Jakub Porzycki | Nurphoto | Getty Visuals

The very best hope for avoiding a collapse of ailing loan provider Initially Republic hinges on how persuasive 1 group of bankers can be with a different team of bankers.

Advisors to To start with Republic will endeavor to cajole the significant U.S. banks who’ve now propped it up into doing one much more favor, CNBC has discovered.

The pitch will go some thing like this, according to bankers with know-how of the problem: Purchase bonds from 1st Republic at above-industry premiums for a full reduction of a couple billion pounds – or confront around $30 billion in FDIC service fees when First Republic fails.

It’s the latest twist in a weekslong saga sparked by the sudden collapse of Silicon Valley Bank very last thirty day period. Days following the authorities seized SVB and Signature, mid-sized banking companies strike by serious deposit runs, the country’s largest banking institutions banded with each other to inject $30 billion in deposits into 1st Republic. That resolution proved fleeting soon after the depth of the firm’s difficulties became known.

If the Very first Republic advisors regulate to convince massive banks to order bonds for extra than they are value — to take the strike of expense losses for the great of the banking system, as very well as their very own welfare — then they are self-assured that other functions will phase up to support the bank recapitalize alone.

The advisors have currently lined up probable purchasers of new 1st Republic stock in that situation, according to the sources.

Important days

These financial investment bankers are now in search of to develop a perception of urgency. CNBC’s David Faber, who initially documented on the most recent rescue approach Tuesday, said that the coming times are very important for 1st Republic.

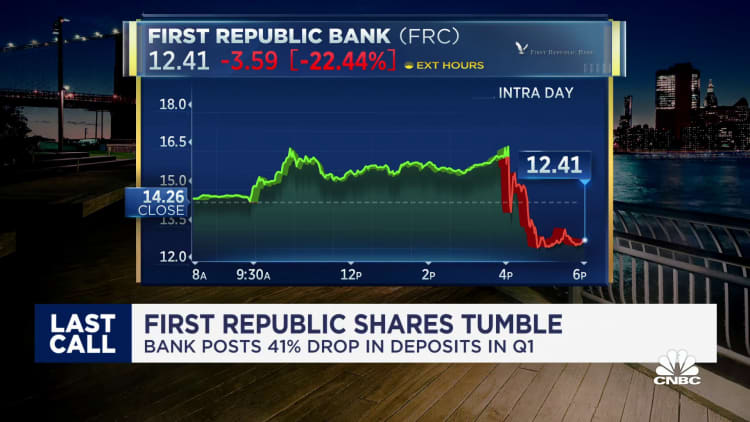

The bank’s inventory has been in freefall given that disclosing Monday that its deposits fell a staggering 40.8% just lately, leaving it with $104.5 billion in deposits, together with the infusion from huge banks. Analysts covering the firm released pessimistic stories after CEO Michael Roffler opted not to acquire any concerns after a brief 12-moment meeting phone.

“Now that the earnings are out, as soon as you’ve got acquired a window to act, it is really time to do it,” stated just one of the bankers, who requested for anonymity to discuss candidly. “You in no way know what will transpire if you hold out, and you do not want to be working with an unexpected emergency condition.”

Wrong begins

For decades, To start with Republic was the envy of peers as its aim on wealthy Us citizens served turbocharge development and allowed it to poach talent. But that product broke down in the aftermath of the SVB failure as its rich customers quickly pulled uninsured deposits.

Lazard and JPMorgan Chase were hired previous month to advise Initially Republic, according to media reviews.

The key gain of the advisors’ system, they say, is that it permits To start with Republic to offload some, but not all of its underwater bonds. In a governing administration receivership, the total portfolio should get marked down at once, resulting in what Morgan Stanley analysts estimated to be a $27 billion hit.

One complication, nevertheless, is that the advisors are relying on the U.S. govt to summon lender CEOs with each other to take a look at probable options.

There have been false starts previously: One major-4 U.S. lender reported that the govt instructed them to be prepared to act on the To start with Republic predicament this past weekend, but practically nothing happened.

Huge lender doubts

When the correct contour of any offer is a issue for negotiation and could consist of a distinctive reason vehicle or direct buys, quite a few opportunities handle the bank’s ailing balance sheet.

First Republic loaded up on minimal-yielding property together with Treasuries, municipal bonds and mortgages, building what was in essence a wager that curiosity premiums would not increase. When they did, the financial institution uncovered by itself with tens of billions of bucks in losses. The financial institution is weighing the sale of $50 billion to $100 billion in personal debt, Bloomberg described Tuesday.

By drastically decreasing the dimension of its harmony sheet, the bank’s money ratios will abruptly be far healthier, paving the way for it to raise extra funds and continue on as an unbiased firm.

Other possible, but significantly less-possible moves contain converting the massive bank’s deposits into fairness, or even finding a buyer. But a suitor has not emerged in the previous month, and isn’t very likely provided that any purchaser would also very own the losses on To start with Republic’s balance sheet.

That has led resources near to the large banks to consider that the most likely scenario for Very first Republic is government receivership, which is how SVB and Signature had been solved.

Those close to the financial institutions ended up hesitant to endorse a system in which they would have to acknowledge losses for overpaying for bonds. They also expressed distrust of authorities-brokered discounts following some of the pacts from the 2008 economical crisis ended up staying costlier than envisioned.

Open vs closed

But the failures of SVB and Signature – the two most significant since the 2008 fiscal disaster – cost the FDIC Deposit Insurance plan Fund many billions of dollars, which is compensated for by member banking companies. They also benefited the customers who have been in a position to cherry-choose the finest assets when the FDIC retains underwater bonds, the To start with Republic advisors mentioned.

Advisors referred to the private-industry options as the “open financial institution” option, while authorities receivership is the “shut-banked” circumstance.

But there is a third probability: the lender grinds on as is, slowly and gradually losing nevertheless extra value amid probable quarterly losses, expertise flight and unceasing uncertainties.

“Time, by the way, is not the bank’s mate,” analyst Don Bilson wrote Tuesday. “If just about anything, previous night’s discouraging update will make it even more challenging for To start with Republic to hold what it has.”