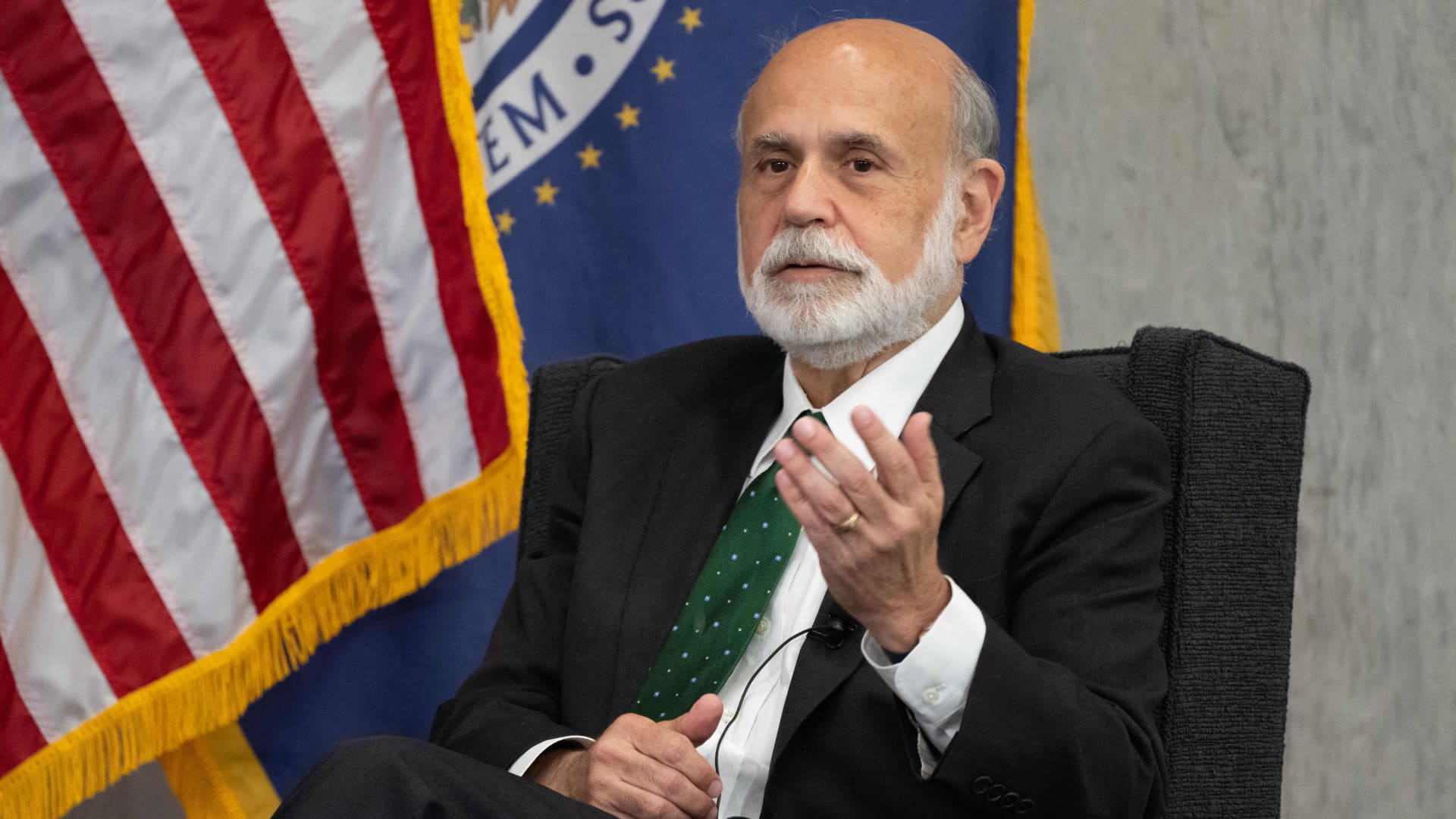

Former Federal Reserve Board Chair Ben Bernanke speaks in the course of a discussion on “Perspectives on Monetary Policy” through the Thomas Laubach Investigation Meeting at the Federal Reserve Board building in Washington, DC, May 19, 2023.

Saul Loeb | AFP | Getty Photos

LONDON — The Bank of England will on Friday publish a extended-awaited critique by previous Federal Reserve Chair Ben Bernanke that could direct to significant modifications in its monetary policymaking.

The evaluation was released previous summer time to assess the Bank’s struggles to precisely task the large world spike in inflation, following Russia’s invasion of Ukraine. This led to the BOE remaining way too gradual to hike fascination fees and subsequently owning to raise its key lender level to a 15-yr superior of 5.25%.

With inflation now slipping speedier than the MPC had expected, some economists have argued that the Lender is committing the very same oversight in the opposite way — by now remaining sluggish on the mark to cut charges, even as the economic climate flatlines.

In a study take note out on Tuesday, Goldman Sachs proposed Bernanke’s suggestions will concentration on two key spots. The 1st bargains with how the Bank of England communicates uncertainty all over its central forecasts.

“We count on that Bernanke will endorse that the admirer chart ought to get a a lot less distinguished job or be retired fully, though suggesting that the Financial institution use option scenarios much more extensively,” Goldman economists Jari Stehn and James Moberly.

“We consider that state of affairs evaluation would connect the conditionality of the forecast far more clearly, assistance to express uncertainty, and far better represent the assortment of sights on the Committee.”

The “lover chart” is the Bank’s extended-held approach of presenting the chance distribution that sorts the basis of its inflation forecasts.

“That reported, some of the information that the situations would comprise is by now captured by the MPC’s judgement on the hazard skew and in MPC members’ communications,” Stehn additional.

Deutsche Financial institution also advocated this will be a focal stage of Bernanke’s assessment. Senior Economist Sanjay Raja prompt in a notice last 7 days that he could suggest a circumstance-dependent technique throughout exogenous shocks.

A central issue for the Financial institution of England and other significant central banking institutions around the environment in the aftermath of the Covid-19 pandemic was quantifying the upside pitfalls to inflation forecasts from world wide provide chain disruptions, irrespective of whether from lockdowns and subsequent desire bottlenecks or from the war in Ukraine.

Enthusiast charts took the brunt of the blame for the MPC’s failure to maintain keep track of of these inflationary pressures, and Raja anticipates that they will “most likely be dropped going forward.”

“Just one possible advice coming from the Bernanke review could be for the MPC to undertake state of affairs-dependent analyses all through times wherever exogenous shocks increase uncertainty all-around the Bank’s central projections,” he said.

“The use of alternative scenarios would also allow for differing views on the committee to be mirrored extra formally (i.e., hawkish vs dovish threats as reflected in the latest make-up of the MPC).”

A alter to the interest charge conditioning route

The 2nd space of concentration, Goldman notes, is very likely to be the conditioning route for desire fees. The Lender at present publishes two forecasts for GDP, unemployment fee and inflation — just one centered on the marketplace-implied trajectory for fascination rates and a further assuming consistent fascination rates.

This differs from the European Central Lender, which provides a solitary forecast based on the market place-implied route for desire premiums, and from the Fed, which presents a “dot plot” by way of which each member charts their class of plan stance, inflation, real GDP and employment.

“While it is not out of the dilemma that Bernanke could propose that the MPC undertake a “‘dot plot’ or publish a Committee forecast for the plan amount, we consider this is a lot less possible. The downside of giving a plan price forecast would be that it could be misconstrued as a determination to a particular price route,” Stehn observed.

“That stated, if the MPC were to swap from conditioning on the market-implied level route to a forecast plan path, this would symbolize a far more major transform in the policy framework than the use of situations.”

Deutsche Bank’s Raja advised Bernanke could propose sticking to just one set of conditioning assumptions and publishing a collective projection for GDP, unemployment price and inflation.

“This could contain an endogenous view on level expectations, changing the sector produce curve with a desired interest fee profile,” Raja said.

“The principal benefit below would be in averting marked shifts in BoE projections as a consequence of market place interpretation of coverage expectations or world-wide spillovers that impact marketplace pricing heading into a forecast spherical. Relying on an interior fascination price conditioning route might be significantly less volatile and could avoid a ‘tail wagging the dog’ circumstance.”

Streamlining communication

A even further concentrate of the overview, Deutsche Lender states, could be on streamlining the Bank of England’s conversation, to lessen files, statements and projections to digest at every assembly — and strengthening the MPC’s core information from assembly to conference, as a final result.

Raja reported this could be reached by making “less and more compact tweaks” to the coverage statement, aligning the course of action far more intently with the concision and consistency of Fed and ECB policy statements. This, in transform, will make it simpler for the marketplace to interpret and isolate “new news.”

While the use of situation-dependent examination or an endogenous curiosity amount route could increase transparency all-around the Lender of England’s policy outlook “on the margins,” nevertheless, Raja was doubtful that it would be a “match changer” for marketplaces or the in close proximity to-term trajectory of financial coverage.

Bernanke’s tips will not be set in motion instantly. Incoming BOE Deputy Governor Clare Lombardelli has been charged with main the implementation when she requires her seat in July.

“Additionally, the MPC continues to be impartial, and finally, all votes and decisions by MPC users will continue being impartial,” Raja claimed.

“The Bernanke Assessment, consequently, will offer a reset to how the Lender operates its forecasts rounds and importantly, how it communicates its projections (and conclusions) to the broader general public.”