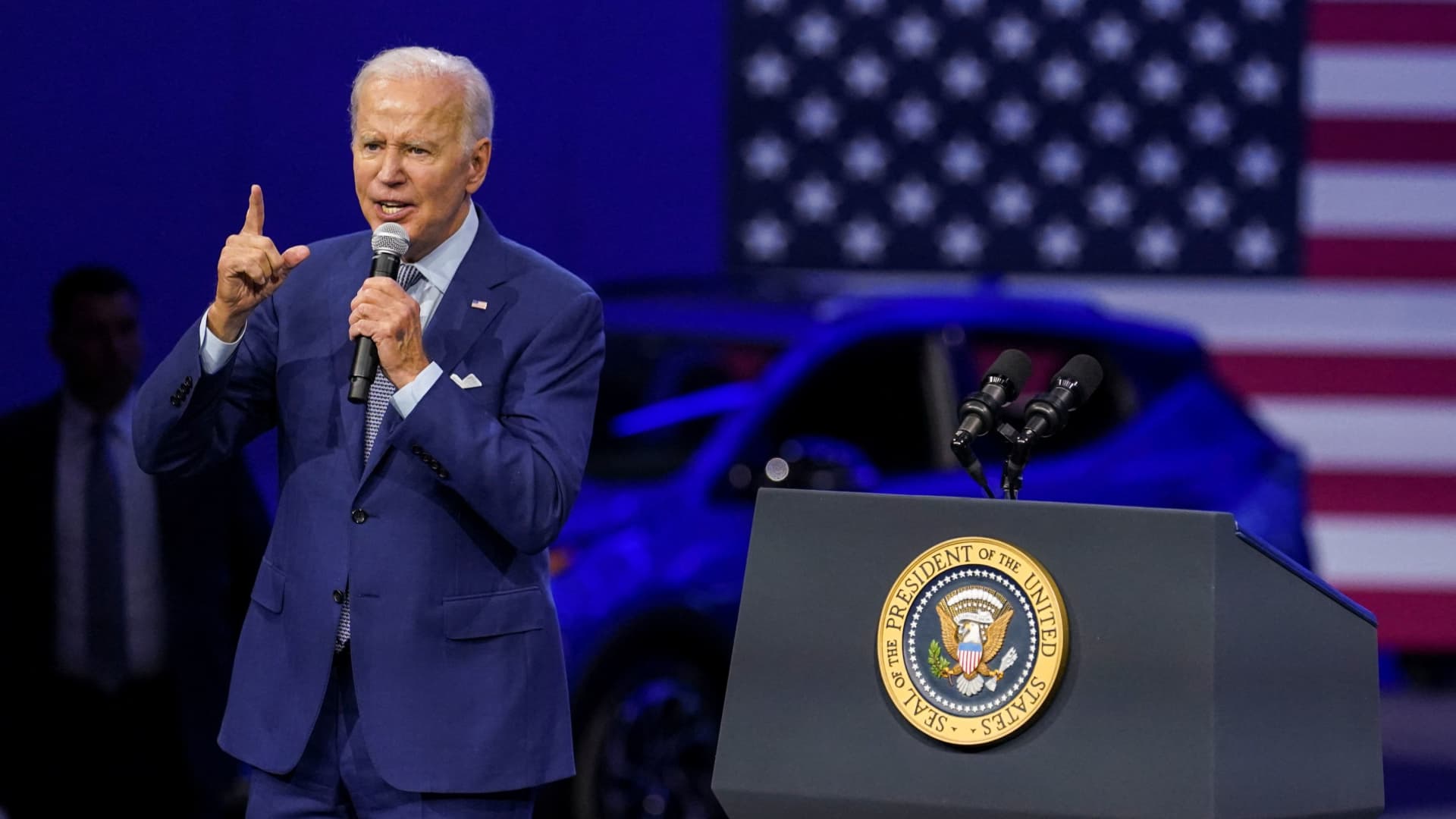

U.S. President Joe Biden provides remarks to emphasize electric powered vehicle producing in The united states, for the duration of a pay a visit to to the Detroit Car Clearly show, September 14, 2022.

Kevin Lamarque | Reuters

The Biden administration on Wednesday explained it will award $2.8 billion in grants for jobs to broaden U.S. producing of batteries for electric powered autos and domestic mineral generation.

The grants, which are funded through the president’s $1 trillion bipartisan infrastructure regulation, will enable manufacturing and processing organizations in at least 12 states to extract and method much more lithium, graphite, nickel and other battery elements.

The announcement is aspect of the administration’s broader thrust to transition the U.S. away from fuel-driven cars to electric powered automobiles. The transportation sector represents about just one-third of planet-warming greenhouse gasoline emissions each individual yr.

“Manufacturing state-of-the-art batteries and factors right here at household will speed up the changeover away from fossil fuels to meet the strong need for electric powered vehicles, building more excellent-shelling out careers across the nation,” Vitality Secretary Jennifer Granholm claimed in a assertion.

The assignments will support establishing sufficient lithium to provide about 2 million EVs per calendar year, establishing enough graphite to source about 1.2 million EVs for every yr and manufacturing sufficient nickel to supply about 400,000 EVs per year, in accordance to the Electrical power Department.

The projects will also put in the country’s very first massive-scale business lithium electrolyte salt creation facility in the U.S and produce an electrode binder facility that will offer 45% of the anticipated domestic demand for binders for EV batteries in 2030, the division mentioned.

Earlier this calendar year, Biden invoked the Defense Generation Act to bolster U.S. manufacturing of minerals demanded to create batteries for EVs and extended-time period energy storage, and to decrease the country’s dependence on overseas supply chains.

“At present, almost all lithium, graphite, battery-quality nickel, electrolyte salt, electrode binder and iron phosphate cathode product are produced abroad, and China controls the supply chains for numerous of these essential inputs,” the White Home stated in a fact sheet.

The White Household has established a purpose for EVs to comprise 50 percent of all new car or truck gross sales by 2030 and has pledged to substitute its federal fleet of 600,000 cars and vehicles with electrical electrical power by 2035. The administration has also rolled out a program to allocate $5 billion to states to fund EV chargers on national highways.