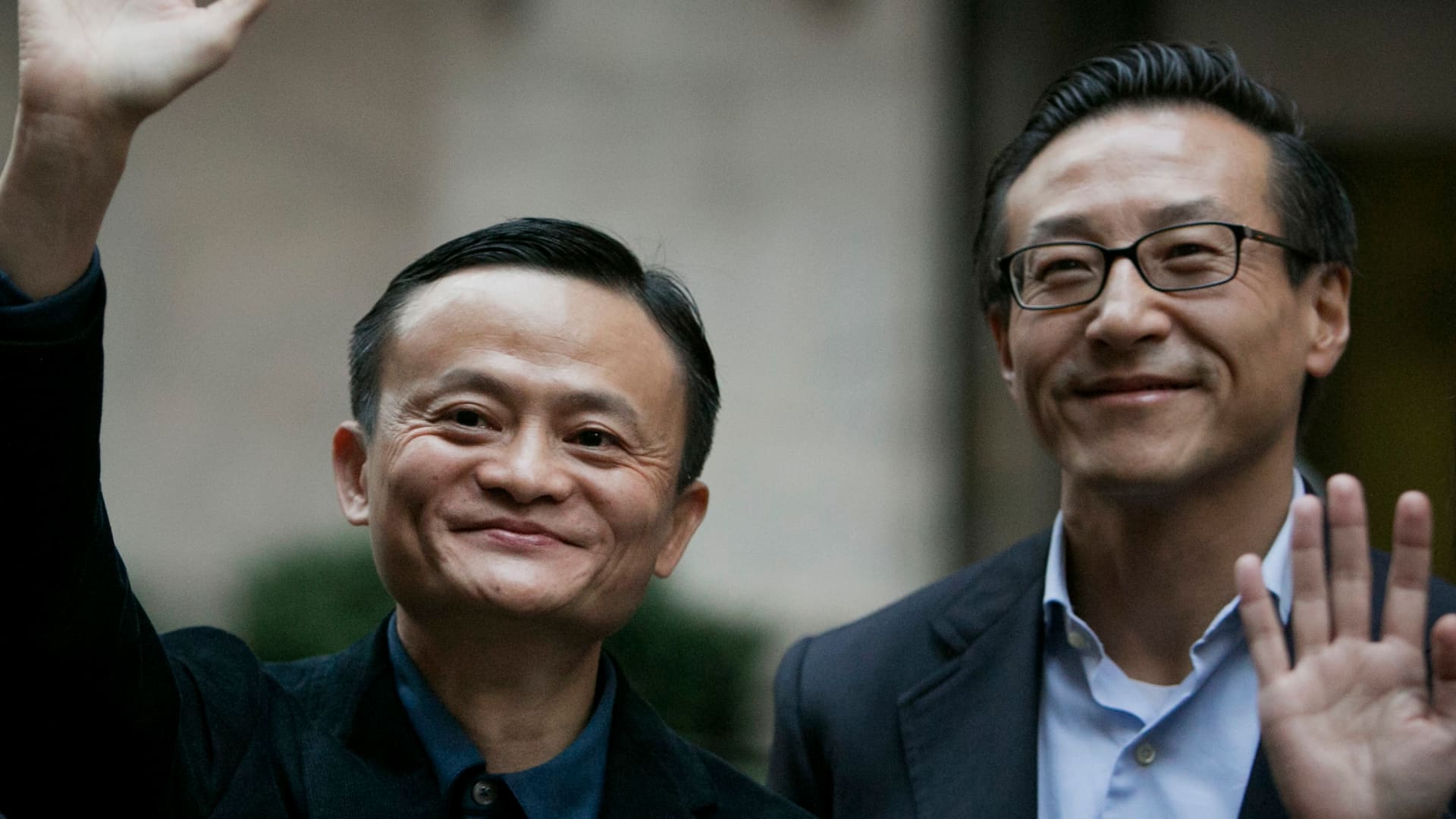

Alibaba co-founders Jack Ma and chairman Joe Tsai, in front of the New York Inventory Trade (NYSE) in New York, U.S., on Friday, Sept. 19, 2014.

Scott Eels | Bloomberg | Getty Illustrations or photos

Alibaba co-founders Jack Ma and Joe Tsai have acquired shares value hundreds of millions of dollars on the open up current market, according to a regulatory filing and The New York Instances, sending the firm’s stock up all over 6% Tuesday in pre-sector buying and selling.

An entity connected to Tsai’s loved ones business office, Blue Pool, obtained almost 2 million Alibaba depository shares worth $152 million in the fourth quarter, in accordance to a Tuesday regulatory filing. Separately, sources acquainted with the matter told the Periods that Ma acquired $50 million truly worth of Alibaba’s Hong Kong stock during the exact interval. Depository shares are effectively U.S.-traded variations of international inventory.

Alibaba has a marketplace cap of far more than $174 billion.

Until eventually recently, Ma had mostly stepped out of the community eye. Tsai maintains a extra seen profile as the owner of quite a few athletics groups, which include the Brooklyn Nets.

But the business they started in 1999 has suffered in the latest yrs. A low point came in 2020 and 2021, when Ma publicly criticized Chinese officials and economic watchdogs, and regulatory force finally derailed a prepared IPO for the Ant Team, Alibaba’s monetary arm.

Geopolitical pressures have also weighed on the enterprise. Alibaba introduced in March 2023 that it would spin off its cloud company as part of a broader company reorganization. Months later on, it scrapped these programs, citing U.S. semiconductor export controls. All around the exact same time the spinoff was canceled, Ma in a regulatory submitting said that he would sell 10 million shares value $870 million.

Alibaba shares are down about 21% given that the cancelled spin-off.

Alibaba referred CNBC to Ma’s foundation, which did not straight away return a ask for for comment.