A employee provides Amazon packages in San Francisco, California, US, on Wednesday, Oct. 5, 2022. Amazon’s Key Early Obtain Sale is on by way of Oct. 12 to improve gross sales between value-conscious consumers who are anticipated to start their holiday purchasing even before this year.

Bloomberg | Bloomberg | Getty Photographs

Amazon buyers seem to have shrugged off promotions for discounted telephone chargers and air fryers all through this week’s Primary Working day-like gross sales bonanza.

The 48-hour event, dubbed the Key Early Accessibility sale, ran as a result of Wednesday. For Amazon, the party examined how customers of its Primary subscription method would reply to two key discount events in the very same calendar year, following the firm’s primary Prime Working day sale in July.

Amazon on Thursday claimed that tens of millions of Primary users ordered more than 100 million products from third-social gathering suppliers. It disclosed minimal else about the final results, this sort of as gross sales figures.

But knowledge gathered by third-occasion analysts gives a further glimpse into how the Prime Day sequel went in excess of with shoppers when compared to Amazon’s product sales event in July.

Revenue throughout this week’s occasion appeared “lighter” in contrast to Key Working day in July, Bank of The us analysts reported. They estimate Amazon introduced in $5.7 billion in profits from the Prime Early Obtain Sale vs. $7.5 billion in July.

Commerce knowledge enterprise Klover said it observed slower paying out and volume, noting transaction frequency was down 30% among the July function and October event.

The regular shell out for each order for the duration of the Prime Early Entry Sale was $46.68, down from $60.29 on Key Day, in accordance to current market research organization Numerator. In the meantime, most types observed a decline in sales relative to the July sale — exceptions bundled toys infant objects and publications, movie and other media, Numerator found.

Not everybody is convinced that the Amazon sale was a flop. Even if the 48-hour celebration failed to exceed Prime Working day gross sales, Amazon nevertheless very likely saw much more gross sales on Tuesday and Wednesday than it would on a standard day, said Juozas Kaziukenas, founder of investigate agency Market Pulse.

“I feel it did good for what Amazon was trying to do, which was to minimize the volume of products they have in their warehouses,” Kaziukenas reported.

Amazon, Walmart, Target and quite a few other significant stores are grappling with a glut of stock just after extended-delayed orders of things that had been hot sellers throughout the pandemic arrived, only to be handed more than by purchasers whose habits have because shifted. Organizations are now opting to kick off holiday break gross sales quicker than at any time with the hope that it will aid distinct out unwelcome inventory.

All those difficulties may have pushed much more brand names to operate promotions in the course of the sale. For illustration, Peloton, which has wrestled with extra stock, was 1 of the major-providing products.

Amazon might also be wanting to juice sales as it confronts slowing earnings expansion and what’s likely to be a lackluster holiday getaway shopping year. On the web shelling out throughout the vacation year is anticipated to expand 2.5%, in accordance to Adobe, marking the slowest progress because the agency commenced monitoring the determine in 2015.

Discounted occasions such as the Primary Early Entry sale are a reasonably low price way to goose sales, Kaziukenas explained.

“The only price tag is the low cost, which is either coming from sellers or makes,” he claimed. “In conditions of placing up the true occasion, it’s a low-priced detail for them to do. They could do it each month if they desired to.”

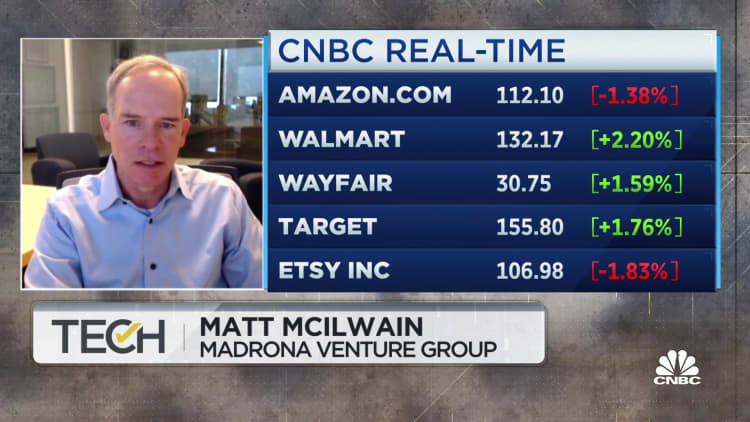

Enjoy: Amazon receives in entrance of vacation searching with 2nd Prime Day of the 12 months