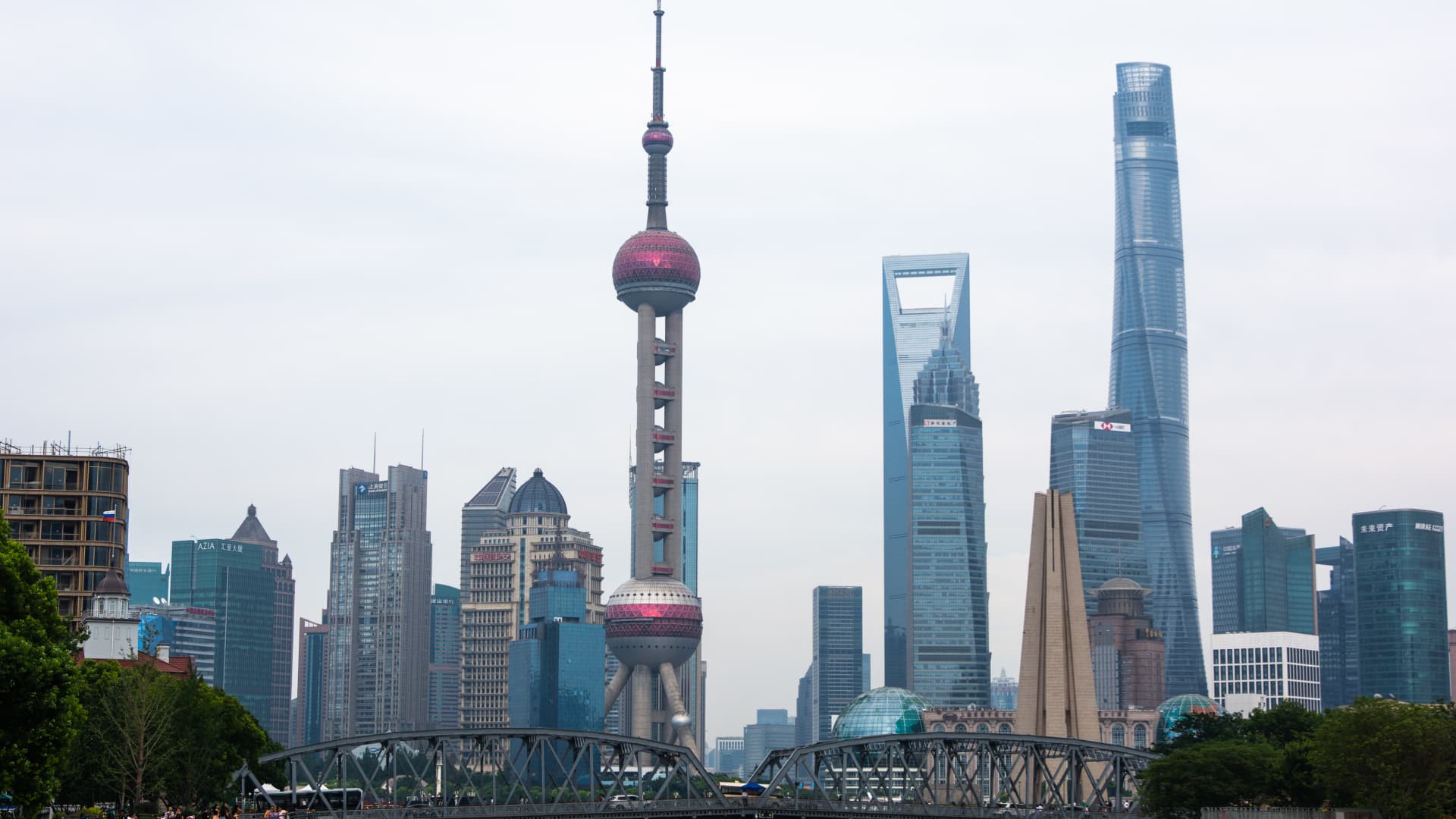

A view of high-rise buildings is seen along the Suzhou Creek in Shanghai, China on July 5, 2023.

Ying Tang | NurPhoto | Getty Images

Asia-Pacific markets are set to open lower on Monday as the region looks to key economic data out from China.

The world’s second-largest economy will release May numbers for its retail sales, industrial output and urban unemployment rate.

The People’s Bank of China is also expected to announce its one-year medium term lending facility rate, with economists polled by Reuters forecasting no change to the current rate of 2.5%.

Hong Kong Hang Seng index futures were at 17,794, lower than the HSI’s last close of 17,941.78.

Futures for Australia’s S&P/ASX 200 stood at 7,717, slightly lower than its last close of 7,724.3.

Japan’s Nikkei 225 futures pointed to a weaker open for the market, with the futures contract in Chicago at 38,570 and its counterpart in Osaka at 38,460 compared to the previous close of 38,814.56.

On Friday in the U.S., the Nasdaq Composite notched a fifth straight winning session, adding 0.12%, while the S&P 500 inched lower by 0.04%, to snap a four-day winning streak.

The Dow Jones Industrial Average slipped 0.15%, to mark four straight days of losses.

—CNBC’s Lisa Kailai Han and Brian Evans contributed to this report.