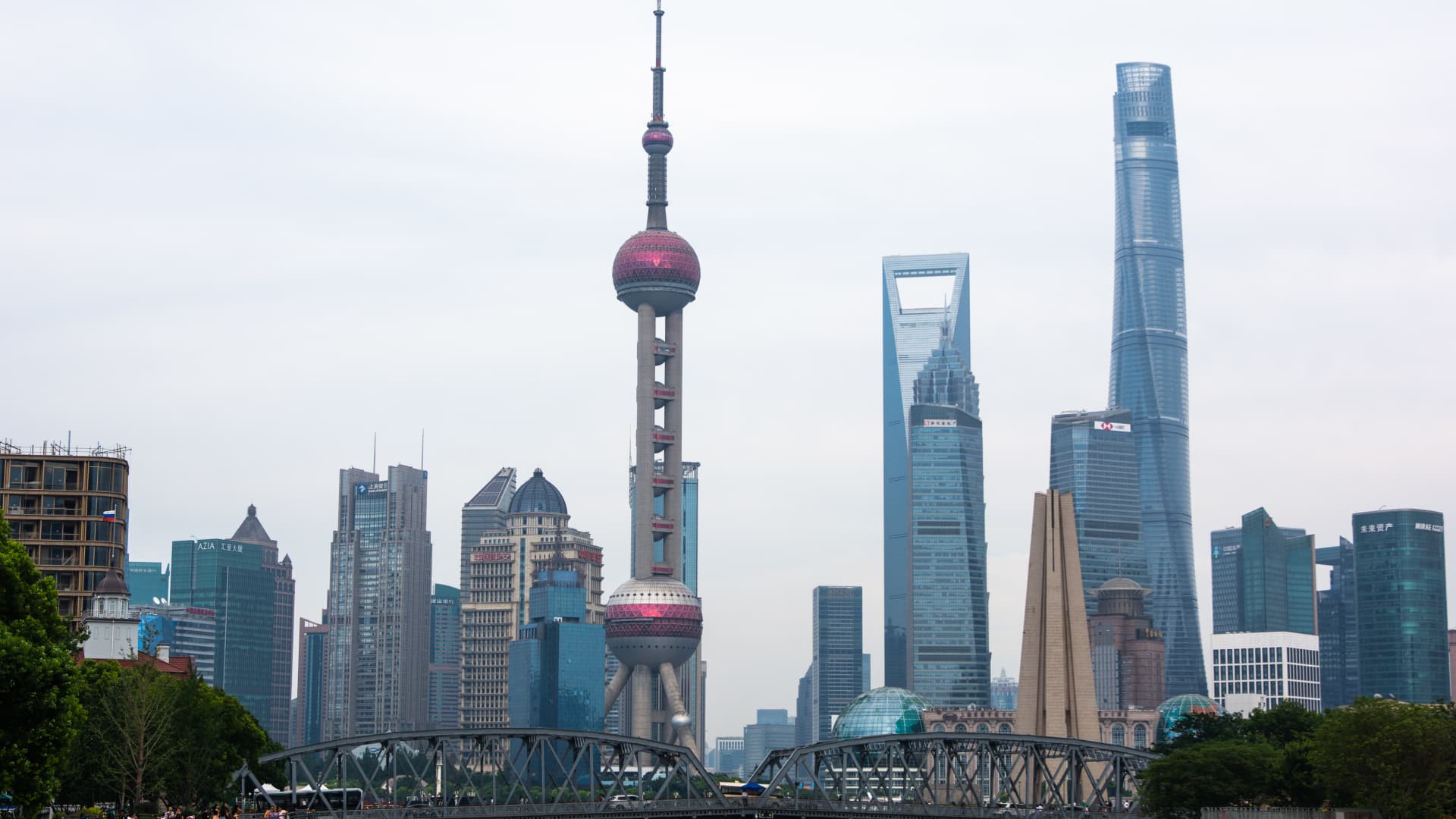

A see of substantial-increase buildings is seen alongside the Suzhou Creek in Shanghai, China on July 5, 2023.

Ying Tang | NurPhoto | Getty Photographs

Asia marketplaces fell as China’s yearly exports dropped for the first time in seven several years, but Japan stocks bucked the craze to lengthen their report rally.

Hong Kong’s Cling Seng index was down marginally, whilst the mainland Chinese CSI 300 dipped .27%. China’s buyer value index fell .3%, considerably less than a .4% drop envisioned by a Reuters poll of economists, and also lessen than the .5% slide viewed in November.

China’s exports for December beat expectations, but overall, overall trade declined in 2023 for the world’s next premier economic climate.

In the meantime, each the benchmark Nikkei 225 and the Topix had been at their maximum concentrations due to the fact 1990, acquiring surged in the previous 7 days.

The Nikkei superior 1.5% to shut at a new 33-12 months significant at 35,577.11, paring some gains just after surging 2.1% at open, even though the broader Topix was up .46% to stop at 2,494.23.

In Australia, the S&P/ASX 200 slipped .1% to end at 7,498.3, when South Korea’s Kospi fell .7% and the modest-cap Kosdaq was down 1.7%.

Overnight in the U.S., all a few important indexes finished Thursday close to the flat line even as U.S. inflation for December arrived in greater than expected.

December’s consumer selling price index report came out somewhat higher-than-envisioned, reflecting a .3% increase in customer prices for the thirty day period, pushing the once-a-year rate to 3.4%, in contrast to the 3.2% anticipated by economists polled by Dow Jones.

The Nasdaq Composite closed at the flat line, even though the Dow Jones Industrial Common eked out a gain of .04%.

The S&P 500 edged reduce by .07%, while previously in the session, the wide industry index briefly traded over its document closing high of 4,796.56.

— CNBC’s Pia Singh and Brian Evans contributed to this report