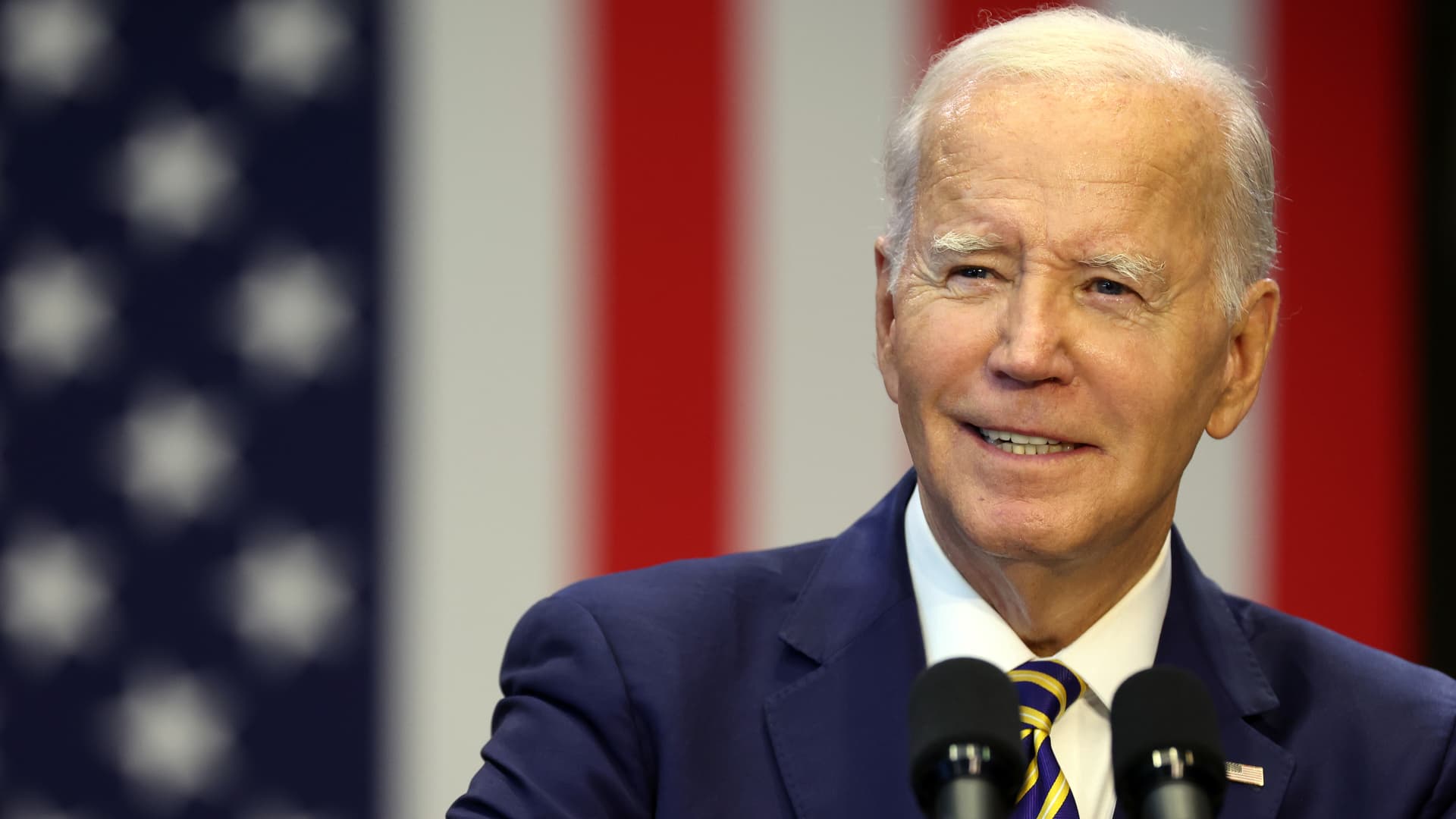

U.S. President Joe Biden provides remarks at Prince George’s Group College or university on September 14, 2023 in Largo, Maryland.

Kevin Dietsch | Getty Illustrations or photos

The Biden administration introduced on Friday the next phase in its new system to terminate people’s scholar credit card debt just after the Supreme Court docket struck down its primary policy in June.

The U.S. Section of Education and learning released its initial agenda of coverage factors for its second endeavor at offering Individuals scholar mortgage reduction. It also shared a listing of people today who will serve on the “College student Personal loan Personal debt Aid Committee,” including Wisdom Cole at the NAACP, Kyra Taylor at the Countrywide Purchaser Legislation Heart and numerous college student personal loan borrowers.

Extra from Particular Finance:

60% of People are nonetheless living paycheck to paycheck

Present-day graduates make significantly less than their mothers and fathers

Buy getaway airfare in Oct

The Biden administration will emphasis on particular teams of borrowers in its new prepare, which includes people struggling from financial hardship or who entered in compensation many years in the past. Its primary program was broader, only reducing out university student mortgage debtors who attained more than $125,000 as people or $250,000 as couples.

“The Biden-Harris Administration has taken unprecedented motion to correct the damaged college student personal loan method and produce file amounts of student debt aid,” U.S. Secretary of Education and learning Miguel Cardona reported in a statement. “Now, we are diligently transferring via the regulatory approach to advance financial debt relief for even more borrowers.”

College student mortgage compensation resumes on October 1

The announcement will come times ahead of the pandemic-period pause on federal college student mortgage expenditures expires. Tens of tens of millions of Us residents have taken advantage of that reduction, which has spanned two presidencies and far more than 3 many years.

Curiosity started accruing once more on federal scholar financial loans as of September 1. Bills will restart on October 1, despite the fact that some borrowers have further time before their first payment is thanks.

The Biden administration had hoped to relieve the changeover again into reimbursement by forgiving up to $20,000 in student financial debt for tens of tens of millions of Us residents. But soon soon after President Joe Biden rolled out his approach in August 2022, conservative groups and Republican states sued to block the relief.

The Supreme Court struck down the policy in June, concluding the president failed to have the electrical power to terminate up to $400 billion in buyer financial debt without the need of prior authorization from Congress.

Debtors might not see reduction until eventually July 2025

Legal gurus expected the president to narrow his reduction this spherical, in the hopes of raising its likelihood of survival.

“That would be less complicated to justify in front of a courtroom that is skeptical of wide authority,” Luke Herrine, assistant professor of legislation at the College of Alabama, instructed CNBC in a earlier job interview.

In contrast to Biden’s initially attempt to forgive university student financial debt quickly through an executive order, this time he’s turned to the lengthy rulemaking process. As a outcome, borrowers could possibly not see the aid before July 2025, in accordance to increased instruction pro Mark Kantrowitz.

“But the Office of Training may test utilizing it faster, probably all around the time of the election,” Kantrowitz explained.