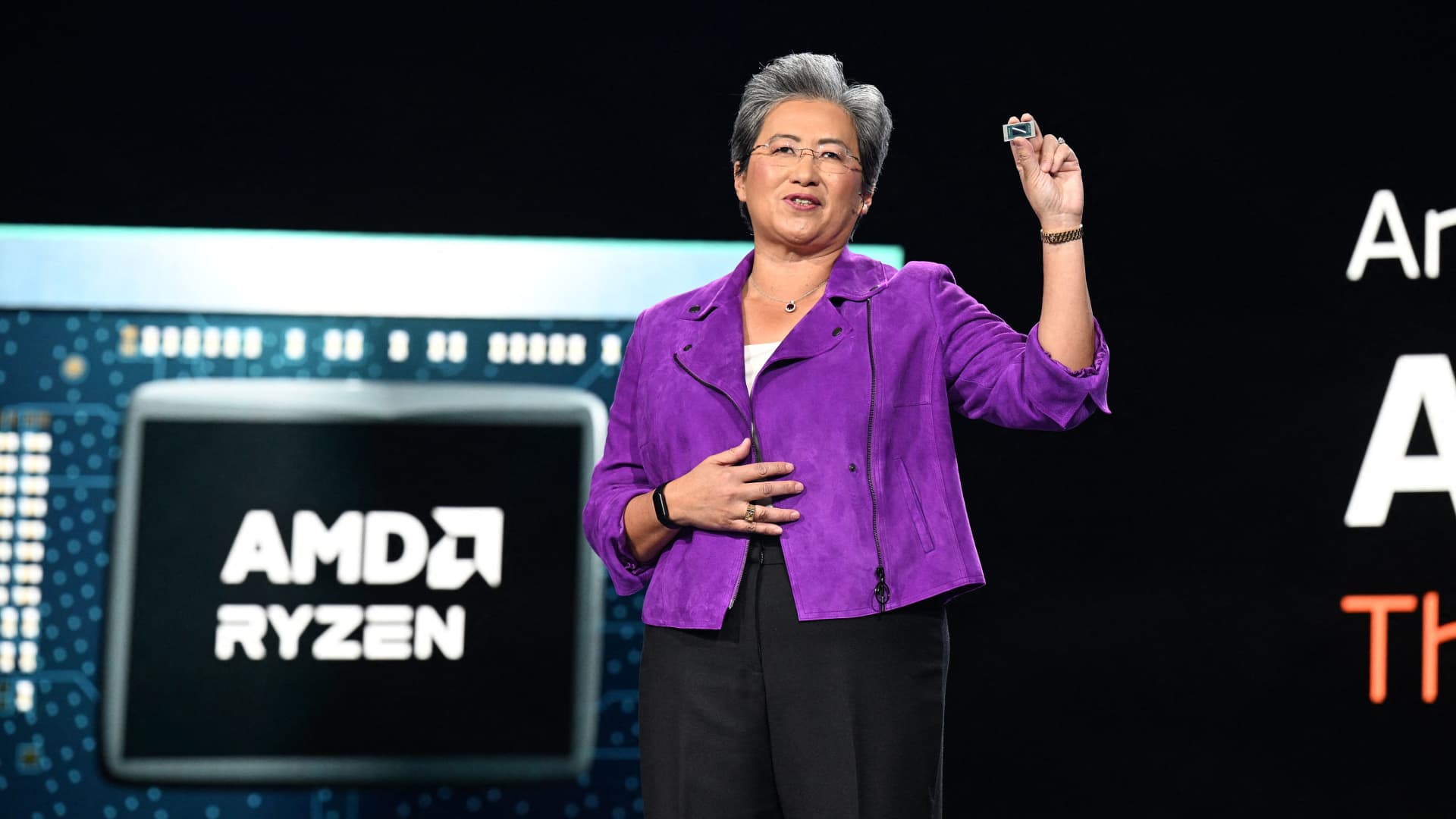

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address all through the Client Electronics Demonstrate (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | AFP | Getty Illustrations or photos

AMD reported fourth-quarter earnings on Tuesday, beating Wall Street anticipations for gross sales and gain, but guided analysts to a 10% decrease in year-over-yr sales in the present-day quarter. The stock rose about 2% in extended trading. This is how the enterprise did versus Refinitiv consensus estimates for the quarter ending in December:

- EPS: $.69, altered, versus $.67 per share anticipated

- Income: $5.6 billion, as opposed to $5.5 billion predicted

AMD said it anticipated $5.3 billion in gross sales in the recent quarter, a little decrease than a Refinitiv estimate of $5.47 billion. AMD’s estimate implies a 10% drop in sales in the recent quarter. AMD’s product sales rose 44% in 2022.

The company also claimed it predicted its altered gross margin to be about 50%, a vital metric for chipmakers.

AMD noted earnings as lots of of its rival chipmakers have stumbled in latest weeks, citing decrease customer need for finished electronics and gluts of elements essential to make PCs and servers.

Intel, AMD’s key competitor, described a disastrous quarter past week that bundled a weak 2023 outlook which includes a 40% yr-over-yr drop in gross sales in the March quarter.

The chipmaker attributed its defeat to strong expansion in its embedded and information heart companies, and explained that its consumer revenue, or chips for PCs and laptops, and its gaming phase have been down.

AMD’s information center phase rose 42% year-over-12 months to $1.7 billion. Its embedded segment grew 1,868%, AMD explained, for the reason that of income from its purchase of Xilinx.

Whilst AMD reported it observed gradual revenue for its Personal computer chips and graphics processors, it explained its information centre phase rose 42% yr-over-calendar year, suggesting it took marketplace share from Intel.

But its shopper group, which incorporates revenue from Computer system processors, was down 51% calendar year-about-yr for the reason that of a slumping Laptop current market, AMD claimed. It extra that its buyers have much too a great deal inventory of its chips, a topic other semiconductor corporations have talked about in latest months. The world wide Computer marketplace is in a protracted slowdown, in accordance to estimates.

AMD CEO Lisa Su informed analysts that the enterprise expects the overall Personal computer industry to be down about 10% in 2023, and reported the Computer system ecosystem was “weak.”

“Even though the demand atmosphere is blended, we are confident in our capability to obtain marketplace share in 2023 and supply extended-time period expansion primarily based on our differentiated solution portfolio,” Su stated in a assertion.

AMD’s gaming enterprise, which is comprised of graphics cards and chips for gaming consoles, was down 7% year-around-yr. The decrease arrived from graphics cards and was offset by “semi-personalized” earnings, which how the enterprise reports income from chips for gaming methods like the PlayStation 5.

AMD expects that the segments with Pc chips and graphics processors will proceed to drop in the latest quarter, but facts center and embedded sales will develop.