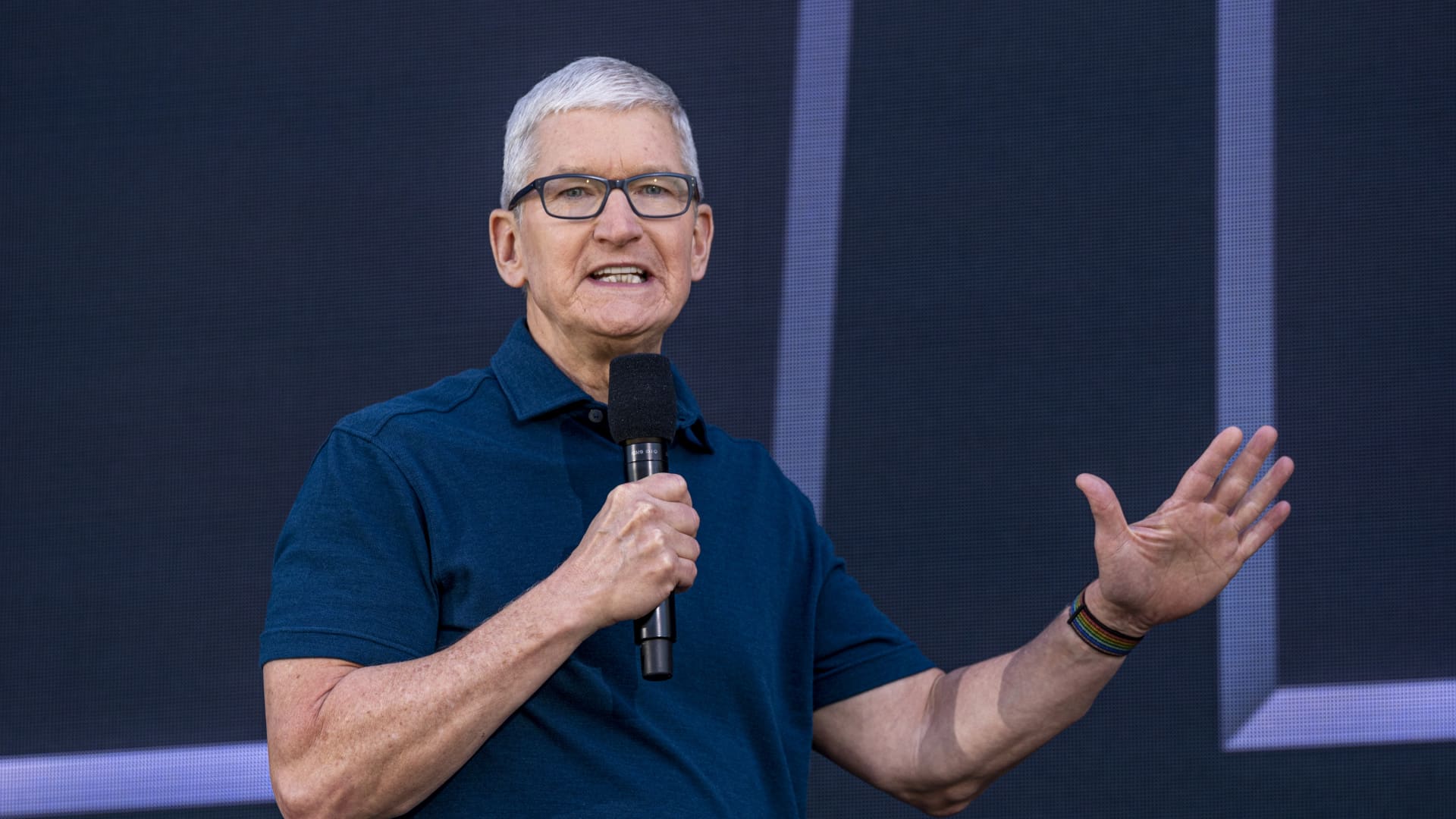

Tim Prepare dinner, main executive officer of Apple Inc., speaks throughout the Apple Globally Builders Meeting at Apple Park campus in Cupertino, California, US, on Monday, June 6, 2022.

David Paul Morris | Bloomberg | Getty Images

Apple has achieved a $490 million settlement to take care of a course-motion lawsuit that alleged Chief Government Tim Prepare dinner defrauded shareholders by concealing falling need for iPhones in China.

A preliminary settlement was filed on Friday with the U.S. District Court in Oakland, California, and calls for approval by U.S. District Judge Yvonne Gonzalez Rogers.

It stemmed from Apple’s unanticipated announcement on Jan. 2, 2019, that the Apple iphone maker would slash its quarterly revenue forecast by up to $9 billion, blaming U.S.-China trade tensions.

Cook experienced advised traders on an Nov. 1, 2018, analyst simply call that even though Apple confronted profits stress in markets such as Brazil, India, Russia and Turkey, where by currencies experienced weakened, “I would not place China in that category.”

Apple told suppliers a couple days later on to curb generation.

The reduced profits forecast was Apple’s 1st considering that the iPhone’s launch in 2007. Shares of Apple fell 10% the next working day, wiping out $74 billion of market value.

Apple and its attorneys did not immediately respond to requests for comment on the ruling.

The Cupertino, California-centered company denied liability, but settled to prevent the expense and distraction of litigation, courtroom papers demonstrate.

Shawn Williams, a lawyer for the shareholders, identified as the settlement an “fantastic consequence” for the class, which incorporates shareholders who purchased Apple shares in the two months between Cook’s remarks and the profits forecast.

Apple posted $97 billion of web cash flow in its most recent fiscal calendar year, and its payout equals a little under two days of earnings.

Past June, Rogers refused to dismiss the lawsuit.

She found it plausible to believe Prepare dinner experienced been talking about Apple’s income outlook and not forex changes, and mentioned Apple realized China’s economic climate was slowing and need could slide.

The guide plaintiff is the Norfolk County Council as Administering Authority of the Norfolk Pension Fund, situated in Norwich, England.

Lawyers for the shareholders may look for service fees of up to 25% of the settlement total.

Apple’s share selling price has much more than quadrupled considering that January 2019, giving the firm a more than $2.6 trillion industry benefit.

The scenario is In re Apple Inc Securities Litigation, U.S. District Court docket, Northern District of California, No. 19-02033.