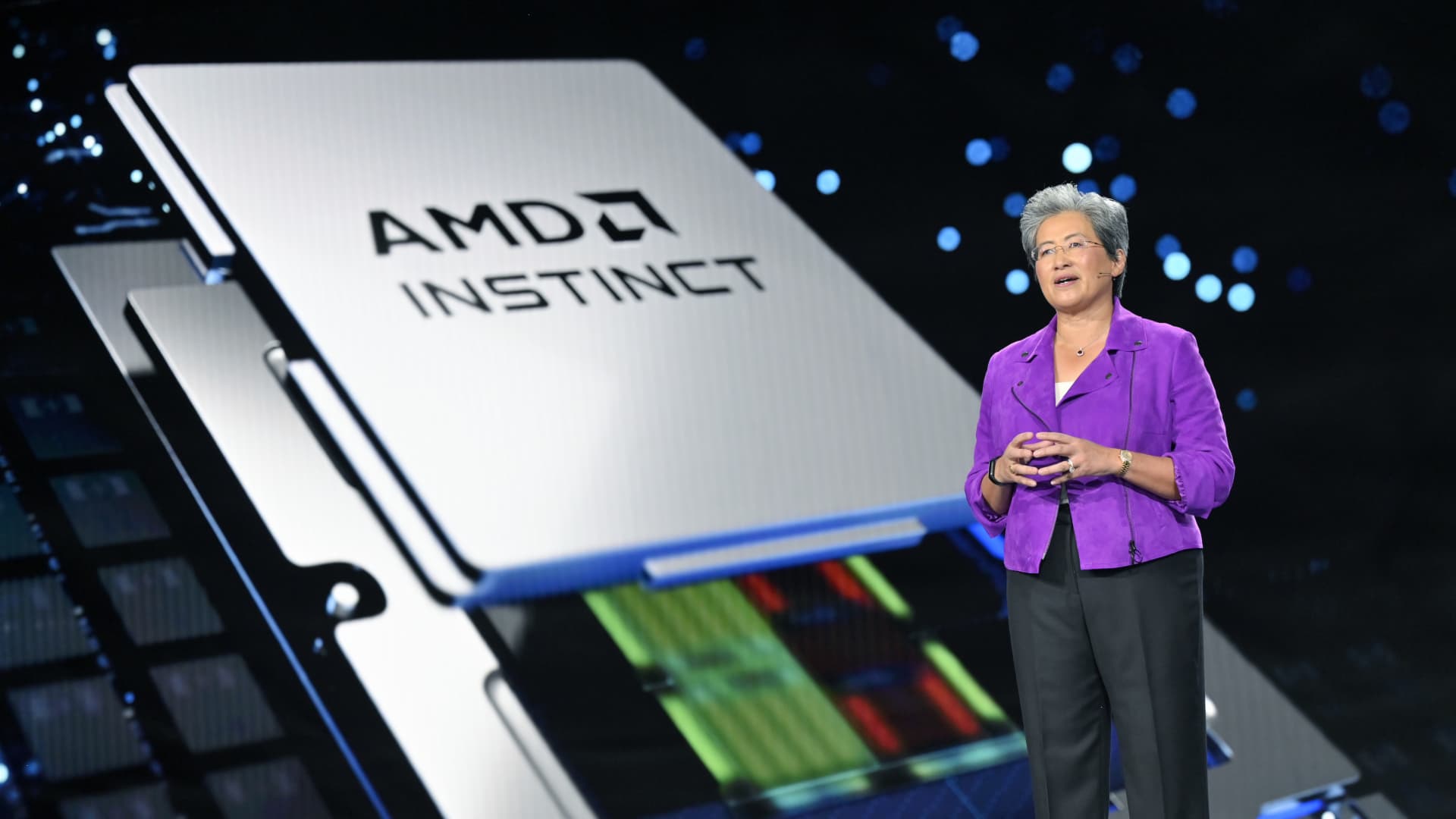

AMD Chair and CEO Dr. Lisa Su provides a keynote address at CES 2023 at The Venetian Las Vegas on January 04, 2023 in Las Vegas, Nevada.

David Becker | Getty Images

AMD described initially-quarter effects on Tuesday that showed income dropping 9% on an once-a-year foundation. Though earnings and sales beat Wall Avenue anticipations, AMD’s direction for the present-day quarter was light-weight and shares dropped above 3% in extended investing.

Here is how the enterprise did as opposed to Refinitiv consensus estimates for the quarter ending in December:

- EPS: $.60 per share, modified, as opposed to $.56 for each share envisioned

- Revenue: $5.35 billion, as opposed to $5.3 billion modified

AMD mentioned it envisioned about $5.3 billion in product sales in the current quarter, versus anticipations of $5.48 billion. However, in a assertion, AMD CEO Lisa Su signaled that the enterprise sees “expansion in the 2nd half of the year as the Computer and server markets reinforce.”

Web decline for the company was $139 million, or a decline of 9 cents for every share, compared to internet profits of $786 million, or $.56 for every share, for the duration of the exact same quarter last year. AMD excludes selected losses on investments and acquisition-associated fees from its earnings.

The major fall came in AMD’s consumer team, which features sales from Laptop processors. AMD described $739 million in gross sales in the classification, a 65% minimize from $2.1 billion in product sales all through the exact period very last 12 months.

AMD’s report will come as the Computer system market is in a deep slump, with shipments dropping 30% in the 1st quarter, in accordance to IDC.

AMD’s info middle section grew a small bit throughout the 12 months, to $1.295 billion from $1.293 billion past calendar year. AMD administration also said that the category is very likely to develop in the present quarter.

AMD’s gaming segment, which features graphics processors for PCs as effectively as chips for consoles like Sony Playstation 5, described $1.76 billion in gross sales, down slightly from final year’s $1.88 billion mark.

Even though the outcomes showed a lack of growth, they arrived through a hard time for chipmakers. Past 7 days, Intel, AMD’s main competitor in the Personal computer and server chip marketplaces, reported that its over-all revenue dropped 36%.