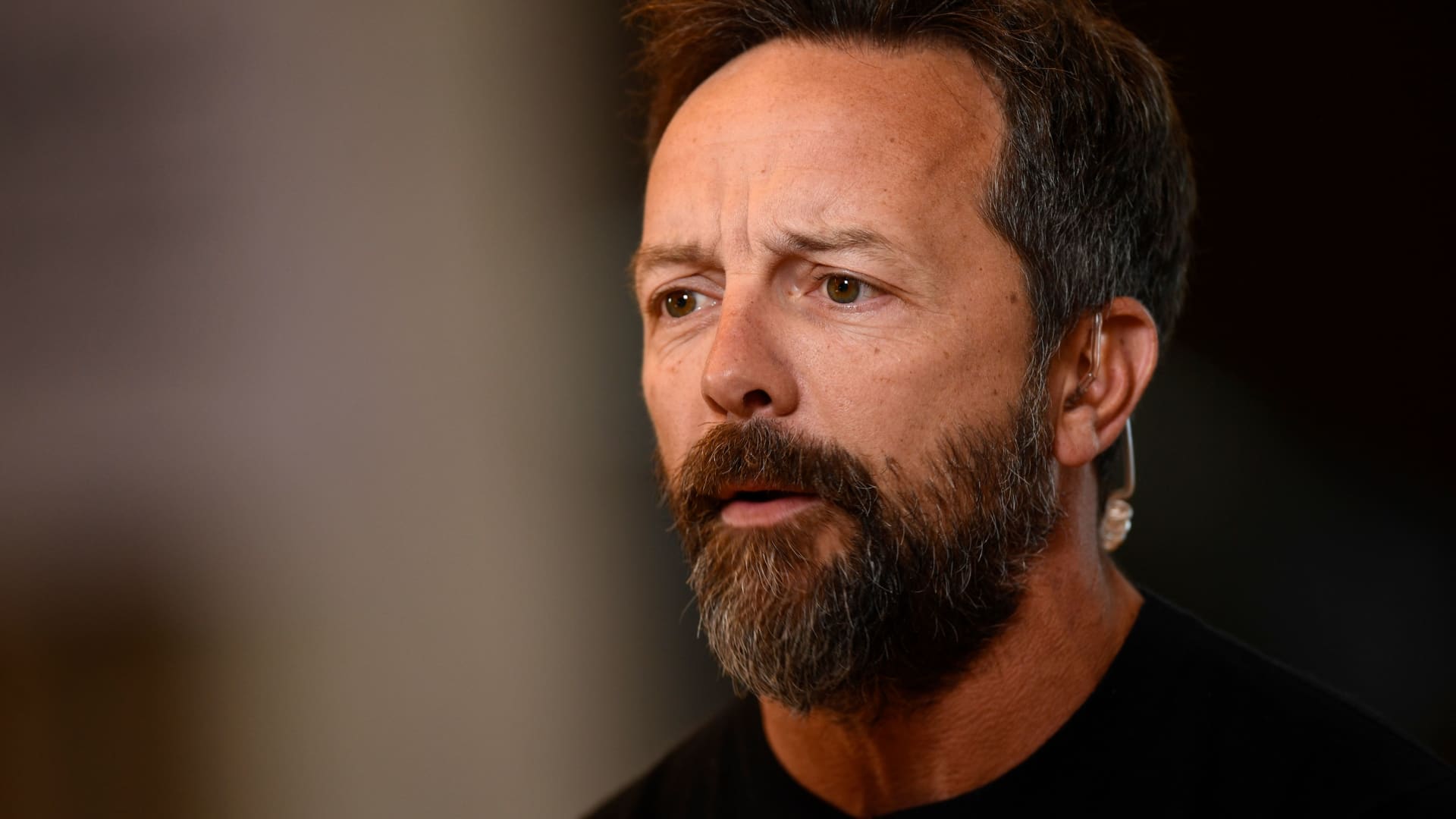

Altimeter Cash Chair and CEO Brad Gerstner revealed a new place in Tesla Thursday, betting on the sector chief amidst the global trend towards automobile electrification. The extensively followed tech trader instructed CNBC’s Scott Wapne r in an interview that he created a new stake in the EV maker in the past two months. “The planet is shifting now wholesale … both for geopolitical realities and for electricity realities, in the direction of electrification,” Gerstner said on CNBC’s “Halftime Report.” “We are only 8% penetration globally of electric cars and trucks.” The EV marketplace is likely to expand 30% to 40% in excess of the next five to 10 many years, aided by initiatives from governments around the entire world, the trader stated. “When you look at Tesla, they have 30% margins. Their competition are operating 10% at most effective. I think they have a compounding gain in the entire world,” Gerstner explained. Shares of Tesla are down a lot more than 13% this year, next a 50% increase in 2021 and 740% in 2020. On the total macro natural environment, Gerstner believes that the risk has shifted to the Federal Reserve “about-tightening.” The tech investor joined other high-profile investors such as Jeffrey Gundlach and Cathie Wooden in warning that the central lender could slow down the financial state too a great deal by enacting jumbo interest price raises in an endeavor to suppress inflation.