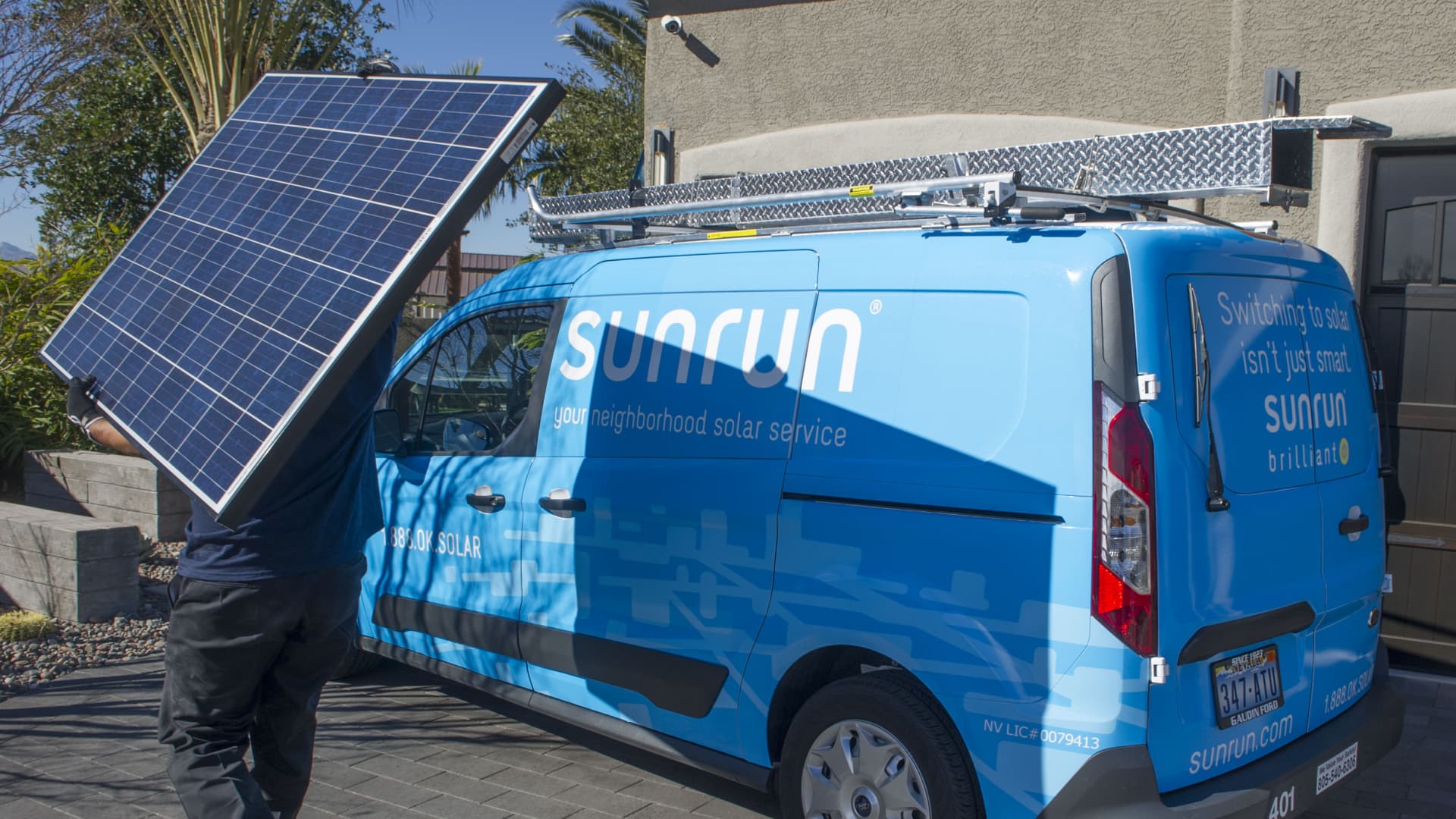

Here are the largest phone calls on Wall Avenue on Thursday: BTIG initiates FlyWire as invest in BTIG mentioned the long term appears to be like bright for the world wide payments and program firm. ” Flywire’s early recognition of application driving price in payments has enabled it to push ~50% annual gross earnings development about the previous 3 a long time. Evercore ISI initiates Teradata as outperform Evercore reported the software business has a aggressive advantage. “Even though Teradata was to begin with sluggish to changeover its details warehousing know-how to the cloud, its system has now developed to a point in which the company is more aggressive in hybrid cloud environments.” Citi reiterates Sunrun as invest in Citi explained it’s bullish heading into Sunrun earnings afterwards this quarter. “We consider FCF technology is more of a 2024 tale as the positive aspects of component charge reduction will not meaningfully demonstrate up in financials this yr. We believe that Operate has higher inventory than its peers and will take for a longer period to make the most of the increased priced inventory.” UBS initiates Duolingo as obtain UBS said the ed tech enterprise is “most effective-in-course.” “We initiate protection of Duolingo with a Get rating and $195 Rate Goal. DUOL has a most effective-in-course model inside the language discovering place which is however early in its on line penetration ramp.” Study a lot more about this get in touch with here. Lender of America reiterates Meta as buy Lender of The usa claimed it really is standing by its invest in ranking on Meta shares immediately after the firm’s Meta Join function on Wednesday. “Big announcements from the event included: 1) Additional particulars on the blended Truth Quest 3 headset, 2) Expose of Upcoming-Gen Ray Ban Good Eyeglasses, 3) Start of Meta AI.” Needham reiterates Amazon as get Needham reported traders should really obtain any dip in shares of the e-commerce giant. “Invest in AMZN on weak point owing to: a) no in close proximity to-time period impact on economics b) Generative AI upside c) advertisement advancement d) a compelled break up of AMZN would be beneficial for shares.” Wolfe reiterates Boeing as outperform Wolfe mentioned it really is standing by its outperform score on the inventory. ” Boeing inventory is down nearly 20% from August highs on a confluence of things like light 737 deliveries ongoing BDS woes and mgmt’s conservative responses at recent conferences on 2024 FCF anticipations.” Bernstein initiates Thermo Fisher as outperform Bernstein mentioned it sees margin enlargement for the well being-care firm. “We feel Thermo’s strength in the quick- and long-expression will drive income bigger than consensus better product sales drive leverage from cross-provide drives greater running margin.” DA Davidson upgrades Tractor Provide to obtain from neutral DA said in its up grade of the farming retailer that shares are interesting. “We believe TSCO has an ‘outstanding company opportunity’, an ‘enduring moat’, ‘exceptional financials’, a ‘shareholder oriented management’, and a ‘compelling possibility/reward.'” JPMorgan updates Huntington Ingalls Industries to obese from neutral JPMorgan claimed it sees a compelling entry point for the defense firm. “HII is down 10% the earlier three months on very little information, and whilst it has been a rough market place for Defense stocks, we see this as an eye-catching entry stage, with prime line visibility, possible for margin self-assist, and a decide on up dollars stream and cash return coming upcoming year.” Read far more about this call here. DA Davidson names Microsoft a best pick DA extra the tech big to its top rated picks list. “We are introducing Microsoft to D.A. Davidson’s Finest-of-Breed Bison record, recognized for companies easy to comprehend, have attractive financial properties and a potent moat, led by shareholder-oriented managers, and demonstrate exceptional financial functionality.” Evercore ISI reiterates Apple as outperform Evercore mentioned that Apple has “considerable Apple iphone pricing electrical power.” “We sustain our optimistic stance on AAPL write-up our study of ~4,000 people today concerning their Apple iphone paying for intentions. In mixture, Iphone device desire stays solid, ASP’s are shifting bigger presented SKU configurations. Wearables remains stable. Expert services viewing stability but modestly reduce AppleCare attach is noteworthy (weak macro?). JPMorgan upgrades DigitalBridge to overweight from neutral JPMorgan claimed the transformation is practically full for the electronic infrastructure company. “We are upgrading DigitalBridge to Chubby with a $25 selling price target. The business is mostly by way of its transformation of the organization to a concentrate on Digital Expense Management and simplifying running outcomes.” Read additional about this phone right here . Deutsche Lender initiates Typical Electric as get Deutsche reported in its initiation of the inventory that the “cultural transformation carries on.” “GE is a defeat and elevate tale with a catalyst loaded outlook, deep moats, and a powerful management staff.” Deutsche Financial institution provides a catalyst connect with acquire on Emerson Electric Deutsche said the multinational business is undervalued and has substantial momentum. ” EMR’ s operational execution improved considerably Q/Q previous earnings time, and we expect ongoing toughness in incremental margins to drive a defeat vs. consensus.” Goldman Sachs reiterates Micron as buy Goldman mentioned it’s standing by its invest in ranking on shares Micron just after its earnings report on Wednesday. “Regardless of what now seems to be a slower than previously envisioned recovery in gross margins and EPS, our constructive thesis on the inventory predicated on enhancing demand from customers and supply self-discipline remains unchanged and, as these, we would view any pullback in the inventory as an prospect to include to positions.” Bernstein reiterates Wendy’s as outperform Bernstein said shares of the fast foodstuff business are exceptionally appealing. “When some are waiting for imminent catalysts, we feel Wendy’s has presently planted the seeds for acceleration, and with valuation close to its 5-year reduced, we struggle to see a far better entry point to take part in Wendy’s future growth.”