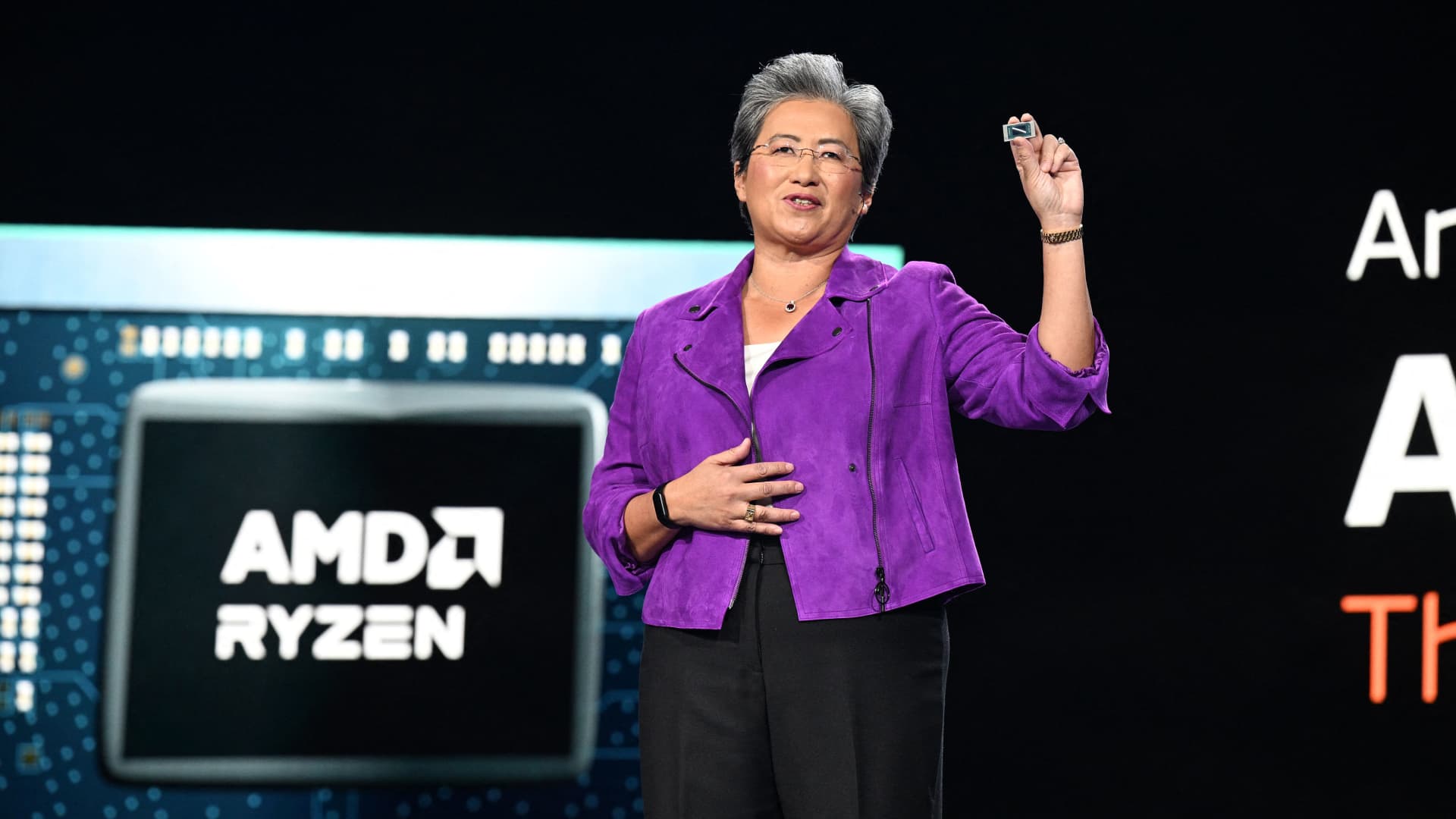

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address during the Buyer Electronics Present (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | AFP | Getty Visuals

AMD documented third-quarter earnings on Tuesday that conquer analyst anticipations, while the chipmaker issued a weaker-than-predicted forecast. The stock dropped about 4% in prolonged trading.

This is how the organization did versus LSEG (previously Refinitiv) consensus estimates:

- EPS: 70 cents adjusted, compared to expectations of 68 cents for each share

- Revenue: $5.8 billion, vs . expectations of $5.7 billion

For the fourth quarter, AMD said it expects about $6.1 billion in sales, when analysts were seeking for income of $6.37 billion.

Internet income in the third quarter rose to $299 million, or 18 cents per share, from $66 million, or 4 cents for every share a yr back. Income increased 4% from $5.6 billion a year earlier.

Revenue in AMD’s Consumer group, which includes revenue from Computer system processors, rose 42% on an once-a-year basis to $1.5 billion, pushed by Personal computer chips.

Past week, chief rival Intel noted third-quarter earnings that conquer anticipations for income and gross sales, but however showed an yearly sales decrease.

Facts centre, which includes AMD’s server processors and AI chips, noted $1.6 billion in gross sales, flat from a year previously. AMD claimed its income of server CPUs grew. AMD also mentioned that it expects potent advancement in its information middle small business in the fourth quarter.

AMD is 1 of the couple of chipmakers able of earning the sort of substantial-close graphics processing models (GPUs) needed to teach and deploy generative AI styles. That market place is dominated by Nvidia. AMD said its forthcoming AI chips, the MI300A and MI300X, are “on track” for quantity creation in the current quarter.

“Our data center business is on a important advancement trajectory primarily based on the toughness of our EPYC CPU portfolio and the ramp of Instinct MI300 accelerator shipments,” AMD CEO Lisa Su claimed in a statement, highlighting the firm’s AI enterprise.

AMD’s embedded phase profits declined 5% to $1.2 billion, which the corporation blamed on a weak communications market. That consists of pieces for networking as properly as the firm’s FPGA unit that it obtained when it purchased Xilinx.

Sales in AMD’s gaming segment declined 8% to $1.5 billion, because of much less “semi-tailor made” chip profits. That is what the business calls its business enterprise that can make processors for consoles like Sony’s PlayStation 5.