Australia’s central bank shocked marketplaces in early October with a smaller sized-than-expected charge hike, a transfer the Reserve Bank of Australia acknowledged was a “finely balanced” discussion even as it vowed to maintain inflation in check.

According to RBA minutes from the Oct. 4 meeting that were being launched Tuesday, two solutions were thought of prior to the bank eventually lifted its money price by 25 basis details to 2.6%, a nine-12 months significant.

It marked the bank’s sixth consecutive hike in its tightening cycle to tame worldwide inflation rates.

Prospective customers of continued “jumbo” desire price hikes persist as central banking companies close to the environment attempt to tackle world-wide inflation. The U.S. Federal Reserved lifted interest costs by 75 foundation details in its September meeting, following the identical go by the European Central bank that very same month.

The RBA deemed two options: Continuing with the 50 basis stage improves in the cash fee, or announcing a lesser 25 basis stage hike, the minutes reported.

“The arguments for continuing with an enhance of 50 basis points stemmed from the inflationary environment and risks to inflation expectations,” in accordance to the minutes.

In the stop, the central bank’s board customers stated they “regarded the gains of a smaller maximize.”

Drawing out coverage changes would also enable to continue to keep general public notice concentrated for a more time period on the Board’s resolve to return inflation to target

Reserve Bank of Australia

The notes from its board members claimed the scenario to gradual down its hikes was in order to “evaluate the outcomes of the sizeable boosts in fascination fees to date and the evolving financial outlook.”

“A smaller sized increase than that agreed at previous conferences was warranted given that the dollars level had been increased substantially in a brief period of time of time and the complete influence of that boost lay forward,” the minutes reported.

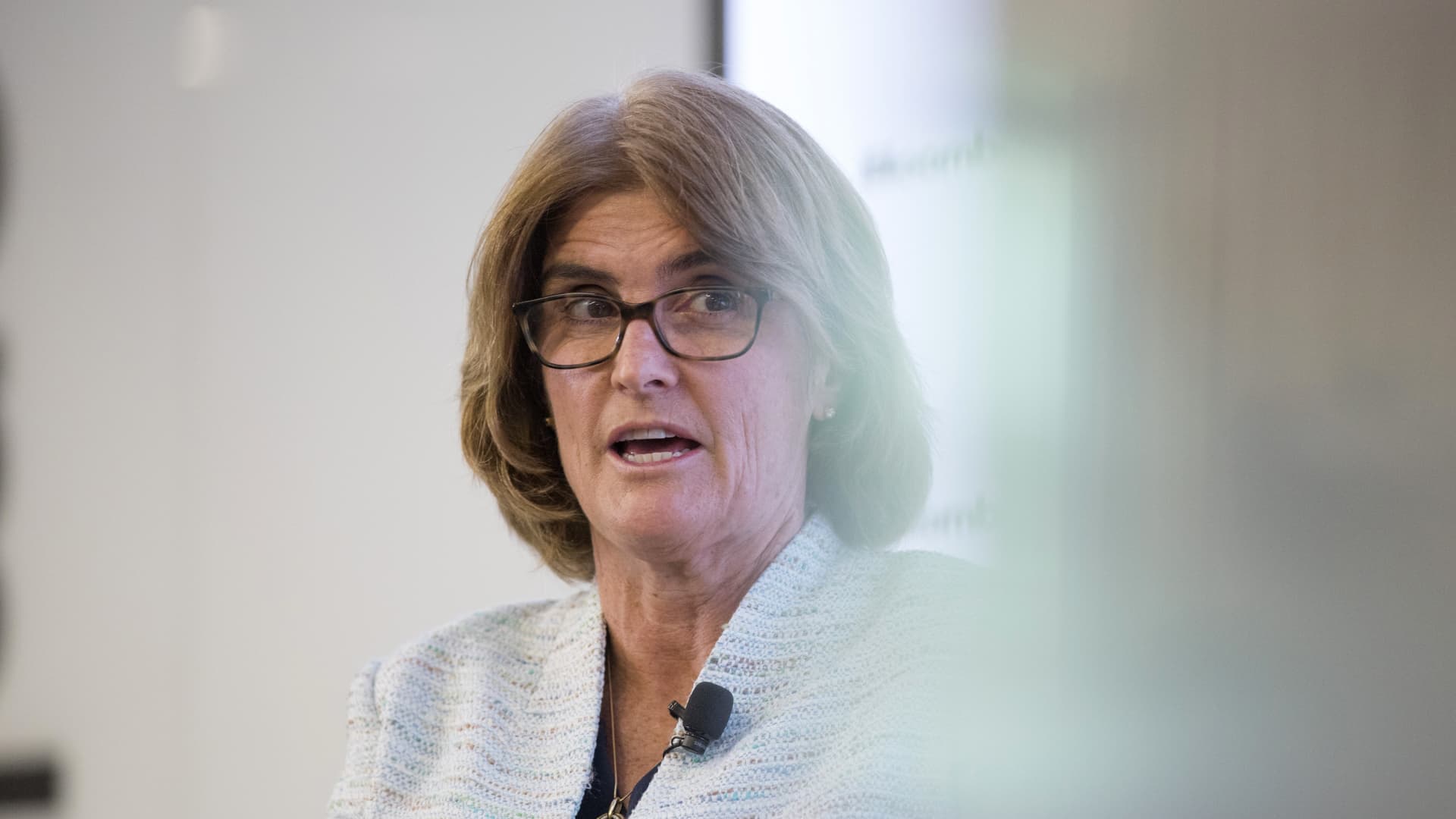

Deputy Governor Michele Bullock explained a multitude of variables had been taken into thought for its the latest more compact action, which includes the grim outlook for world-wide markets.

“The international financial setting has also deteriorated quite sharply,” she stated at the Australian Finance Marketplace Association.

“For these motives, the Board felt that a smaller raise in October was warranted even though it took inventory of developments in intake, wages and the intercontinental economic climate,” she extra.

She reported the central bank has more flexibility for the “dimensions and timing of amount raises” for the reason that its board retains additional conferences in contrast to other central financial institutions in the area. The RBA is able to attain identical outcomes with smaller sized personal charge increases, she stated.

“It also means that if we raise interest charges at each individual meeting, we can potentially go much faster than abroad central banking companies. Or alternatively, we can reach a comparable rise in interest costs with smaller increments,” she reported.

The Australian dollar rose near to .2% against the U.S. dollar soon right after the maximize, and past traded at $.6284

Inflation fears

The central bank also pointed out the wider public’s aim on its fight towards inflation as a crucial worry.

The minutes stated, “Drawing out plan changes would also aid to hold community attention concentrated for a for a longer period period on the Board’s solve to return inflation to target,” including that the board stays determined to “do what is required” to return inflation to its focus on.

The Reserve Lender of Australia has an inflation focus on of involving 2% to 3%. Yearly inflation in the thirty day period of August rose to 6.8% from just less than 2% prior to the pandemic.

The RBA minutes also pointed out the central financial institution could lose extra if it fails to maintain inflation ranges below control.

“If the Board have been to lower the measurement of the price raise, it would be the very first to do so among sophisticated economies,” it mentioned. “Eventually, if upside hazards to inflation were being to materialise, or the credibility of the path to reduce inflation arrived into question, it would be costly to re-build lower inflation.”

The RBA mentioned that foreseeable future desire amount boosts will be established by even more facts and the outlook for inflation and the labor current market.

“Inflation is much too significant in Australia and is envisioned to increase further more,” reported RBA Deputy Governor Bullock. “You really should be in no doubt, however, that the Board is decided to do what is required to return inflation to target.”