As equities soared in 2020 and customers flocked to buying and selling apps like Robinhood, Apple and Goldman Sachs had been functioning on an investing feature that would let shoppers acquire and provide stocks, according to three people common with the ideas.

The venture was shelved final 12 months as the marketplaces turned south, explained the sources, who requested not to be named because they were not approved to communicate on the matter.

The effort and hard work, which has not been beforehand reported, would have additional to Apple’s suite of economical items driven by Goldman. Apple initial teamed up with the Wall Avenue financial institution to give a credit history card in 2019, and then added invest in now, pay out later (BNPL) loans and a higher-generate cost savings account. The firm explained last month that the savings account giving experienced climbed earlier $10 billion in user deposits.

Representatives for Apple and Goldman declined to comment.

Apple CEO Tim Cook retains a new Iphone 15 Professional all through the ‘Wonderlust’ function at the company’s headquarters in Cupertino, California, U.S. September 12, 2023.

Loren Elliott | Reuters

Apple was doing work on the investing function at a time of zero curiosity charges all through Covid, when customers ended up trapped at household and paying out additional of their time and their document cost savings in buying and selling shares, which includes meme stocks like GameStop and AMC, from their smartphones.

Apple’s discussions with Goldman started throughout that hoopla cycle in 2020, two sources stated. Their get the job done progressed, and an Apple investing characteristic was intended to roll out in 2022. One hypothetical use scenario pitched by executives associated the skill for Iphone users with further funds to place income into Apple shares, a single particular person stated.

But as markets have been roiled by larger rates and soaring inflation, the Apple group feared consumer backlash if individuals lost revenue in the inventory sector with the guidance of an Apple product or service, the resources said. That’s when the Iphone maker and Goldman switched instructions and pushed the plan to start personal savings accounts, which profit from greater charges.

The status of the inventory-trading challenge is unclear just after Goldman CEO David Solomon bowed to internal and external stress and resolved to retrench from almost all of the bank’s purchaser initiatives. A person resource stated the infrastructure for an investing element is mostly built and all set to go should Apple sooner or later decide to transfer ahead with it.

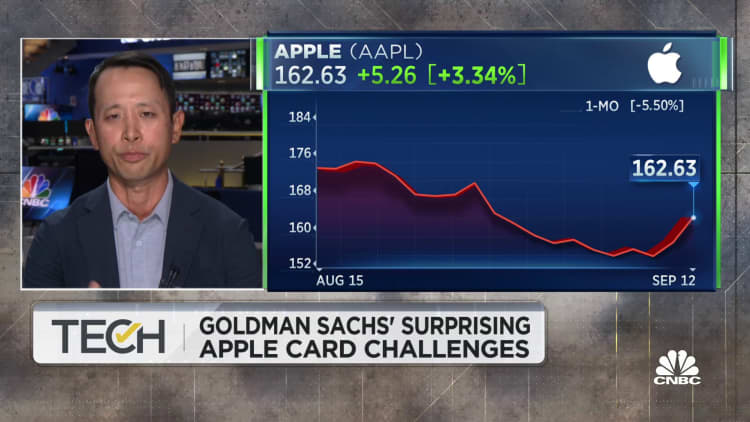

The Apple Card launched with substantially fanfare 3 years back, but the business enterprise brought regulatory heat and racked up losses as its consumer foundation expanded. Previously this 12 months, Goldman rolled out a higher-desire personal savings account for Apple Card buyers, supplying a 4.15% once-a-year share produce.

Goldman was also central to Apple’s BNPL supplying. The product or service, called Apple Spend Later, can be employed for buys of $50 to $100 “at most web sites and apps that settle for Apple Shell out,” in accordance to the guidance website page. Borrowers can split a buy into four payments about six weeks without the need of incurring curiosity or charges.

Right before Goldman’s pivot absent from retail banking, the corporation examined strategies to increase its partnership with Apple, sources explained. Extra a short while ago, Goldman was in conversations to offload both of those its card and discounts account to American Express.

Experienced designs for the investing app progressed, Apple would have entered a industry with stiff level of competition, showcasing the likes of Robinhood, SoFi and Block’s Square, alongside with standard brokerage firms this sort of as Charles Schwab and Morgan Stanley’s E-Trade.

Stock investing has turn out to be another way for money firms to continue to keep clients and generate engagement on their platforms. Apple was pursuing the same strategy, a person supply claimed. It is a go that could seize the curiosity of regulators, who have scrutinized Apple for its App Retail outlet procedures. Robinhood has also been grilled by regulators for what they explained as “gamifying” marketplaces.

Other tech businesses have been pushing into the house. Elon Musk’s X, previously acknowledged as Twitter, is functioning on a way to allow users obtain shares and cryptocurrencies by way of a partnership with eToro. PayPal had options to launch inventory trading following choosing a important marketplace government in 2021. But the corporation abandoned people strategies, and mentioned on an earnings connect with that it would lower investing and refocus on its main e-commerce business enterprise.

Observe: Goldman’s Apple Card faces mounting credit losses