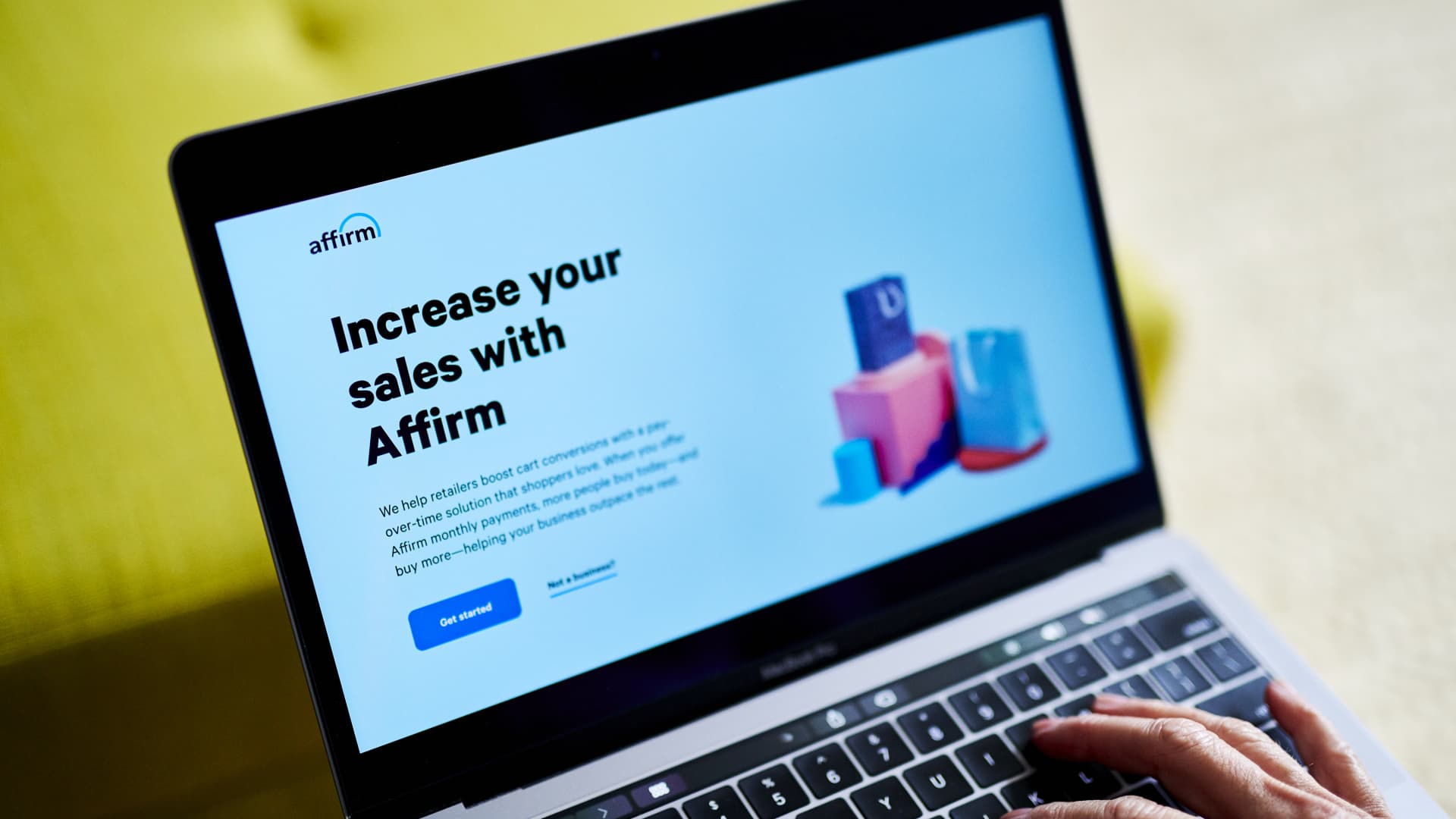

Affirm Holdings Inc. web site house display screen on a laptop computer personal computer in an organized photograph taken in Very little Falls, New Jersey.

Gabby Jones | Bloomberg | Getty Pictures

Affirm shares popped as substantially as 26% in early buying and selling on Friday, a working day just after the buy now, pay afterwards company described fiscal fourth-quarter success that topped expectations and gave optimistic assistance for the very first quarter.

This is how the organization did:

- Reduction for every share: 69 cents vs. 85 cents as anticipated by analysts, according to Refinitiv.

- Income: $446 million vs. $406 million as expected by analysts, in accordance to Refinitiv.

Affirm also gave robust steering for the fiscal first quarter, projecting $430 million to $455 million in profits, compared to analyst expectations of $430 million.

The corporation described gross items volume, or GMV, of $5.5 billion, an enhance of 25% calendar year about 12 months, and greater than the $5.3 billion expected by analysts, according to StreetAccount. GMV is a intently watched market metric employed to evaluate the full value of transactions above a specified period of time.

Affirm posted a net reduction of $206 million, or 69 cents a share, in contrast to a web reduction of $186.4 million, or 65 cents a share, in the yr-in the past quarter.

Purchase now, fork out afterwards companies this kind of as Affirm soared all through the pandemic together with a increase in on line buying. But Affirm has been contending with a worsening financial setting, as very well as rapidly increasing desire fees.

“Inspite of significant adjustments in fascination prices and client demand, we continue to sent good credit history outcomes, device economics, and GMV advancement,” Affirm finance main Michael Linford claimed in a statement. “We also shown that the business can continue on to develop profitably even in a superior interest level environment.”

The company acknowledged in its earnings report that the resumption of scholar mortgage payments in October will be “a modest headwind” to its fiscal 2024 GMV.

Analysts mainly cheered the final results. Deutsche Financial institution analysts elevated their selling price goal from $12 to $16 and reiterated their keep score on the inventory. They pointed to advancement of the Affirm Card, the company’s debit card. Affirm was trading at about $17 a share midday Friday.

“Though some uncertainty stays about how AFRM’s product will grow in the out a long time amid a cloudy macro, the organization proceeds to show differentiated credit score general performance and we see probable upside to figures if the Affirm Card lives up to the lofty anticipations mgmt. has established for it,” the analysts wrote.

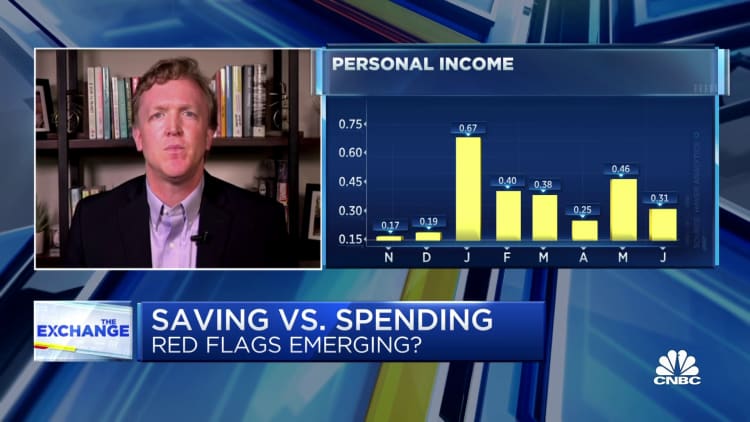

Check out: Desire rates are forcing buyers to rethink purchases, claims LendingTree’s Matt Schulz