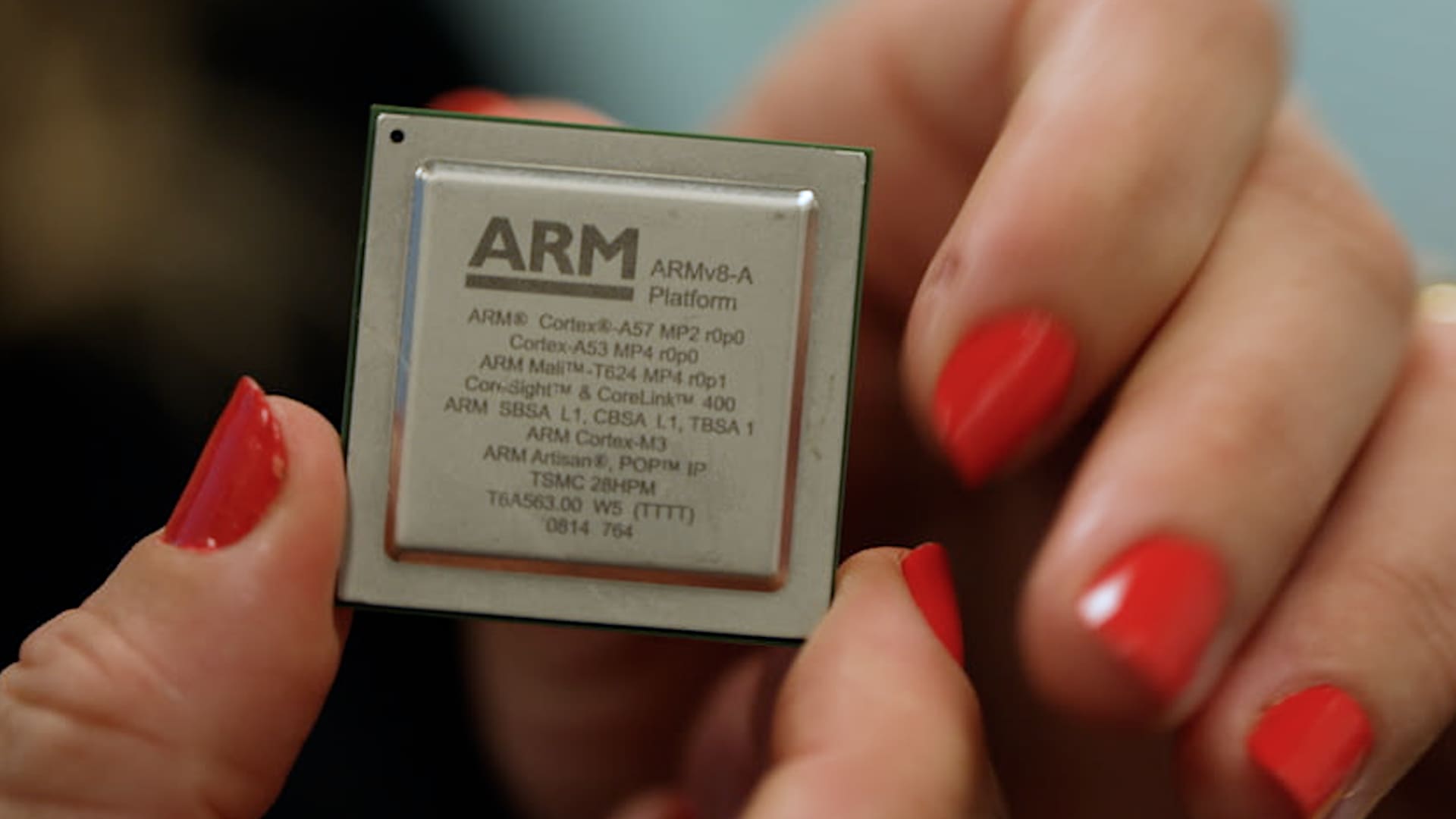

Arm will make the CPU architecture for chips discovered in virtually all smartphones. An Arm chip is revealed in this article in San Jose, California, on October 12, 2023.

Sydney Boyo

Arm reported fiscal third-quarter earnings that conquer estimates and gave a solid gain forecast for the recent quarter. The shares soared a lot more than 20% in prolonged trading.

Here is how the corporation did versus LSEG consensus estimates for the quarter ending December:

- Earnings: $824 million, vs. $761 million anticipated

- EPS: 29 cents adjusted, vs 25 cents envisioned.

Arm, whose chip structure engineering is in nearly each and every smartphone and several PCs, stated it expects earnings per share for the fiscal fourth quarter of between 28 cents and 32 cents on gross sales of $850 million to $900 million. Analysts anticipations earnings of 21 cents per share on product sales of $780 million.

The firm claimed internet profits of $87 million, or 8 cents per share. Complete income in the quarter improved 14% from a yr before.

Arm tends to make cash as a result of royalties, when firms spend for obtain to make Arm-compatible chips, typically amounting to a compact share of the last chip cost.

Arm said its shoppers delivered 7.7 billion Arm chips through the September quarter, which is the most modern period which figures are out there.

Royalty income greater 11% on an annual basis to $470 million. The firm reported the soar was partly because of a recovery in the smartphone sector, as properly as raising revenue to automotive businesses and cloud vendors. Arm mentioned that it expects progress to be pushed by royalty revenue.

In the latest decades, Arm has emphasized its licensing company, providing accessibility to extra complete patterns that semiconductor organizations can acquire and plug into their prepared chips. That method saves chipmakers time and exertion, and it really is additional beneficial for Arm than basically accumulating royalties.

Arm’s license and other revenue was $354 million, up 18% 12 months-over-12 months. Arm stated far more organizations had been deciding on to license its CPU models to run synthetic intelligence, and that the organization charges increased licensing service fees for advanced types.

Arm, which experienced been owned by SoftBank, went public in September. The organization was started in 1990 to produce know-how for lower-electricity chips, but grew to become much more significant to the in general engineering market when the Apple Apple iphone and competing Android units standardized on Arm-based mostly chips.

Arm claims that organizations including Apple, Google, Microsoft, and Nvidia use its technologies.