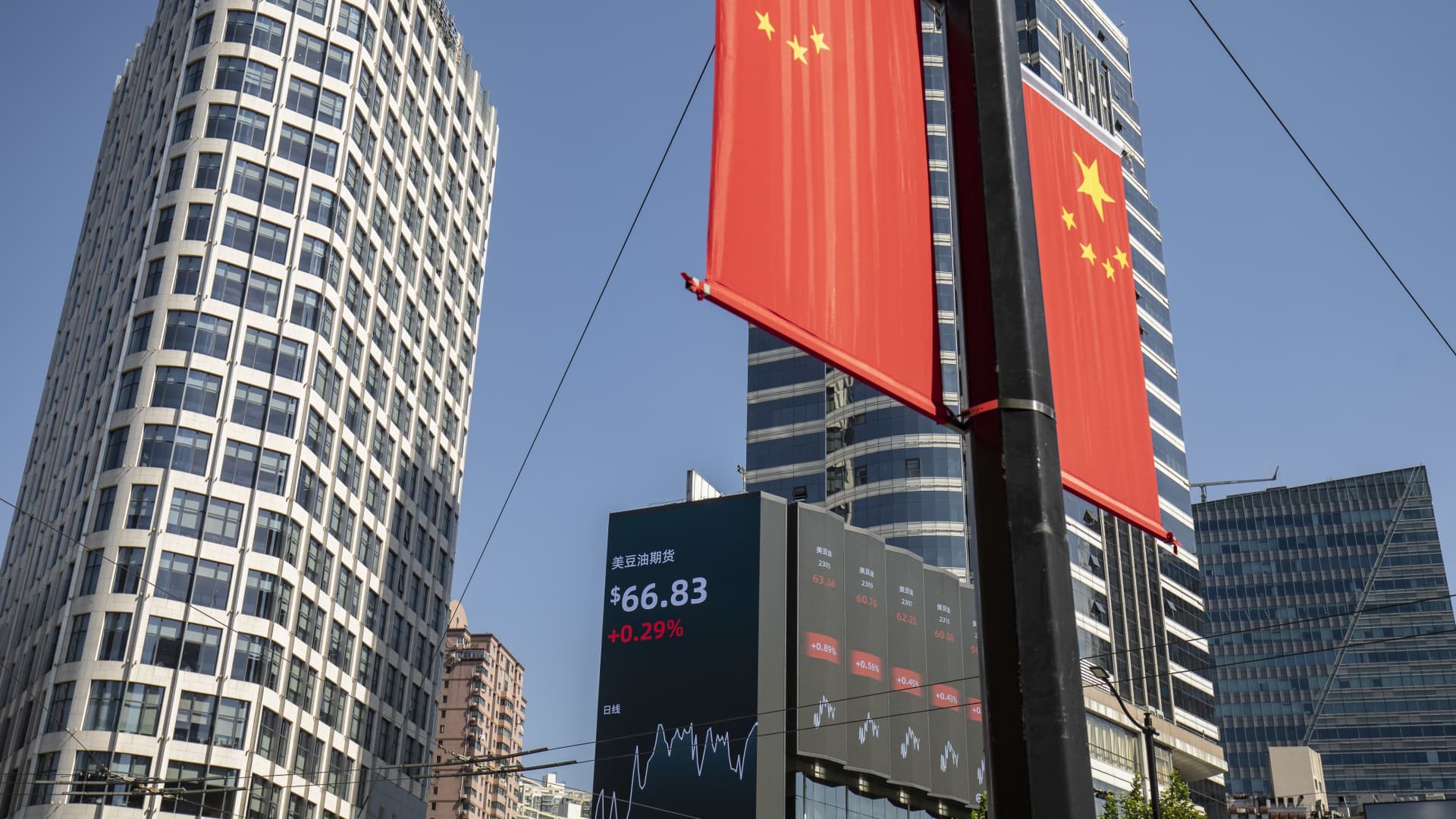

A public display screen displays inventory figures in Shanghai, China, on Monday, Oct. 10, 2022.

Bloomberg | Bloomberg | Getty Pictures

Asia-Pacific marketplaces fell in advance of the charge conclusion from the U.S. Federal Reserve and a slew of financial information from across the area, such as China and Australia.

Australia will release its inflation figures for December and the fourth quarter, whilst China will announce its official getting administrators index figures for January.

Retail income and industrial output knowledge for December are also anticipated out of Japan and South Korea.

In Australia, the S&P/ASX 200 slipped .15% following marking a seven-working day profitable streak on Tuesday.

Japan’s Nikkei 225 slid .75% in early trade, though the broad primarily based Topix inched down .26%.

South Korea’s Kospi was down .17%, even though the smaller cap Kosdaq saw a even bigger reduction of .32%.

The moves appear just after heavyweight Samsung Electronics noted a 34% slide in working revenue calendar year-on-12 months in the fourth quarter, as effectively as a 73.4% plunge in web earnings in the same period of time. Shares of Samsung fell .67%.

Futures for Hong Kong’s Hold Seng index stood at 15,702, pointing to a comparable open up in comparison with the HSI’s shut of 15,703.45.

Right away in the U.S., the 3 big indexes ended the working day blended as Wall Avenue also waits for the newest Fed determination on curiosity rates.

The Fed cash futures industry has priced in a 97% likelihood that the central financial institution will depart fees unchanged, according to the CME FedWatch resource, so investors are in its place left anticipating a change in the plan assertion that will close out the assembly.

The S&P 500 slipped .06%, whilst the Nasdaq Composite pulled again .76%. In distinction, the Dow Jones Industrial Average added .35% to stop at 38,467.31, marking its seventh report close this year.

— CNBC’s Brian Evans and Alex Harring contributed to this report