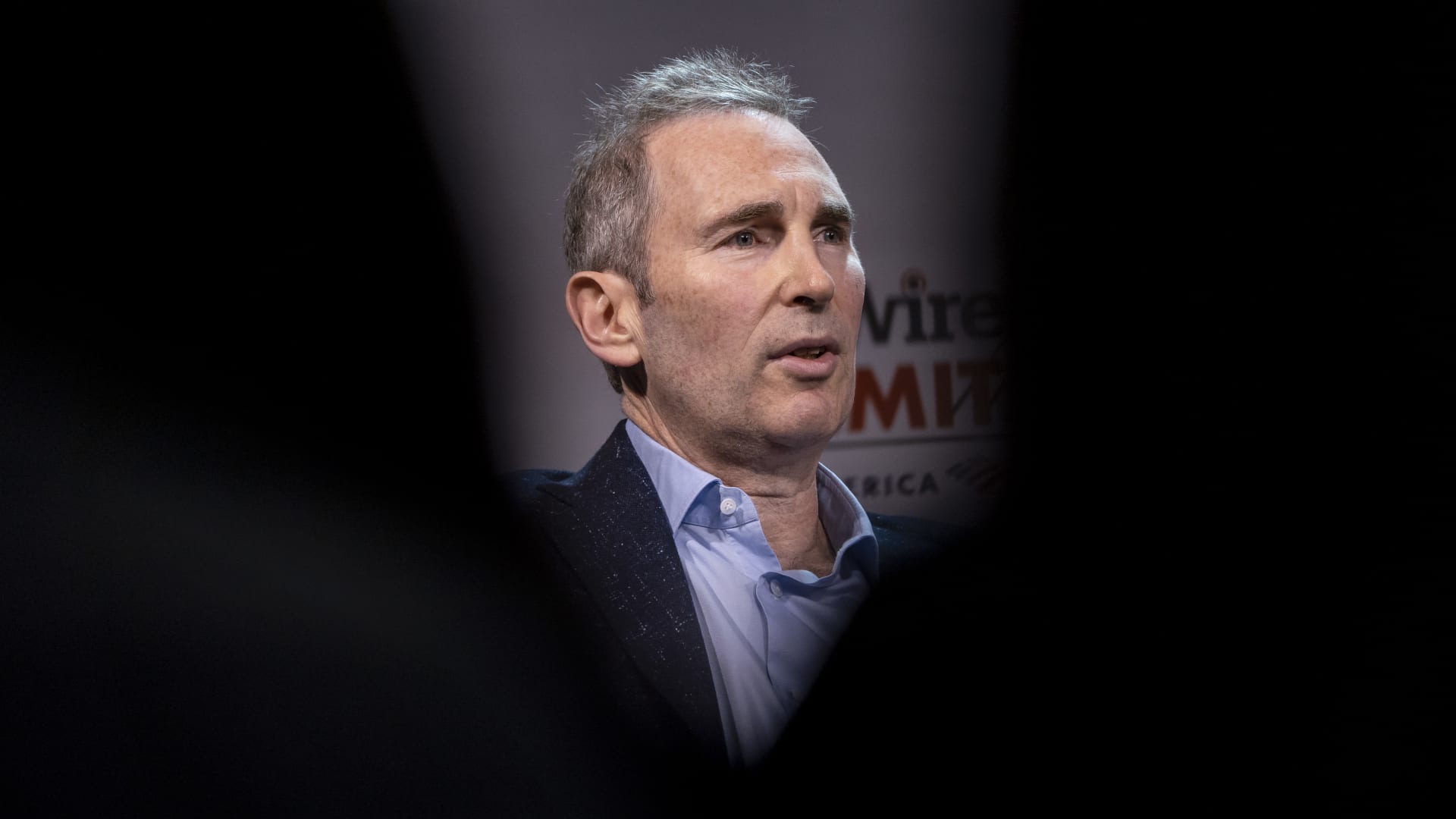

Amazon CEO Andy Jassy speaks in the course of the GeekWire Summit in Seattle on Oct. 5, 2021.

David Ryder | Bloomberg | Getty Photos

Amazon‘s inventory selling price has misplaced all of its pandemic-fueled gains, falling again to exactly where it was investing when Covid-19 started off shutting down the U.S. financial state.

On Monday, the e-retailer’s shares dropped 3.4% to $84.92, the cheapest shut considering that March 16, 2020.

Amazon has fallen sharply this 12 months amid a broader tech selloff tied to soaring inflation, a worsening economy and increasing interest fees. For the initial time in virtually two many years, the tech-large Nasdaq Composite is established to get rid of to the S&P 500 in consecutive several years. Trillions of dollars have been wiped from tech shares.

Shares of Amazon have tumbled 49% in 2022 and are on pace for their worst yr because the dot-com crash of 2000, when the company lost 80% of its benefit. Among the the greatest-valued tech firms, Meta has had the worst 12 months, down 66%, followed by Tesla at 57% and then Amazon.

It’s a marked reversal from 2020, when Amazon stock rallied amid unprecedented on the web need. Amazon noticed a hurry of orders from consumers at the peak of the pandemic, as many averted visits to actual physical shops and turned to the internet for essential and non-crucial products.

Very last calendar year, the story started to alter, as e-commerce businesses reckoned with tricky yr-over-year comparisons and the economic system started off to reopen, foremost quite a few men and women to return to physical shops. By early 2022, higher fees tied to inflation, source chain constraints and the war in Ukraine generated additional force on Amazon and other tech businesses.

For Amazon, the problems go deeper. It’s also contending with slowing expansion in its core retail small business, and the company has been compelled to scale back immediately after it historic enlargement for the duration of the pandemic.

Amazon back to pre-pandemic ranges

CNBC

CEO Andy Jassy has embarked on a vast-ranging assessment of the firm’s expenditures, resulting in some packages being shuttered, and a hiring freeze throughout its company workforce. Past thirty day period, the business commenced laying off hundreds of workers as element of a wave of position cuts that are expected to increase into upcoming yr.

The discomfort is not probably to permit up shortly. Amazon spooked buyers in Oct when it projected revenue between $140 billion and $148 billion for the current quarter, symbolizing development of just 2% to 8%. That was significantly down below analysts’ average forecast of $155.15 billion, according to Refinitiv.

View: Amazon CEO Andy Jassy on shifting buyer paying out practices