With all eyes on the banking sector, CNBC’s Jim Cramer on Wednesday explained the Federal Reserve may require to consider “determined steps” at up coming week’s conference — which could be “great” for your portfolio.

“This is heading to be the most momentous Fed meeting in recent memory for the reason that the following shift is so substantial, and we never know what it really is likely to be,” he reported.

On the other hand, it truly is far too early to say if the Fed’s moves will outweigh the negative consequences of the increasing banking crisis, Cramer claimed.

“We are near to the stage where by the Fed may possibly feel the require to just take desperate steps that could be wonderful for your shares for your portfolio,” Cramer said. “We just do not know if it’s enough to outweigh the terrible from the snowballing banking crisis.”

In excess of the earlier handful of days, a monetary sector disaster has unfolded pursuing the collapse of Silicon Valley Bank and Signature Financial institution in New York, each of which failed to take care of a series of curiosity rate hikes from the Federal Reserve more than the previous 12 months.

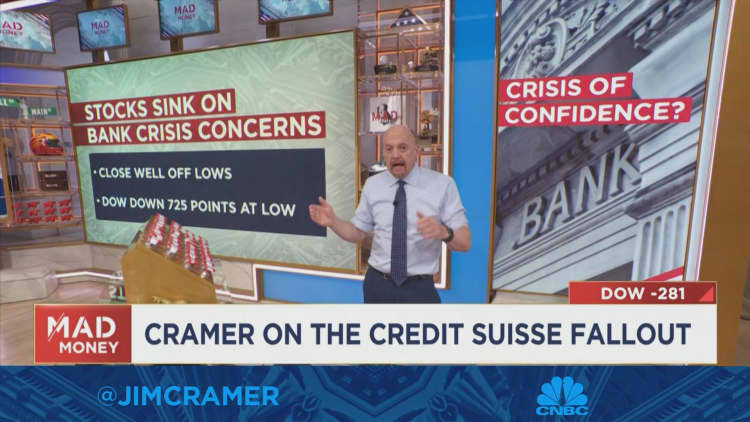

Shares dropped on Wednesday above fears of the banking disaster spreading into Europe, with buyers mulling in excess of the foreseeable future of global bank Credit Suisse. The key averages recovered some ground in the afternoon after a Swiss regulator introduced the country’s central bank would provide Credit rating Suisse with liquidity if necessary.