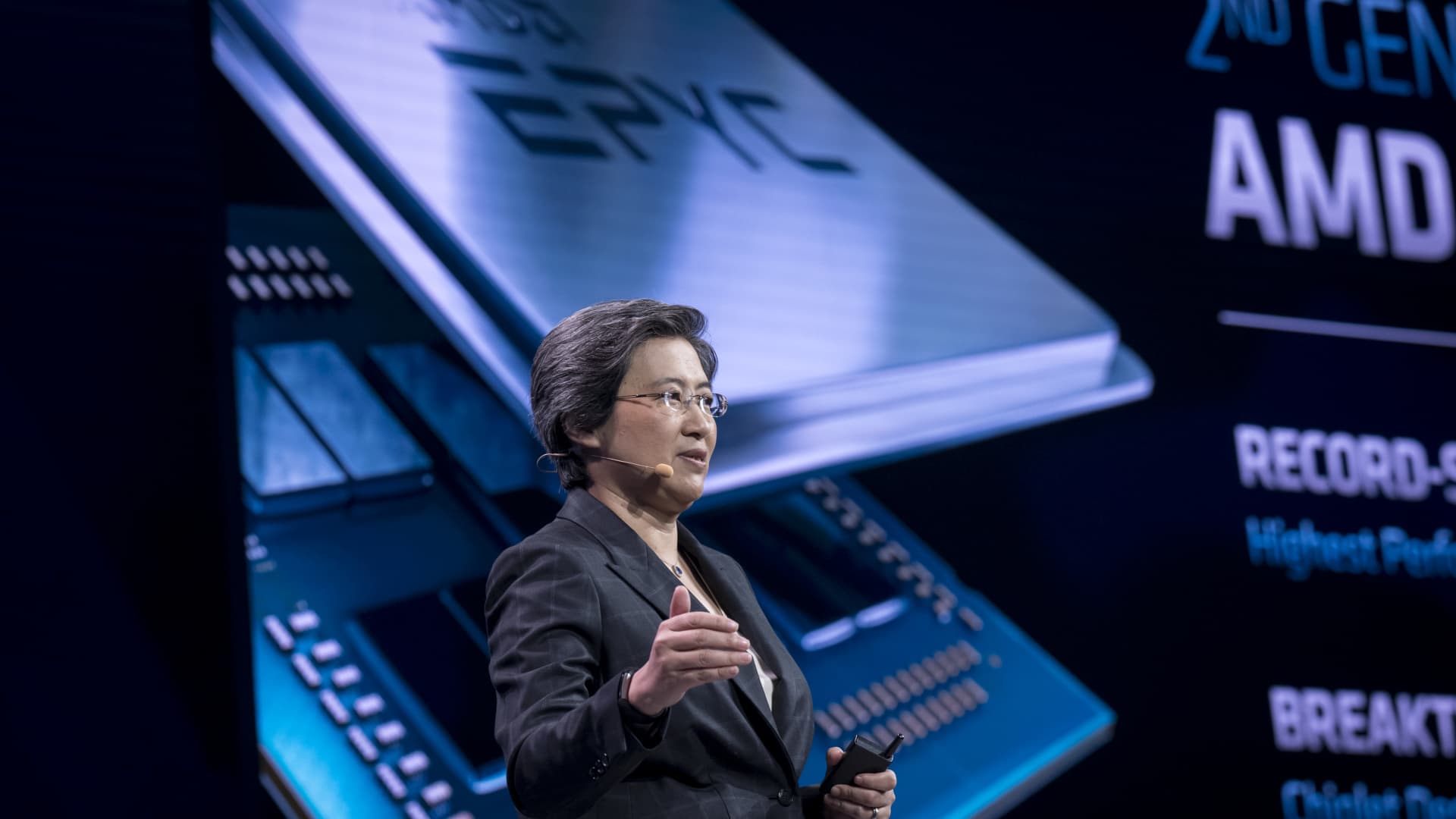

Lisa Su, president and CEO of Advanced Micro Products, speaks for the duration of a launch function in San Francisco on Aug. 7, 2019.

David Paul Morris | Bloomberg | Getty Visuals

AMD inventory shut up extra than 9% Wednesday, a working day immediately after the firm defeat major- and bottom-line earnings estimates and gave a promising 2024 forecast for its artificial intelligence chip company.

The chipmaker posted earnings per share of 70 cents, altered, narrowly beating the LSEG, previously Refinitiv, estimate of 68 cents for each share. Profits was also a slender beat, totaling $5.8 billion as opposed to the $5.7 billion expected.

1 remark would seem to have energized Wall Road: AMD CEO Lisa Su stated Tuesday evening that the organization expects GPU revenue of about $400 million for the duration of the fourth quarter, and to prime $2 billion in 2024.

That forecast turned the stock all-around and helped it rally Wednesday.

Wall Road analysts like AMD’s potential customers in the AI industry, which is at the moment dominated by Nvidia. Continue to, AMD is one of only a handful of companies able of creating significant-driven graphics processing units that electricity AI models.

“Upcoming MI300 accelerator is guided to $400mn gross sales in Q4E and $2bn+ in CY24E, with balanced traction throughout hyperscalers, enterprises, OEMs, and AI startups,” Bank of America analysts claimed in a observe to investors. AMD said its new MI300A and MI300X GPUs are on monitor for volume creation all through the fourth quarter of this calendar year.

Analysts at Raymond James reduced their price tag focus on from $145 to $125 but held AMD as a “sturdy purchase” mainly thanks to its AI enterprise.

“We are decreasing our estimates but proceed to like the story due to very long phrase AI/ML opportunity. AMD is off to a reliable begin, and we see no explanation why the company are unable to capture 10–20% share of the $100B+ AI accelerator market lengthier time period,” the Raymond James analysts reported.

Analysts at Jeffries echoed the very same sentiment towards AMD’s GPU enterprise.

“Most likely the best information on the earnings connect with was that AMD now expects its datacenter GPU spouse and children (MI300) to ship for $2bn in revenues in 2024 (we feel Street was at $1bn-$1.5bn), setting up at $400m in equally 4Q23 (HPC) and in 1Q24 (inferencing + coaching),” wrote Jeffries analysts in an investors’ notice.

— CNBC’s Kif Leswing and Michael Bloom contributed to this report.

You should not skip these stories from CNBC Pro: