Kanye West at an event saying a partnership with Adidas on June 28, 2016 in Hollywood, California.

Getty Illustrations or photos

Adidas on Wednesday slash its entire-12 months advice on the back of the German sportswear giant’s termination of its partnership with Kanye West’s Yeezy manufacturer.

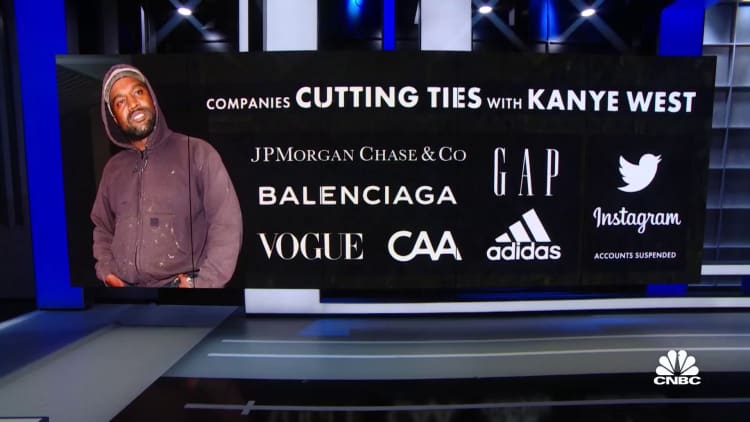

The enterprise finished its marriage with Ye, formerly recognized as Kanye West, on Oct. 25 just after the musician released a series of offensive and antisemitic tirades on social media and in interviews.

Adidas now jobs a internet income from continuing functions of around 250 million euros ($251.56 million), down from a target of all over 500 million euros laid out on Oct. 20. The enterprise now expects forex-neutral revenues for low single-digit expansion in 2022, with gross margin now predicted to arrive in at all around 47% for the yr.

Adidas reported a 4% year-on-yr enhance in forex-neutral product sales in the third quarter, with double-digit growth in e-commerce in the EMEA, North The usa and Latin The us. Gross margin fell by 1 proportion stage to 49.1% on the back of “bigger supply chain costs, increased discounting, and an unfavorable marketplace blend,” the organization stated.

Operating income came in at 564 million euros, even though net cash flow from continuing operations of 66 million euros, down from 479 million euros a 12 months in the past, was “negatively impacted by a number of 1-off expenses totalling almost 300 million as well as remarkable tax consequences in Q3,” Adidas mentioned.

“This amount of money differs from the preliminary figure published on Oct 20, 2022, owing to unfavorable tax implications in the 3rd quarter linked to the company’s determination to terminate the adidas Yeezy partnership. This adverse tax result will be entirely compensated by a optimistic tax influence of identical size in Q4,” Adidas reported.

The organization also exposed that it experienced already lowered its comprehensive-12 months advice on Oct. 20 as a result of “even further deterioration of visitors tendencies in Increased China, larger clearance action to lessen elevated stock stages as properly as whole one-off expenses of all over 500 million euros.”

“The sector natural environment shifted at the commencing of September as buyer demand from customers in Western markets slowed and website traffic developments in Better China further more deteriorated,” Adidas CFO Damage Ohlmeyer claimed in a statement.

“As a result, we observed a significant inventory buildup throughout the sector, top to increased promotional activity in the course of the remainder of the 12 months which will increasingly weigh on our earnings.”

Ohlmeyer claimed the enterprise was “encouraged” by “noticeable” enthusiasm in the buildup to the FIFA Planet Cup in Qatar later this month.