CNBC Pro: Fail to remember Amazon. Here’s what top rated tech investor Paul Meeks is obtaining

Investor self-confidence in the tech sector has been shaken this yr amid a flight to protection, but top rated tech trader Paul Meeks claimed he is now “additional bullish” on the sector than in current months, while he remains selective within just the sector.

He tells CNBC the stocks he favors.

Pro subscribers can study additional right here.

— Zavier Ong

South Korea’s revised GDP confirms advancement in the third quarter

South Korea’s revised gross domestic product or service for the 3rd quarter verified progress of 3.1% as opposed to the identical period of time a year in the past – increased than a 2.9% expansion observed in the 2nd quarter.

The financial state noticed slower quarterly advancement of .3% in the 3rd quarter, adhering to a growth of .7% in the prior period of time.

Independently, South Korea claimed a trade deficit of $7.01 billion for November, exceeding expectations of $4.42 billion — marking the 3rd consecutive thirty day period of rising trade deficit pushed by sluggish exports.

Exports shrank by 14%, reduced than forecasts of a drop of 11% — though imports grew more than envisioned by 2.7%, according to preliminary information from the customs agency.

– Jihye Lee

CNBC Pro: UBS reveals 15 worldwide stocks sensitive to China’s reopening plans

Chinese shares have risen this 7 days immediately after the nation’s health and fitness authorities documented a new uptick in vaccination rates, which gurus regard as important to reopening the nation.

The effects of Beijing’s modify in tack toward working with the outbreak of Covid-19 is currently being felt not only in China but also about the environment.

The Swiss lender UBS has determined 15 shares in the MSCI Europe index that will outperform “in an environment where China’s growth rebounds and the nation reopens its borders.”

CNBC Pro subscribers can read additional listed here.

— Ganesh Rao

Powell proceeds to think in a path to a delicate-ish landing

Federal Reserve Chair Jerome Powell claims he proceeds to imagine in a route to a “soft-ish” landing — even if the path has narrowed above the past 12 months.

“I would like to go on to think that you can find a path to a comfortable or comfortable-ish landing” Powell mentioned at the Brookings Institution.

“Our task is to consider to accomplish that, and I assume it is really still achievable,” Powell mentioned. “If you glance at the heritage, it’s not a probable end result, but I would just say this is a various set of conditions.”

— Sarah Min

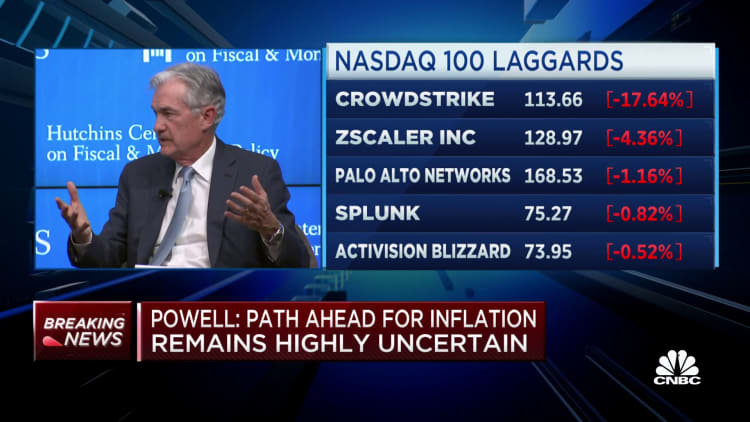

Indexes jump on Powell feedback

Fed Chair Jerome Powell’s reviews indicating the central lender will gradual upcoming fascination rate hikes as shortly as December put upward stress on the a few big indexes.

The S&P 500 jumped up .6% from the crimson on the news.

The Dow was around flat just after trading down for most of the working day.

The Nasdaq Composite acquired steam to 1.3% up.

— Alex Harring

Powell claims Fed can “moderate the rate” of future rate will increase due to lagged effect of previous hikes

Federal Reserve chairman Jerome Powell advised an audience at the Brookings Institution Wednesday that the central bank can afford to pay for to relieve back again on its tighter financial coverage at its December conference (owing to wrap up Dec. 14).

The lagged impact of better premiums currently taken in 2022, furthermore the drawing down of the sizing of the Fed’s stability sheet through quantitative tightening, mean “it will make feeling to average the pace of our price boosts as we tactic the amount of restraint that will be sufficient to bring inflation down,” Powell reported.

“The time for moderating the speed of fee boosts might arrive as before long as the December assembly,” said the 69-calendar year-outdated Fed chair.

In response to Powell’s remarks, the S&P 500 swiftly obtained to about 3970 vs about 3950 before the deal with.

— Scott Schnipper, Jeff Cox