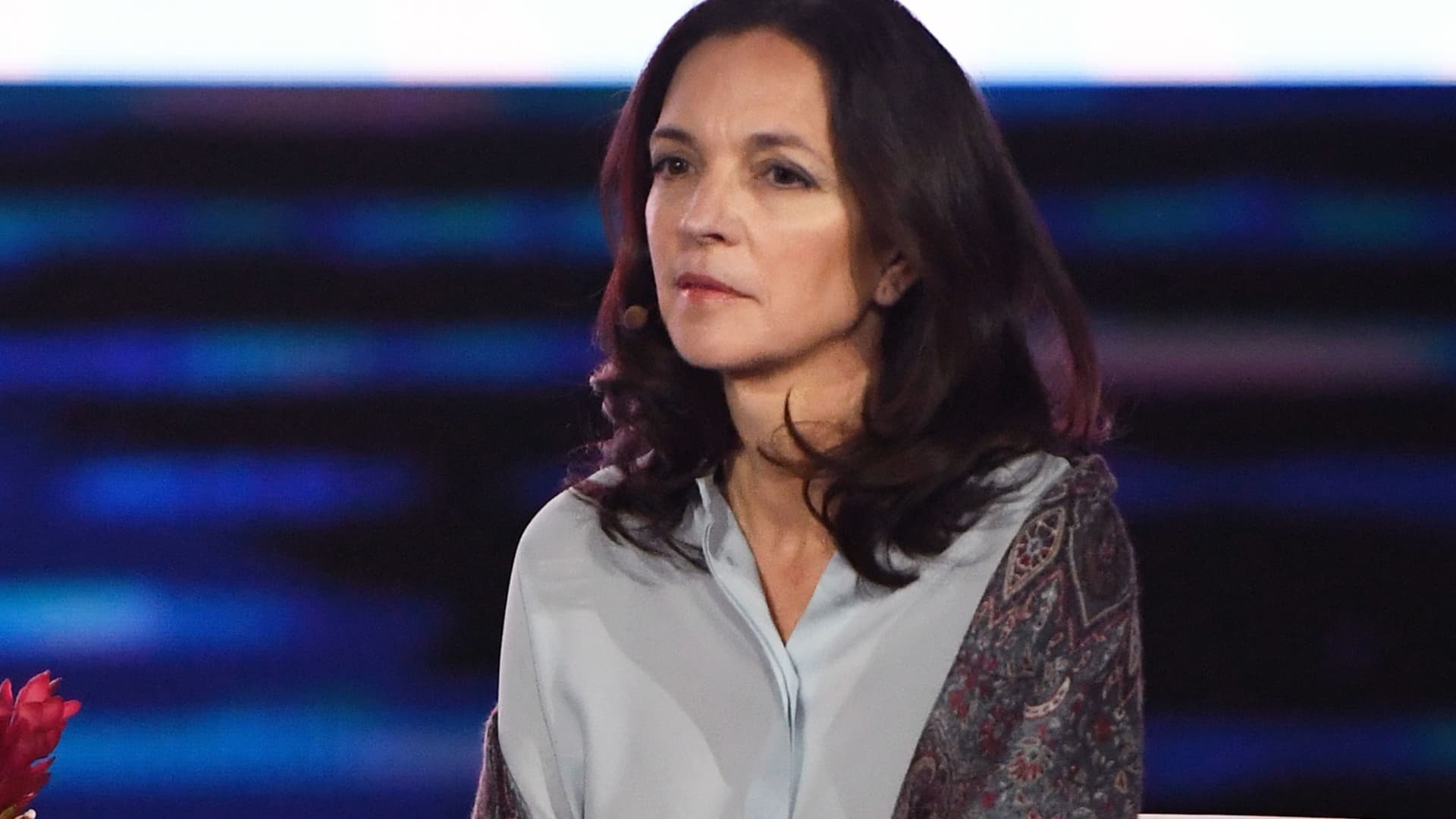

Founder and CEO of 605 Kristin Dolan participates in a keynote panel on the future of video at CES 2018 at Park Theater at Monte Carlo Resort and Casino in Las Vegas on January 10, 2018 in Las Vegas, Nevada.

Ethan Miller | Getty Images

AMC Networks, the company that owns TV channels like AMC and IFC, named Kristin Dolan its new CEO on Wednesday.

Dolan, who will become CEO effective Feb. 27, has served on AMC’s board and worked closely with the company. She’s an industry veteran, and most recently served as CEO of 605, a data analytics firm that measures audience numbers for TV networks.

She is also the spouse, albeit separated, of James Dolan, the AMC Networks interim executive chairman James Dolan.

“I look forward to bringing my broad experience — across programming, cable operations, and most recently, utilizing data to reimagine television advertising — to leverage AMC Networks’ strong assets, drive the next phase of the company’s growth, and build shareholder value in the coming years,” Kristin Dolan said in a news release on Wednesday, noting AMC is where she started her career.

Dolan held various marketing roles at AMC, when it was known as Rainbow Media, in the early part of her career. She also spent 16 years in various roles at Cablevisions Systems Corp., the cable-TV company once owned by the Dolan family before it was sold to Altice in 2016.

In November, Christina Spade stepped from her role as CEO less than three months after being promoted to the position. That same week, AMC told its employees it would be going through a significant round of layoffs, which amounted to roughly 20% of its U.S. staff, CNBC previously reported.

The Dolan family has been considering the best way to move AMC Networks forward as it deals with cord-cutting and a tight ad market.

In a memo to staff in November, James Dolan said it was the company’s belief that cord-cutting losses would have been stemmed by streaming. “This has not been the case. We are primarily a content company and the mechanisms for the monetization of content are in disarray,” he told staff in a memo at the time.

Shortly after Spade stepped down, AMC announced it would begin a restructuring “designed to achieve significant cost reductions, in light of ‘cord cutting’ and the related impacts being felt across the media industry as well as the broader economic outlook,” according to a securities filing. The company said it expects the restructuring to be completed by the end of this year.

More than half of AMC Networks’ revenue comes from the traditional pay-TV bundle, which has been bleeding subscribers as they opt for less expensive streaming services.

In addition to its linear TV namesake channel, which is known for content like “The Walking Dead,” and recent new series built off the library of the novelist Anne Rice, the company owns streaming services like AMC+ and horror-focused Shudder.

For some time now, AMC Networks has been considered an acquisition target for larger media companies looking to bulk up their libraries.