The U.S. authorities has introduced some of its most sweeping export controls still aiming to slice China off from state-of-the-art semiconductors. Analysts mentioned the transfer could hobble China’s domestic chip business.

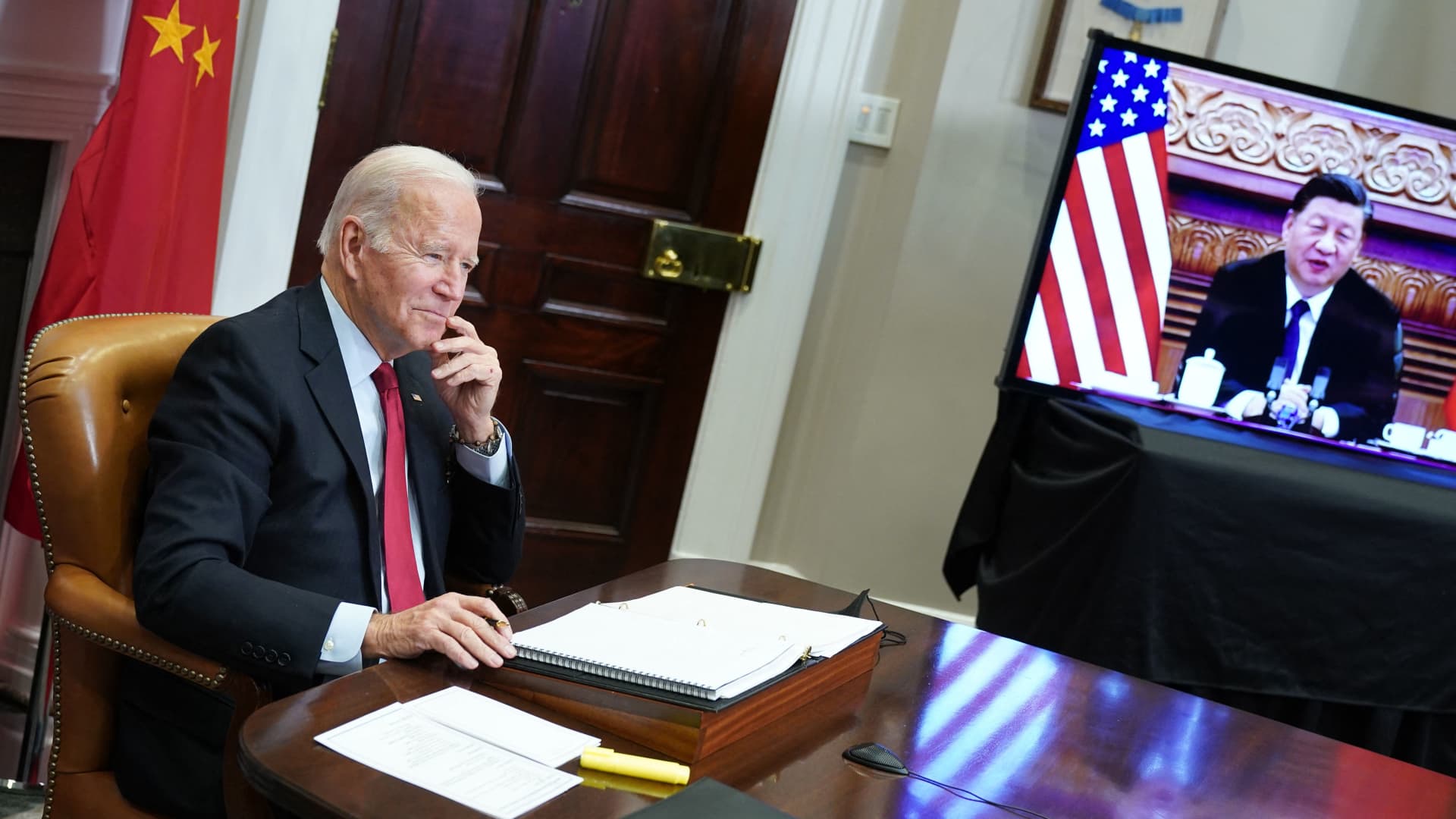

Mandel Ngan | AFP | Getty Visuals

China’s ambitions to improve its domestic chip sector has likely turn into magnitudes additional tough and high priced following the U.S. launched some of its most wide-ranging export controls similar to technologies towards Beijing.

On Friday, the U.S. Section of Commerce released sweeping rules aimed at cutting China off from getting or production important chips and factors for supercomputers, in what is noticed as a huge escalation in tensions between Beijing and Washington in the engineering sphere.

The us argues that these types of highly developed semiconductors can be utilized by China for sophisticated army capabilities.

“There is no likely back to the way factors ended up,” Abishur Prakash, co-founder of the Center for Innovating the Long term, an advisory company, instructed CNBC.

“With the most recent action, the chasm in between the U.S. and China has now expanded to the issue of no return.”

Here are some of the highlights of the new U.S. regulations:

- Organizations call for licenses to export superior-efficiency chips, typically developed for artificial intelligence purposes, to China.

- Even overseas-designed chips connected to AI and supercomputing, that use American instruments and program in the layout and production procedure, will call for a license to be exported to China.

- U.S. businesses will be heavily limited in exporting machinery to Chinese businesses that are production chips of a certain sophistication.

“The hottest chip principles are a sign that Washington is not seeking to rebuild relations with Beijing. Alternatively, the U.S. is creating it apparent that it’s using this competition much more seriously than it at any time has, and is prepared to take actions that have been once unthinkable,” Prakash explained.

What affect will U.S. limitations have on China?

Semiconductors are some of the most significant technological innovation solutions. They go into every little thing from smartphones to automobiles and refrigerators. But they’re also observed as important to army programs and advancing artificial intelligence.

As geopolitical tensions among China and the U.S. have ramped up in the previous couple of a long time, technology, and in particular delicate locations like chips, have been dragged into the struggle.

Synthetic intelligence, quantum computing and semiconductors are all areas China has determined as “frontier” technologies it wants to raise its domestic capabilities in. But the new U.S. guidelines will make that particularly hard, specially in the region of chips.

“The U.S. has formally shifted its purpose from outpacing China in the semiconductor field to actively denying it obtain to superior chips,” Pranay Kotasthane, chairperson of the high tech geopolitics program at the Takshashila Institution, explained to CNBC.

“China’s homegrown chip sector will be hobbled by these extensive controls.”

The mother nature of the supply chain

The purpose why the U.S.’s export controls could be so successful is how they could contact various components of the semiconductor source chain, even these not specifically primarily based in The united states or controlled by American firms.

That comes down to the world wide nature of the chip provide chain but also how electric power and know-how is managed by really handful of firms.

The United States, whilst robust in lots of parts of the sector, has lost its dominance in producing. In excess of the previous 15 a long time or so, Taiwan’s TSMC and South Korea’s Samsung have come to dominate the production of the world’s most state-of-the-art semiconductors. Intel, the United States’ premier chipmaker, fell far behind.

Reinventing the wheel will be considerably additional expensive now (for China).

Pranay Kotasthane

Takshashila Establishment

Taiwan and South Korea make up about 80% of the world wide foundry market. Foundries are services that manufacture chips that other organizations style and design.

The U.S., however, however boasts sturdy companies in the place of design equipment, a lot of of which are used by other companies in the supply chain. For example, it can be not likely that superior chips manufactured by TSMC will never have utilised American instruments somewhere together the way. In this occasion, the U.S. export constraints to China will implement.

Washington has applied this so-identified as foreign immediate product rule in advance of on the poster youngster of the Trump-period U.S.-China tech tensions — Huawei. Under all those rules, Huawei was slash off from the most innovative chips that TSMC was manufacturing and that had been designed for its smartphones. Huawei, which was the moment the number one player in the smartphone market place, saw its handset business enterprise crippled.

But by no means has these kinds of a rule been used so broadly by the U.S.

China will want to ‘reinvent the wheel’

Meanwhile, other international locations could be under strain to not ship particular pieces of gear to China. For case in point, the hottest guidelines signify firms will require to get licenses to ship equipment to Chinese foundries if those amenities are making certain memory chips or logic semiconductors of 16 nanometer, 14 nanometer or below.

The nanometer figure refers to the dimension of each and every individual transistor on a chip. The scaled-down the transistor, the much more of them can be packed on to a single semiconductor. Normally, a reduction in nanometer size can produce extra highly effective and effective chips.

China’s most sophisticated chipmaker, Semiconductor Producing Global Co. or SMIC, is currently generating 7nm chips, but not on a massive scale. It is generations at the rear of the likes of TSMC and Samsung which have a roadmap to make 2nm chips.

But to make chips of this sophistication on a big scale, with decreased charges and additional reliability, SMIC and other Chinese foundries will need to have to get their arms on a precise piece of package known as an extreme ultraviolet lithography equipment. The Dutch agency ASML is the only organization in the globe capable of producing this crucial piece of machinery.

If it falls underneath the U.S.’s export limits or arrives below stress from Washington not to promote to Chinese corporations, this could hamper development between the country’s chipmakers.

ASML underscores the complexities of the semiconductor supply chain.

“Semiconductor generation is a hyper globalised offer chain. Currently being cut off from this motor will necessarily mean that Chinese businesses need to ‘reinvent the wheel’ domestically. China’s semiconductor sector will have to have substantially greater cash and expertise infusion to take up this shock,” Kotasthane explained.

But this will be an uphill climb.

Kotasthane said that China will be equipped to make superior chips even without having ASML’s machinery “but the produce will be significantly decreased, that means larger prices and lessen reliability.”

Meanwhile, Chinese firms will have to rely on “lessen-conclude” domestic alternate options for style applications, Kotasthane explained, which they would generally have gotten from American and Japanese corporations.

Washington’s latest rules also have to have any “U.S. persons” to acquire a license if they want to guidance the growth or manufacturing of semiconductors at certain China-dependent manufacturing amenities. This successfully cuts off a key pipeline of American expertise to China.

“Reinventing the wheel will be significantly extra costly now,” Kotasthane said.