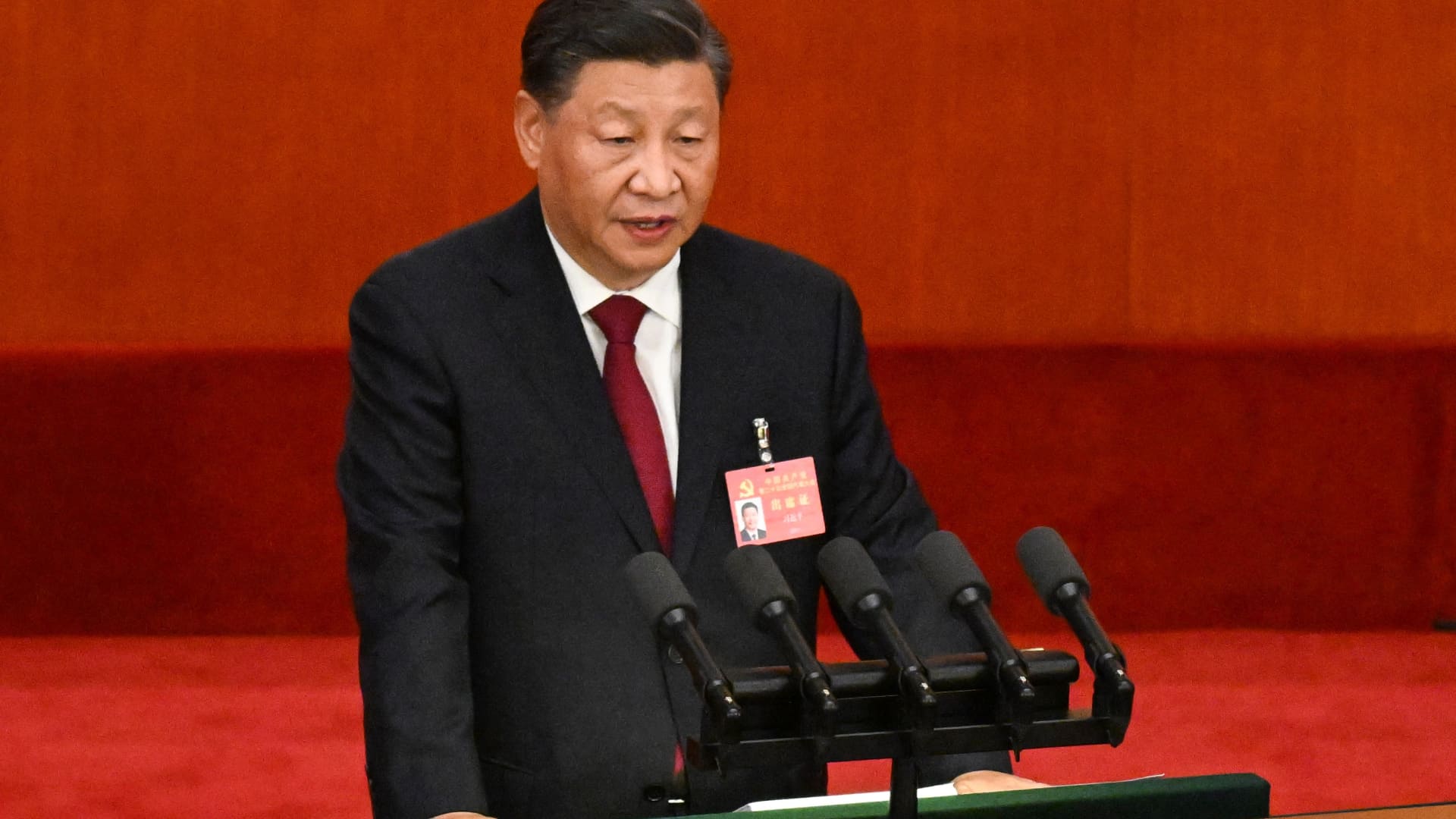

China’s President Xi Jinping speaking at the opening session of the 20th Chinese Communist Party’s Congress at the Fantastic Corridor of the Folks in Beijing on Oct. 16, 2022.

Noel Celis | AFP | Getty Images

Chinese technological innovation stocks tanked Monday following a political reshuffle in the world’s 2nd-greatest economic system tightened President Xi Jinping’s grip on ability with traders fearing this could be a detrimental for non-public companies.

Tech giants Alibaba and Tencent shut down much more than 11% in Asia research organization Baidu was 12% decreased although food supply firm Meituan tanked extra than 14%.

The moves occur right after Xi paved the way for an unprecedented 3rd phrase as chief and packed the Politburo standing committee, the core circle of energy in the ruling Communist Get together of China, with loyalists.

That tends to make it not likely that any person would challenge any “coverage errors” that Xi makes which could hamper growth of the tech sector, Xin Sun, senior lecturer in Chinese and East Asian company, at King’s College or university London said.

“Now that the new Politburo standing committee is packed with Xi’s individual picks and those people in rival factions … had been all out, it gets apparent that no other political elite dares to obstacle his coverage mistakes or even deviate on the other hand a little bit from his most popular coverage agenda, which of system in excess of the earlier handful of several years has concentrated on favouring the state sector at the cost of the non-public one particular,” Sunlight informed CNBC by way of e mail.

“As a result, it is unlikely for these policies to be reversed or corrected, main to an extremely gloomy economic outlook.”

Beneath Xi’s leadership, China has implemented a raft of policy that has tightened regulation on the tech sector in places from info protection to governing the way in which algorithms can be employed.

Meanwhile, Xi has caught to the rigorous “zero-Covid” plan which has noticed metropolitan areas, including the mega financial hub of Shanghai, locked down this year, even as most of the entire world has opened their economies.

These two policies have contributed to billions of pounds being wiped of the benefit of Chinese tech giants and providers together with Tencent and Alibaba reporting their slowest expansion in record this year.

“Tech shares have never ever been the most effective pal of Xi and it can be clear that the marketplace thinks that purge will continue,” Justin Tang, head of Asian research at United To start with Associates, instructed CNBC.

As component of the management reshuffle in China, Li Qiang, get together secretary of Shanghai is expected to be designed premier following 12 months. Li oversaw oversaw the lockdowns and “zero-Covid” technique in Shanghai this calendar year. He has not served as vice-leading marking a break with a prolonged-standing custom of the Communist Celebration. Li will substitute outgoing Premier Li Keqiang, an official noticed as pro-enterprise.

Sun explained the new management is mostly party officials “who had constrained to no prior experience or credible record in economic management,” marking a further reason buyers are worried about the potential.

“A rigid political routine with minimal capability to accurate many of its coverage blunders, the deficiency of capable and knowledgeable financial policymakers, and escalating geopolitical dangers, all less than the leadership of a one person whose monitor report has tested unfriendly to the non-public sector,” Sunlight stated, detailing the destructive marketplace sentiment toward China tech stocks.

Having said that, not all analysts are anxious about even further regulatory tightening. In the last couple of months, Beijing has taken fewer dramatic regulatory action from tech giants, prompting some commentators to counsel a softening stance from the federal government towards web firms.

“Some of the coverage toward tech shares has been softened,” Duncan Wrigley, chief China economist at Pantheon Macroeconomics, advised CNBC’s “Street Signs Europe.”

“In general, I imagine the stance of the leadership and the governments has develop into on stability much more positive about the very last yr.”