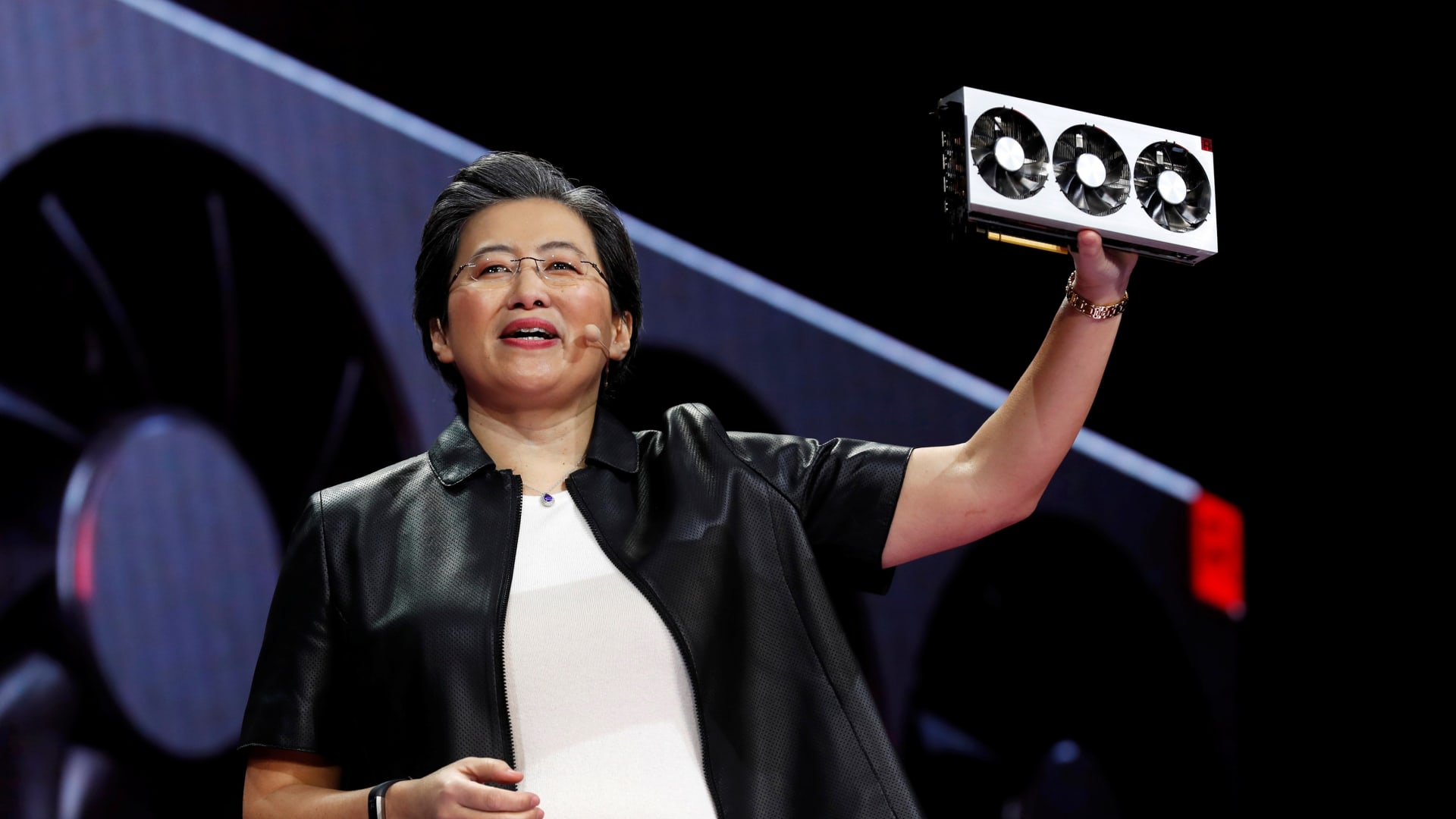

Lisa Su, president and CEO of AMD, talks about the AMD EPYC processor during a keynote address at the 2019 CES in Las Vegas, Nevada, U.S., January 9, 2019.

Steve Marcus | Reuters

AMD described fourth-quarter earnings on Tuesday that had been in line with analyst expectations, though the company’s profits defeat estimates, but AMD supplied a initially-quarter forecast that fell quick of anticipations.

AMD inventory slid extra than 5% in extended trading, even after the company gave a favourable update on how rapidly its new AI chips are promoting.

Here is how the firm did versus LESG (previously Refinitiv) consensus estimates for the quarter ended in December:

- EPS: $.77 per share, adjusted, compared to $.77 for every share predicted

- Profits: $6.17 billion, compared to $6.12 billion envisioned

For the initially quarter, AMD said it expects about $5.4 billion in revenue, as well as or minus $300 million, even though analysts ended up searching for income of $5.73 billion. AMD extra that it predicted some of its main organizations, including Computer system chips, to decrease sequentially in the course of the quarter. It said that its facts center revenue would be flat as server CPU declines would be offset by AI GPU product sales.

“For 2024, we be expecting the desire natural environment to continue to be mixed,” AMD CEO Lisa Su stated on a connect with with analysts.

Net income in the fourth quarter was $667 million, or $.41 per share, compared to $21 million, or $.01 for each share a calendar year back.

AMD can make graphics processing units, or GPUs, which are required to prepare and deploy generative synthetic intelligence designs. Even though that current market is at present dominated by Nvidia, AMD has stated that its new AI chips launched final 12 months will problem Nvidia’s H100 GPUs for some applications, and traders are on the lookout for important development in the company’s data center phase above the future couple of a long time.

AMD gave a good update on its AI chips gross sales. In Oct, AMD explained it envisioned $2 billion in server GPU income in 2024. On Tuesday, it claimed it now expects $3.5 billion in data heart GPU revenue underneath its “Intuition” manufacturer this 12 months.

“In cloud, we are doing the job intently with Microsoft, Oracle, Meta and other big cloud clients on Instinct GPU deployments powering both equally their inner AI workloads and external offerings,” Su mentioned.

Data middle, which consists of server CPUs and AI chips, rose 38% on an once-a-year foundation to $2.28 billion in product sales. It really is now firmly AMD’s biggest business enterprise and the organization reported that much of the enhance in income was attributable to “potent growth” for profits of its Intuition graphics processors, which are applied for AI. Nevertheless, AMD’s over-all performance in the small business was in line with a $2.29 billion FactSet estimate for the Information Centre organization.

Historically, AMD’s primary enterprise has been central processors, or CPUs, for PCs and servers. In contrast to AI chips, that part of the semiconductor field has been flat or shrinking more than the earlier couple of a long time, as Personal computer product sales have suffered write-up-pandemic.

AMD’s consumer team, which is comprised largely of chips for PCs and laptops, rose 62% calendar year-above-yr to $1.46 billion in profits, which the firm reported was boosted by latest chip launches.

Income in AMD’s gaming segment, which involves “semi-tailor made” processors for Microsoft Xbox and Sony Playstation consoles, fell 17%. AMD blamed slower console gross sales, and claimed it predicted semi-tailor made income to decrease by a “substantial” double-digit percentage in the current quarter.

AMD’s embedded phase, which involves chips for networking, reported $1.1 billion in gross sales, down 24% on an once-a-year basis.