Pedestrians wander earlier a billboard announcing the Earth Financial institution Group and Global Monetary Fund once-a-year meetings, on the side of the Global Monetary Fund headquarters in Washington DC on Oct 5, 2023.

Mandel Ngan | Afp | Getty Visuals

Leading economists and central bankers look to be in settlement on a single point: fascination rates will keep higher for for a longer period, clouding the outlook for world-wide markets.

Central banking institutions about the planet have hiked interest premiums aggressively in excess of the earlier 18 months or so in a bid to rein in soaring inflation, with different levels of accomplishment as a result considerably.

Just before pausing its hiking cycle in September, the U.S. Federal Reserve had lifted its major coverage amount from a focus on assortment of .25-.5% in March 2022 to 5.25-5.5% in July 2023.

Regardless of the pause, Fed officials have signaled that rates may well have to keep on being better for for a longer period than marketplaces experienced initially envisioned if inflation is to sustainably return to the central bank’s 2% target.

This was echoed by Environment Lender President Ajay Banga, who told a information convention at the IMF-Entire world Lender meetings last 7 days that costs will probable stay bigger for for a longer period and complicate the financial investment landscape for companies and central financial institutions close to the world, specially in light of the ongoing geopolitical tensions.

U.S. inflation has retreated considerably from its June 2022 peak of 9.1% year-on-12 months, but continue to came in earlier mentioned expectations in September at 3.7%, according to a Labor Section report very last week.

“For confident, we are likely to see costs higher for extended and we saw the inflation print out of the U.S. recently which was disappointing if you were hoping for costs to go down,” Greg Guyett, CEO of world-wide banking and markets at HSBC, advised CNBC on the sidelines of the IMF conferences in Marrakech, Morocco previous week.

He added that problems close to persistently better borrowing expenses were resulting in a “really quiet deal setting” with weak funds issuance and recent IPOs, this kind of as Birkenstock, having difficulties to find bidders.

“I will say that the strategic dialog has picked up rather actively due to the fact I think businesses are seeking for progress and they see synergies as a way to get that, but I feel it will be a although before persons start out pulling the induce presented financing fees,” Guyett additional.

The European Central Financial institution final month issued a 10th consecutive desire charge hike to acquire its major deposit facility to a history 4% in spite of signals of a weakening euro zone economy. Having said that, it signaled that even more hikes may possibly be off the table for now.

Quite a few central bank governors and members of the ECB’s Governing Council told CNBC previous week that although a November rate increase may perhaps be unlikely, the door has to continue being open to hikes in the foreseeable future presented persistent inflationary pressures and the possible for new shocks.

Croatian Countrywide Financial institution Governor Boris Vujčić claimed the suggestion that rates will keep on being better for more time is not new, but that markets in both of those the U.S. and Europe have been gradual in repricing to accommodate it.

“We cannot assume prices to occur down just before we are firmly certain that the inflation amount is on the way down to our medium-time period concentrate on which will not happen quite shortly,” Vujčić informed CNBC in Marrakech.

Euro zone inflation fell to 4.3% in September, its cheapest level because Oct 2021, and Vujčić stated the drop is expected to go on as foundation results, financial coverage tightening and a stagnating financial system continue on to feed by way of into the figures.

“On the other hand at some place when inflation reaches a degree, I would guess somewhere shut to 3, 3.5%, there is an uncertainty whether, specified the toughness of the labor sector and the wage pressures, we will have a even further convergence with our medium-expression target in a way that it has been projected at the moment,” he added.

“If that does not happen then there is a risk that we would have to do extra.”

This warning was echoed by Lender of Latvia Governor and fellow Governing Council member Mārtiņš Kazāks, who reported he was happy for curiosity premiums to keep at their latest degree but could not “shut the door” to further increases for two good reasons.

“One particular is of course the labor marketplace — we nevertheless have not viewed the wage progress peaking — but the other just one of course is geopolitics,” he told CNBC’s Joumanna Bercetche and Silvia Amaro at the IMF meetings.

“We may possibly have extra shocks that may push inflation up, and that is why of training course we have to continue to be very careful about inflation developments.”

He additional that monetary plan is getting into a new “greater for longer” period of the cycle, which will probably carry as a result of to make certain the ECB can return inflation solidly to 2% in the second half of 2025.

Also at the additional hawkish stop of the Governing Council, Austrian Nationwide Financial institution Governor Robert Holzmann advised that the risks to the existing inflation trajectory were nevertheless tilted to the upside, pointing to the eruption of the Israel-Hamas war and other achievable disturbances that could mail oil charges bigger.

“If further shocks appear and if the information we have proves to be incorrect, we could have to hike a different time or potentially two occasions,” he explained.

“Which is also a concept offered to the marketplace: really don’t commence to speak about when will be the 1st decrease. We’re nonetheless in a period of time in which we do not know how long it will choose to appear to the inflation we want to have and no matter whether we have to hike additional.”

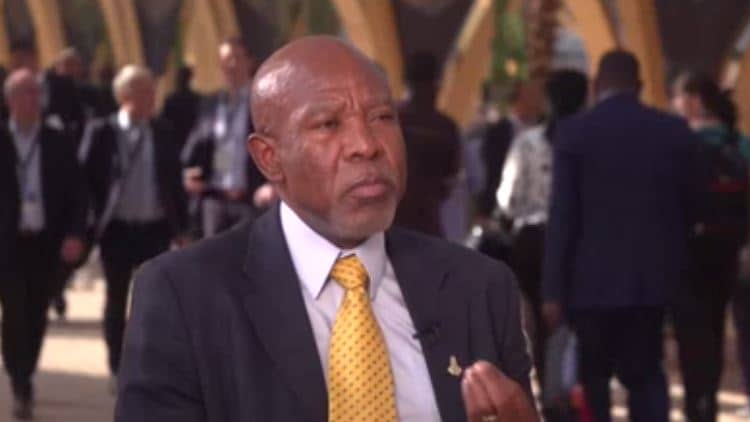

For South African Reserve Lender Governor Lesetja Kganyago, the career is “not yet carried out.” Nevertheless, he prompt that the SARB is at a place where by it can pay for to pause to evaluate the full outcomes of prior monetary policy tightening. The central financial institution has lifted its primary repo price from 3.5% in November 2021 to 8.25% in May perhaps 2023, the place it has remained considering that.