Lisbon , Portugal – 12 November 2024; Dan Rogers, CEO, LaunchDarkly, on SaaS Summit stage during day one of Web Summit 2024 at the MEO Arena in Lisbon, Portugal.

Harry Murphy | Sportsfile | Getty Images

Collaboration software maker Asana said Wednesday it has chosen former Rubrik and ServiceNow executive Dan Rogers to be its new CEO, replacing co-founder Dustin Moskovitz.

Rogers will start at San Francisco-based Asana on July 21, the company announced. Rogers will leave his post as CEO of LaunchDarkly, a startup with software for carefully releasing code updates. Rogers joined LaunchDarkly in 2023.

Moskovitz co-founded Facebook parent Meta before leaving to start Asana in 2008. In March, Asana said he would retire. Moskovitz will continue as chair of Asana’s board of directors as the company works to diversify with artificial intelligence tools. Asana’s AI Studio software generated over $1 million in annualized revenue during the April quarter.

“This moment represents an unprecedented opportunity for AI to evolve the way people work, and Dan is the leader with the experience, vision, and expertise needed to guide Asana into its next chapter,” Moskovitz said in a statement. “I am excited to support Dan.”

Moskovitz, whom Bloomberg estimates is worth over $11 billion, has received $5 in total compensation for the past five fiscal years. Rogers, by contrast, will receive a $650,000 base salary and $35 million in restricted stock units. Rogers will also be eligible for a $650,000 annual target bonus.

Before joining LaunchDarkly, Rogers ran marketing at ServiceNow and Symantec, and he held roles at Amazon Web Services, Microsoft and Salesforce. He arrived at LaunchDarkly after spending three years as president of data management software company Rubrik. LaunchDarkly did not immediately respond to a request for comment on its own succession plans.

After going public through a direct listing in 2020, Asana saw shares rise during the pandemic, alongside other software stocks. The stock price gradually drifted downward, and Moskovitz bought up more and more of the company. On Wednesday, the stock closed at $12.93 per share, down from its record close of $142.68 in November 2021. Moskovitz owns about 39% of outstanding Asana shares, according to FactSet.

The stock was unchanged after hours following the CEO announcement.

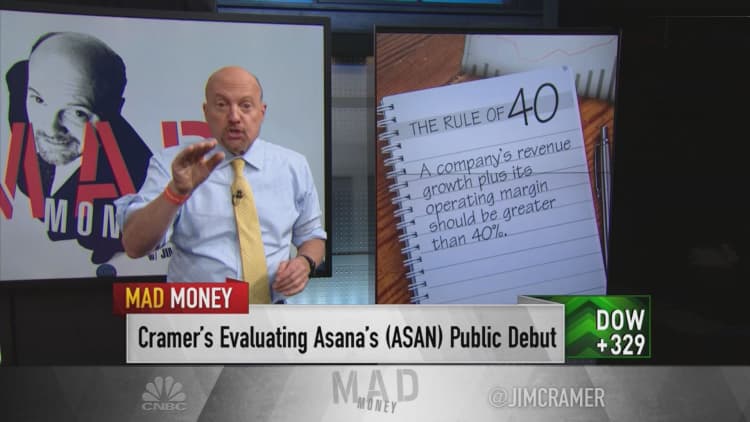

WATCH: Newly public Asana is worth something, but shares are ‘too high’ to buy, Jim Cramer says