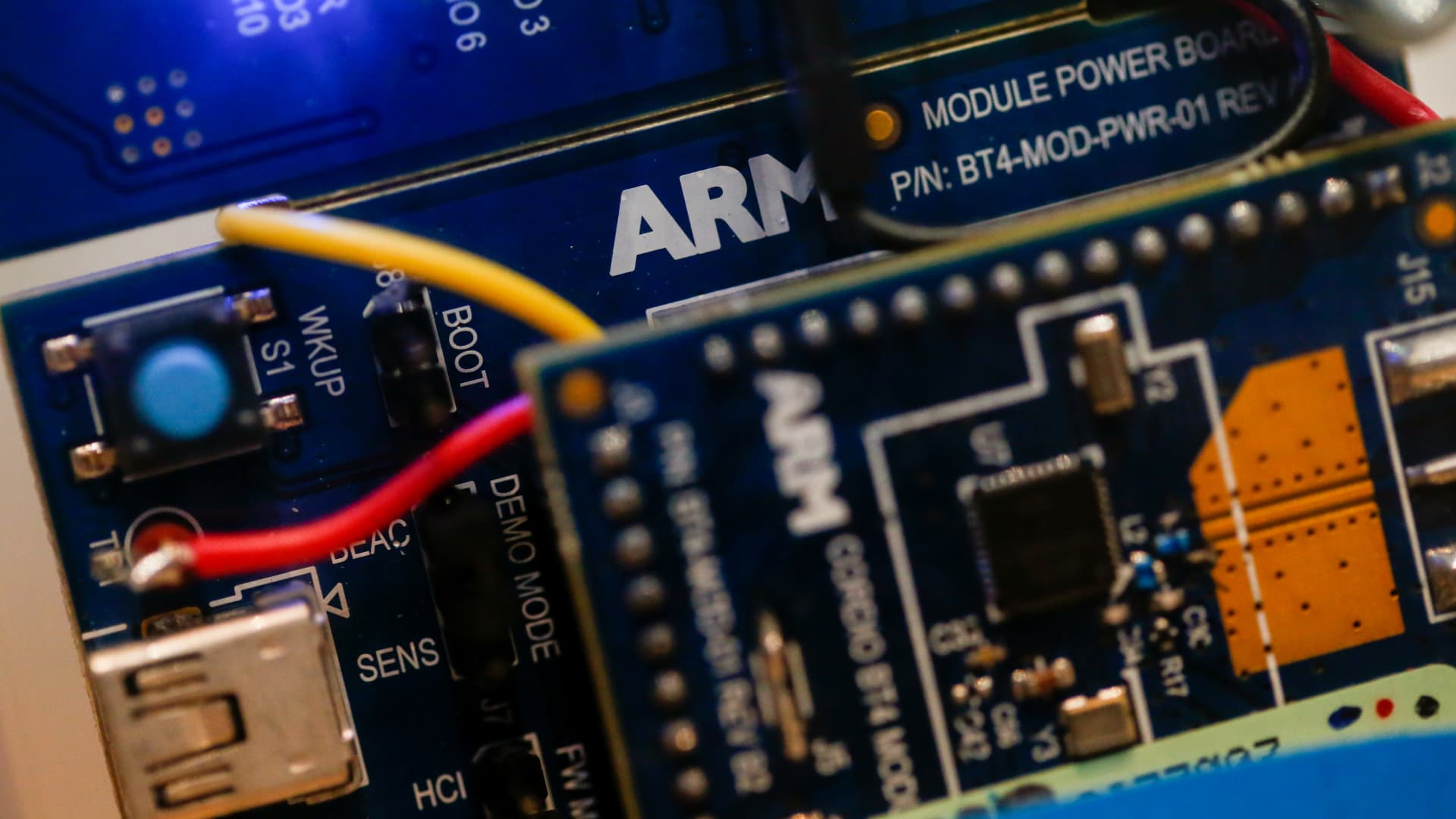

Parts made by Arm sit within a demonstration ARMmbed parking meter on display screen on the next day of Cell World Congress in Barcelona, Feb. 28, 2017.

Pau Barrena | Bloomberg | Getty Illustrations or photos

Apple has struck a deal with Arm as a result of 2040 and “beyond,” Arm said in a U.S. Securities and Exchange Commission submitting Tuesday.

The news signifies that Apple has secured entry to a main piece of intellectual residence, the Arm architecture, made use of in its Iphone and Mac chips, for the foreseeable future.

Arm, owned by SoftBank, is established to debut on the Nasdaq stock exchange in the coming weeks at a overall valuation that could be as substantial as $52 billion, which would be the most important technology original general public supplying this 12 months.

For Arm, its observe about the Apple offer indicates that at minimum a person of its most critical companions will continue on to use the firm’s know-how for a long time, quelling some fears that the alter in Arm’s corporate composition could prompt some of its consumers into on the lookout for technological options.

“Even further, we have entered into a new extensive-time period arrangement with Apple that extends over and above 2040, continuing our longstanding romantic relationship of collaboration with Apple and Apple’s entry to the Arm architecture,” Arm said in its current SEC submitting.

Arm’s architecture is used in almost each smartphone chip, which includes Apple’s A-collection for iPhones. Arm’s instruction established outlines how a central processor works at its most standard degree, these kinds of as how to do arithmetic or obtain laptop memory. Switching big software package jobs to other instruction sets is highly-priced, complicated and time consuming.

Arm, originally started in 1990, commenced developing fiercely after the Apple iphone arrived out in 2007 and smartphone makers needed chips that were being geared for low-energy use, particularly in contrast with the x86 architecture employed in Computer system and server chips by Intel and AMD.

Cornerstone traders

1 purpose corporations these types of as Apple use Arm’s architecture is mainly because it has not been owned by a competitor. Arm, a British company, licensed its know-how to all comers, and its clients could plan to make investments billions in building Arm chips with no stressing that their access to the technology could be curtailed.

The enterprise reported 230 billion chips have shipped working with Arm’s architecture, whilst about 50 % the company’s royalties profits will come from products and solutions unveiled concerning 1990 and 2012, in accordance to the submitting.

Considerations more than accessibility to Arm technological innovation is a single of the most important good reasons regulators blocked Nvidia’s bid to acquire Arm early final 12 months, foremost to this fall’s IPO.

Apple, Google, Nvidia, Samsung, AMD, Intel, Cadence, Synopsis, Samsung and Taiwan Semiconductor Producing Corporation have expressed curiosity in purchasing some Arm shares as aspect of the featuring, as substantially as $735 million in complete in accordance to the filing, which would give these firms a stake in Arm’s possession and some say in how it is managed. They are referred to as “cornerstone buyers.”

An Arm agent declined to remark and referred to the SEC filing. Apple reps didn’t right away reply to CNBC’s ask for for comment.