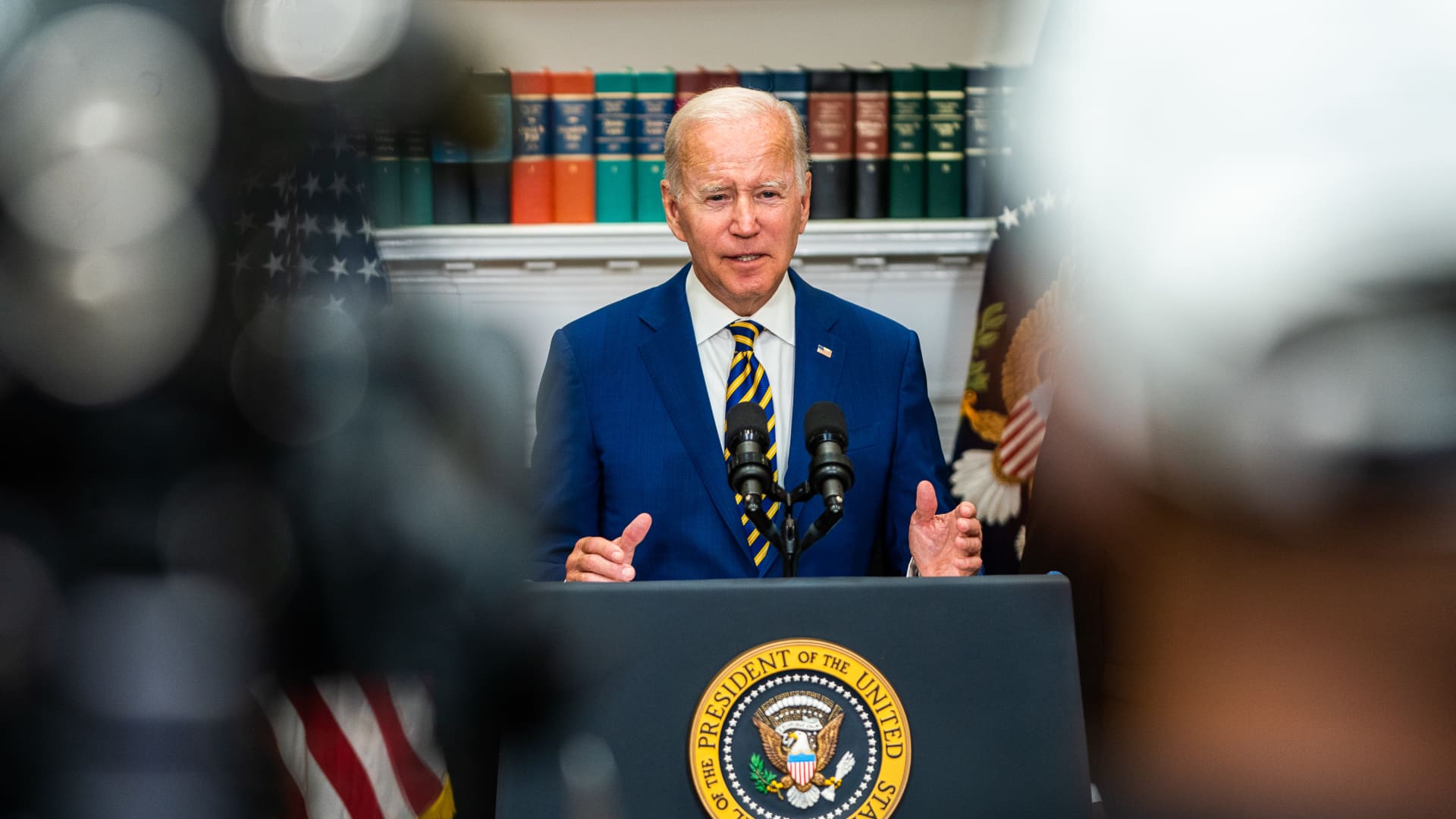

U.S. President Joe Biden delivers remarks pertaining to student bank loan credit card debt forgiveness in the Roosevelt Space of the White Household on Wednesday August 24, 2022.

Demetrius Freeman | The Washington Publish | Getty Pictures

The Biden administration reported in a new courtroom submitting Thursday that it will question the Supreme Courtroom to elevate an injunction and allow for a major scholar mortgage personal debt relief software to resume.

The filing arrived a few times soon after the federal appeals court docket for the 8th Circuit in St. Louis issued a nationwide injunction briefly barring the plan.

That ruling by the appeals court, which will be the target of the prepared ask for to the Supreme Court docket, was the most recent in a series of authorized troubles to President Joe Biden’s prepare to terminate up to $20,000 in university student financial debt for tens of millions of Us residents.

The Biden administration stopped accepting applications for its aid previously in the thirty day period soon after a federal district decide in Texas struck down its prepare last week, calling it “unconstitutional.”

The courtroom filing on Thursday asked the federal appeals courtroom for the 5th Circuit to keep the Texas judge’s order pending an charm by the Division of Justice of the ruling. The submitting states the decide “lacked jurisdiction to enter an purchase.”

And the submitting claims, “the governing administration will be filing an software with the Supreme Courtroom to vacate a different injunction from the [Education] Secretary’s action entered by the Eighth Circuit before this week.”

Before Thursday, the Biden administration disclosed up to date rules that will make it simpler for individuals battling with their university student debt to discharge it in personal bankruptcy.

In the case at issue in the 8th Circuit, a different federal decide rejected the challenge to the debt reduction software brought by the six states — Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina, The judge ruled that while the states lifted “essential and significant problems to the debt aid strategy,” they in the end lacked lawful standing to go after the scenario.

Standing refers to the plan that a a particular person or entity will be influenced by the action they request to problem in court docket.

The GOP-led states appealed just after their lawsuit was denied.

A three-decide panel on the 8th Circuit then dominated Monday that Missouri experienced revealed a likely personal injury from the administration’s method, pointing out that a key personal loan servicer headquartered in the point out, the Missouri Higher Schooling Personal loan Authority, or MOHELA, would reduce revenue less than the prepare. Missouri’s state treasury division gets funds from MOHELA.

The Biden administration has has defended the legality of its program and vowed to maintain preventing the problems.

“We feel strongly that the Biden-Harris Student Debt Relief Strategy is lawful and necessary to give debtors and functioning family members breathing room as they get better from the pandemic and to assure they do well when compensation restarts,” Training Secretary Miguel Cardona explained in a statement.

“Amidst attempts to block our financial debt relief plan, we are not standing down.”

A top rated formal at the U.S. Department of Training recently warned that there could be a historic rise in scholar personal loan defaults if its forgiveness program is not authorized to go as a result of. (edited)

“These student bank loan borrowers had the affordable expectation and perception that they would not have to make further payments on their federal scholar financial loans,” U.S. Department of Schooling Under Secretary James Kvaal wrote in a court docket filing.

“This belief may very well prevent them from building payments even if the Section is prevented from effectuating credit card debt reduction,” he wrote.

“Except if the Office is authorized to deliver 1-time university student mortgage financial debt aid,” he went on, “we assume this group of borrowers to have increased mortgage default prices thanks to the ongoing confusion about what they owe.”